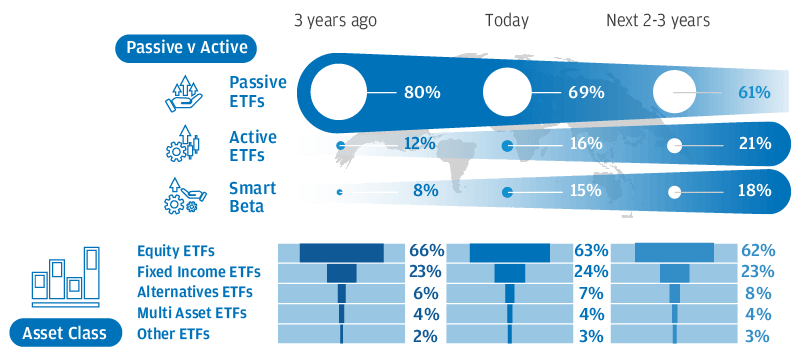

Active and smart beta lead the way

The Global ETF Study 2020 shows that active and smart beta ETFs are expected to grow faster than passive funds in the next two-to-three years.

This trend could accelerate in the wake of the Covid-19 outbreak. Active ETFs, for example, have the flexibility to trade outside of their normal rebalancing period, which means portfolio managers can buy or sell securities to reflect a change in market view at any time. Smart beta funds are also able to maintain a more diversified exposure compared to market cap weighted index funds. These characteristics can make a big difference when unexpected market events take place.

Benefits of active

Active and smart beta funds are growing in popularity as investors increasingly come to see ETFs as tools to help them tackle a range of issues in portfolio construction and asset allocation.

Investors particularly like how active strategies provide effective access to different outcomes and specific investment criteria, such as environmental, social and governance factors.

An active or smart beta approach also has the potential to boost long-term returns and to mitigate the risks faced by index funds.

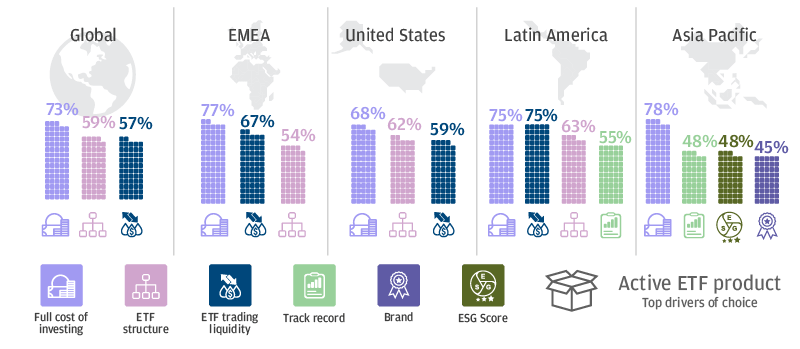

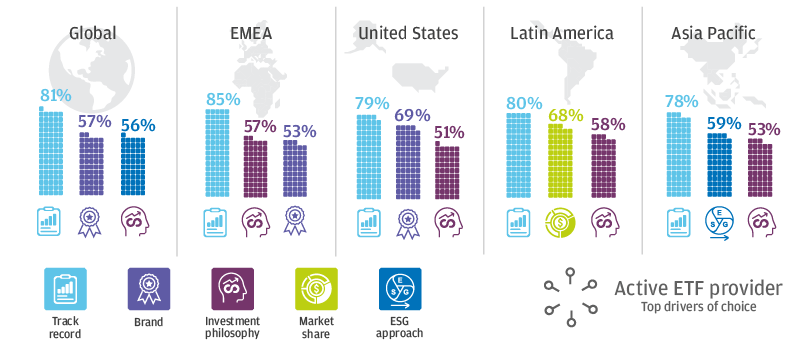

The reasons why investors choose active ETFs

Using active ETFs

While investors look at all the costs incurred by active ETFs, such as transaction costs related to portfolio rebalancing, trading costs and creation/redemption costs—they should also consider any participation in security lending schemes used to offset costs.

An active ETF’s exposure to liquid and tradeable underlying securities is also crucial, as this will allow the cost of creating and redeeming shares to be low, and the ability to provide intra-day pricing to be high.

Other important consideration are the investment criteria used to select securities, the risk management tools that the strategy uses, any tracking error considerations that are in place, plus the trading expertise of the provider—including access to the secondary market.

Top considerations when choosing an active ETF

Allocations favour active

Investors are increasing regional exposure to emerging markets and China, and find the best opportunities in fixed income in emerging market bonds, high yield bonds and corporate bonds.

Emerging markets offer strong long-term growth potential for equity investors, while emerging market bonds, high yield bonds and corporate bonds offer attractive yields compared to traditional high quality developed market bonds.

Shifting allocations favour strategies that can filter out the risks inherent in market-cap weighted indices, or that can use proprietary research to focus on the highest quality companies and issuers.

Rising use of active ETFs

Using active ETFs in a portfolio

Active ETF strategies are well suited to helping investors build out the strategic core of their portfolios. At the same time, an active strategy can be used to add alpha to a portfolio with core passive holdings, or to allocate tactically at different times through the market cycle.

The Global ETF Survey 2020 provides insights into investor attitudes towards active and smart beta funds. The findings are analysed in detail by our research partner, Core Data Research.