Challenges in EM during current pandemic

04/16/2020

Felipe Illanes

- Shocks due to the COVID-19 pandemic, the oil crash and the sudden stop in capital flows triggered a major challenge for emerging market (EM) investors, with the magnitude of these shocks continuing to evolve.

- While we expect EM will face a recession in 2020, we believe a 2021 recovery is likely, though some sovereign balance sheets will be pressured.

- Policy tools, access to buffers and institutional strength to meet this pressure varies widely across EM.

- Widespread defaults within the core EM are unlikely, but we see greater risk in the Frontier EM.

- EM valuations reflect much of the outlook ahead, but the uncertain COVID-19 impact remains a downside risk. As such, we remain defensive, favoring EM investment-grade credit.

COVID-19 and its EM Challenges: Recession Certain, Full Impact Uncertain

COVID-19’s outbreak in China halted an incipient EM expansion. It also propelled the recent drop in oil prices, a major hit to several emerging markets. The combination contributed to the sharp Q1 developed markets (DM) selloff that tightened EM external funding. In two weeks in March, EM (EMBIGD) spreads more than doubled while EM FX fell by almost 12%. Recently, however, the Fed’s action prompted some retracement of financial conditions tightening, and EM assets have stabilized somewhat in response.

The COVID-19 outlook, however, is still a challenge. Serving as a template for others, China has already unwound most lockdown measures and is resuming production. Still, the recovery is constrained by concern around new infections and weak external demand due to social distancing abroad. In developed markets, there are signs that infection curves are peaking. However, the China example shows that the initial recovery may be gradual, so EM will have to deal with soft external demand, low commodity prices and weak tourism and remittances flows until recoveries in developed markets and China kick in.

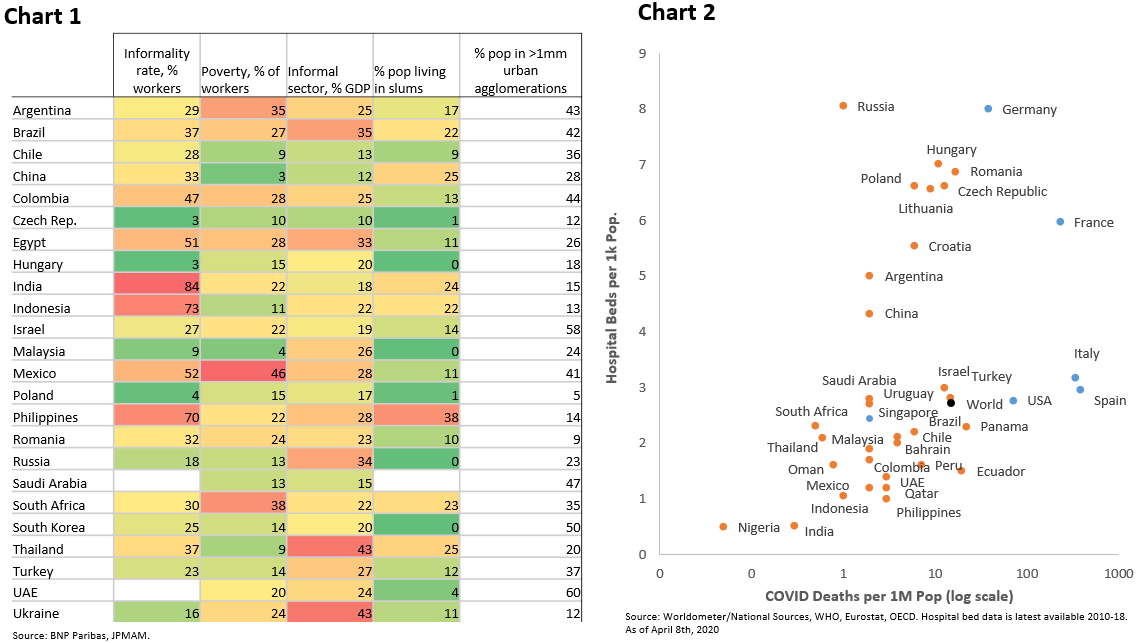

A major concern is whether EMs more recently affected by COVID-19 will see a harder impact. Several countries in this group have younger populations and warmer climates, cited as infection mitigation factors. Still, most also have weaker conditions to tackle an epidemic, albeit with wide dispersion in this regard (charts 1 & 2).

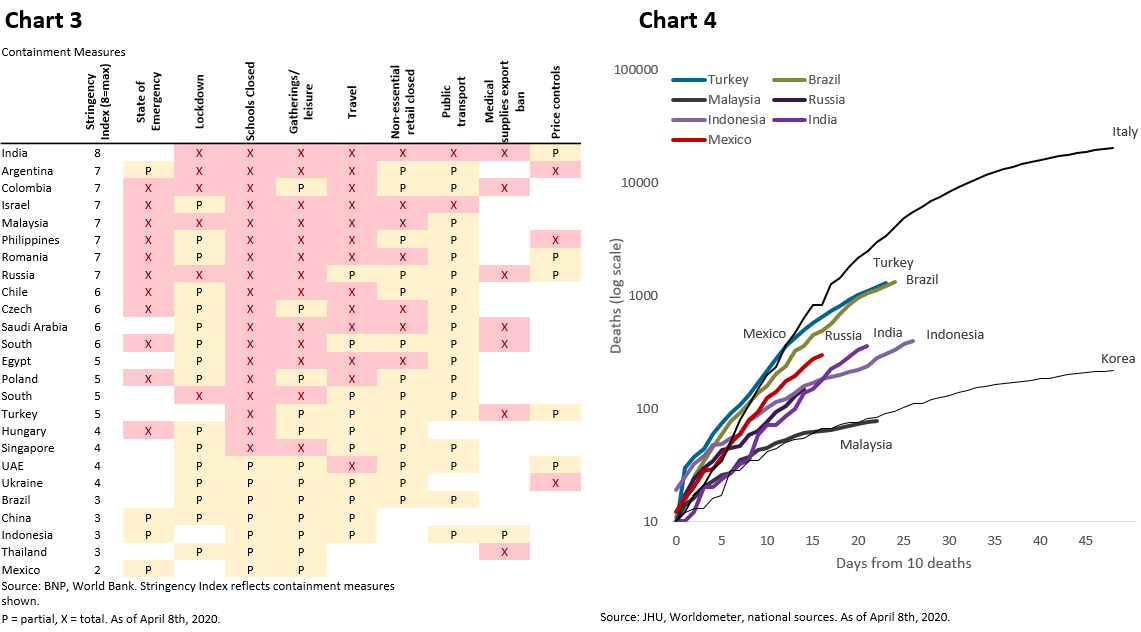

The point is that there will be less resources to tackle the virus compared to countries where infection curves are already flattening. Social distancing may need to be more sustained, which will create greater economic impact. Indeed, the pandemic’s visibility prompted some emerging markets to social distance sooner than countries with the highest infection curves. In fact, to date COVID-19 deaths within some EMs are evolving more favorably than in some DMs, although a few – such as Turkey and Brazil – are a concern (charts 3 & 4).

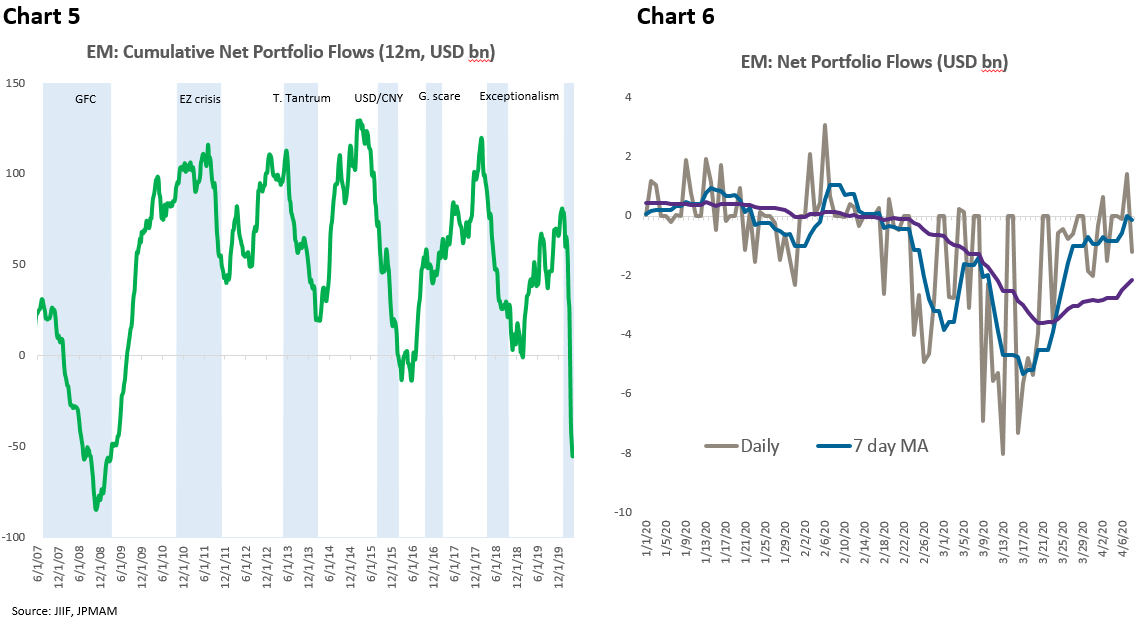

A related challenge is how competition for funding in a global recession will impact capital flows. EM saw USD75 billion in capital outflows in March – a monthly record (chart 5) – although daily data shows that flows have flattened over the last two weeks (chart 6). However, amid a global recession, and with EM ex China slowing later than DM, a quick EM return to capital inflows seems unlikely.

All this means that a major EM recession is baked in, but its duration is an evolving question. EM governments deployed unprecedented policy stimulus to mitigate the hit on households and firms. Fiscal stimulus to date totals almost 2.5% of EM GDP and virtually all EM Central Banks have undertaken policy rate cuts, regulatory relaxation and/or (quasi) QE programs. This helps, but going much beyond this may backfire, as it may be seen as increasingly unsustainable. Hence, policy will have to be calibrated carefully, especially as social demands may rise with lengthy social distancing.

External Vulnerability and Default Risk: More of a Frontier Problem

The above raises the issue of whether the overall impact of COVID-19 will tip EMs into external insolvency. The IMF estimates 2020 EM gross external funding needs at USD2.5 trillion, about one-third of total EM FX reserves. The institution swiftly stepped up to help tackle this, setting up quick disbursement facilities (USD100 billion) and securing approval to boost its lending capacity to around USD1.3 trillion. Most of this, however, requires conditionality and a forecast of stable public debt “with a high probability”, a bar not met by all. So, initially, many EMs will have to face tight funding with their own means.

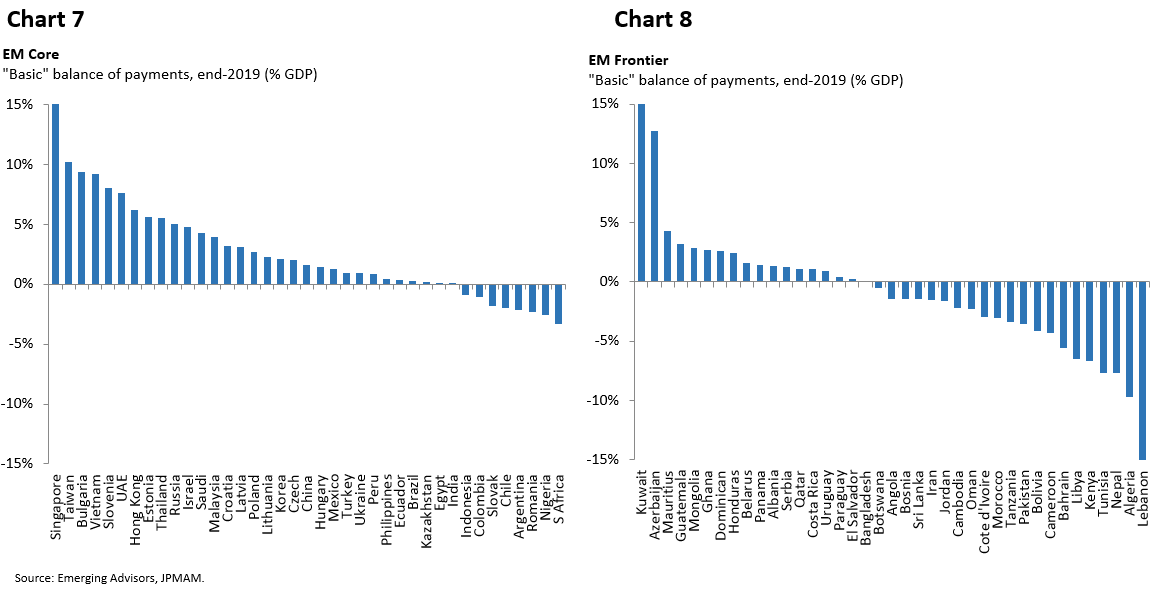

Ability in this regard varies widely across the EM, as shown by their basic balances, broadly capturing whether a country is a net supplier or borrower of foreign capital. Most of core EM runs a balance/surplus in this metric and most who don’t are well flagged as distressed (chart 7). Frontier EM, however, has more countries running deficits, with a higher risk of large external funding gaps (chart 8).

The core EM group is more likely to see mark-to-market rather than actual defaults, although credit ratings downgrades should be expected. A look at the ability to deal with COVID-19 (including health and social dimensions) vs external vulnerability (including liquidity and solvency), shows who may do better and worse in this regard (chart 9). For the frontier (and distressed) EM, the focus has to be on short-term external liquidity. This shows that some in this group face unfunded net financing gaps (positive values in chart 10), revealing where external defaults are more likely to occur in EM.

Investment Implication: Defensive But Watching

Until we get more visibility on the COVID-19 path, a defensive investment stance on EMD seems warranted in spite of historically attractive valuations. Investment-grade sovereigns seem to offer a more attractive risk-reward. Our analysis suggests that Malaysia, Hungary and Peru are countries that may fare better facing the current scenario, while Oman, Iraq and Turkey may fare worse. EM local debt, outside of a few cases, currently seems more challenged by declining growth and domestic market volatility. Looking ahead, individual EM’s ability to deal with the cited challenges varies widely so reengagement in EM needs to be approached selectively.