Diverging pathways, common destination

While different factors are shaping insurance portfolio strategies across various regions, CIOs seemingly share a common goal: the pursuit of mispriced opportunities and the hunt for higher returns. Extreme volatility has created investment opportunities in both public and private markets, prompting insurers to put their capital to work, but in very different ways. Surveying some CIOs from across China’s insurance industry, as well as their global counterparts across the US, Europe and Asia, our annual China Insurance CIO Survey 2023 illuminates how CIOs are thinking about portfolio positioning in the next 12-24 months and the major risks and opportunities that lie ahead.

-

Growth concerns dominate as inflation risks ebb

Against the backdrop of retreating inflation and tight monetary policy, growth risks loom large

-

Eyeing opportunities from market dislocations

Extreme market swings have created attractive opportunities across many asset classes

-

Alternatives continue to retain their shine among CIOs

Opportunities in private markets and real assets abound in the near-, medium- and longer-term

-

The transformation continues for China’s insurance sector

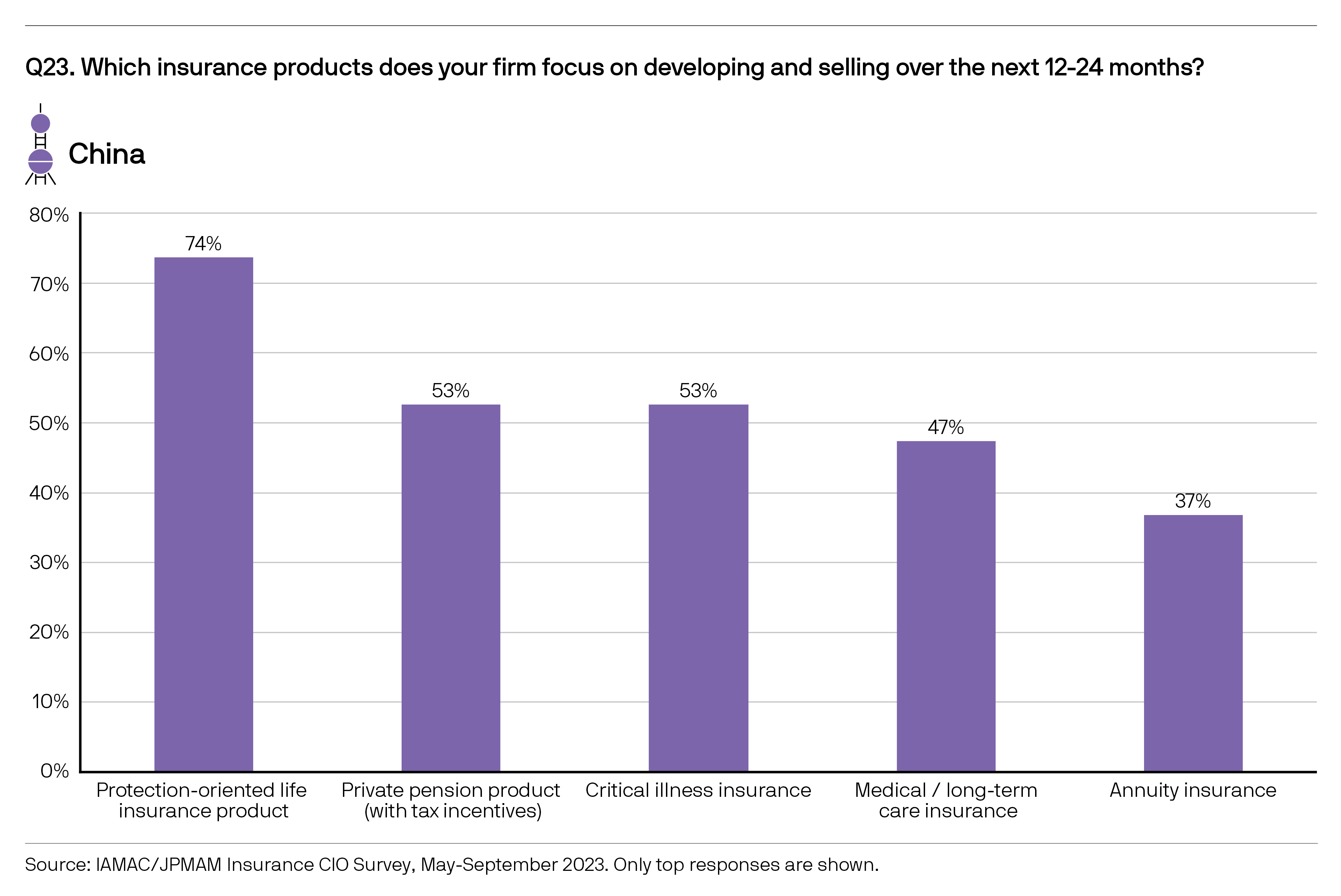

Product priorities among Chinese insurers reflect the evolving needs of a maturing population

Growth concerns dominate as inflation risks ebb

Against the backdrop of retreating inflation and tight monetary policy, growth risks loom large

Concerns about the ongoing economic slowdown has replaced inflation as the dominant macroeconomic risk globally. Unsurprisingly, a significant majority of CIOs in China, the US and Europe view the economic slowdown – domestic or global – as a primary macro risk to their firm’s investment strategies. Meanwhile, the risk to real estate prices in the US remains a major market concern for over 60% of US CIOs.

Eyeing opportunities from market dislocations

Extreme market swings have created attractive opportunities across many asset classes

Extreme price swings and market dislocations have created mispriced opportunities across public and private markets. Accordingly, CIOs in EMEA, US and APAC (ex-China) are keen to seek out these mispriced assets. In addition, for CIOs in EMEA and China, the pursuit of higher yields and returns remains a top priority.

Alternatives continue to retain their shine among CIOs

Opportunities in private markets and real assets abound in the near-, medium- and longer-term

In the near team, real estate debt, infrastructure and transport appear relatively attractive. While real estate continues to face headwinds from higher interest rates, the sector presents opportunities with attractive entry points. Over the medium-term, private credit sectors such as distressed debt and special situations could benefit from a slowing growth backdrop. Taking a longer term perspective, alternative assets across the spectrum look compelling, buoyed by robust fundamentals and cheaper valuations.

The transformation continues for China’s insurance sector

Product priorities among Chinese insurers reflect the evolving needs of a maturing population

China’s insurance industry continues to transform as changing demographics, evolving customer needs and a shifting tax landscape create demand for new types of insurance products. Among the top product priorities for Chinese insurers over the next 12-24 months include protection-oriented life insurance, private pension products (with tax incentives), and critical illness insurance. Not only do these products cater to the evolving needs of a maturing population, they are also expected to create long-term value for shareholders

Download the 2023 China Insurance CIO Survey Report