High Yield Valuations in the Age of Coronavirus

03/25/2020

Jim Shanahan

As all asset classes have repriced over the past few weeks, the Global High Yield Team believes looking at leveraged credit valuations in the context of historical bear markets can provide actionable insights for investors. Combined with a view into current fundamentals, especially liquidity, at the issuer level, we see a market that is likely to be supportive given our expectations of defaults remaining below 10%.

- We believe the current high yield market, particularly the BB segment of the market, presents attractive buying opportunities for investors with medium to long-term time horizons.

- While several parts of the market have been adversely impacted by macro shocks – energy because of OPEC and leisure, transportation, lodging and gaming due to COVID-19 - the recent selloff in the high yield market, like in all other markets, has forced managers to sell their best and most liquid securities, pushing down the prices of defensive, high quality issuers along with the rest of the market.

- Our research analysts and portfolio managers are going through our portfolios name-by-name to evaluate the impact of the severe economic slowdown due to COVID 19 under a range of scenarios to assess the potential impact on the near-term and longer term health of the issuers. Most issuers in the market, including many in sectors impacted by COVID 19, have substantial liquidity to address significant near-term business disruptions; many also have no near-term maturities that could create insolvency issues. In addition, we expect that there will be significant policy response to what is widely recognized as an economic crisis brought on by COVID 19.

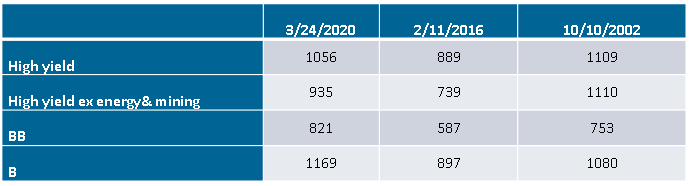

- We anticipate that the combination of much lower oil prices and the economic slowdown will generate a recession, despite the expected economic policy response, and that the high yield default rate is likely to climb from its recent low levels, driven primarily by energy and the weakest of the issuers in those sectors most directly impacted by COVID 19. However, spreads for the broad market of 1,056 bps effectively price in a near-term increase in the default rate of more than 10%, similar to the default rate the market experienced in recessions before the Great Financial Crisis of 2008.

- There have been some comparisons of current valuations to those seen in early 2016, implying that spreads have room to widen. In reality, however, current valuations are actually cheaper than the high yield market at the trough in 2002 and 2016 for BB and B rated segments.

Source: ICE BAML

- While the near term outlook for spreads remains uncertain, historically high yield has provided attractive returns on the rare occasions when spreads exceed 1,000 bps. Even an investor who bought high yield when spreads first rose through 1,000 bps at the end of September 2008 made 22.73% over the next twelve months despite being two-and-a-half months early and down 17.69% in the first three months.