ETF knowledge

Brush up on your understanding of the world of ETFs, including how ETFs work, ETF pricing and ETF liquidity.

ETF expertise

Our ETF strategies are backed by the extensive research, trading and technology resources of one of the world’s leading asset managers.

It’s this combination of investment expertise and ETF know-how that sets our ETF strategies apart, allowing us to track indexes more efficiently, and provide competitively priced access to new opportunities through the development of innovative active, strategic beta and index strategies.

1. Source: Bloomberg. Data as of 31.05.2024.

2. Award source: AsianInvestor Asset Management Awards 2024. The awards are issued by AsianInvestor in the year specified, reflecting performance as at the previous calendar year end.

3. Source: J.P. Morgan Asset Management. Data as of 31.03.2024. Includes portfolio managers, research analysts, traders and investment specialists with VP title and above. There can be no assurance that the professionals currently employed by J.P. Morgan Asset Management (JPMAM) will continue to be employed by JPMAM or that the past performance or success of any such professional serves as an indicator of such professional's future performance or success.

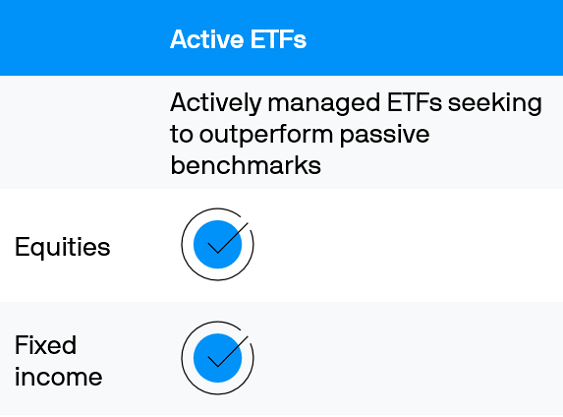

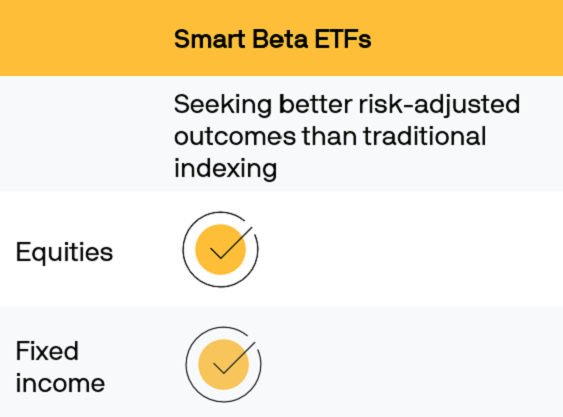

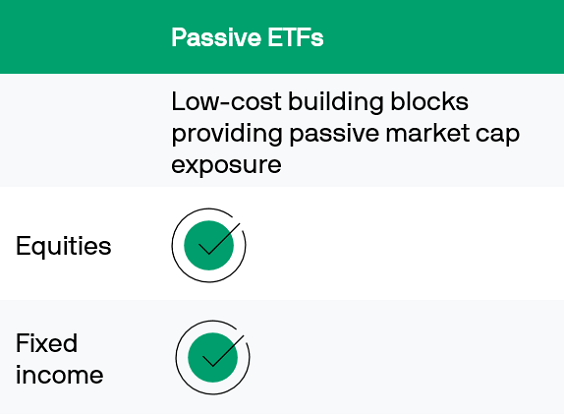

Explore ETFs by investment goals

Whether you are looking to pursue growth, seek income or mitigate risk, our expanding suite of innovative ETF strategies can help achieve your investment objectives.

Provided to illustrate the characteristics of respective ETF strategies, Not to be construed as offer, research or investment advice. The strategies seek to achieve the stated objectives. There can be no guarantee the objectives will be met.

Explore insights from J.P. Morgan Asset Management’s ETF experts, and read the latest commentary on topics related to ETF themes and strategies.

ETF knowledge

Brush up on your understanding of the world of ETFs, including how ETFs work, ETF pricing and ETF liquidity.

For more information on our ETF offerings, please email us or contact your J.P. Morgan client advisor.