The euro as a funding currency

03/02/2020

In Brief

- The euro has been an attractive funding currency for some time due to negative yields in the eurozone, low volatility in currency markets and the behaviour of the currency as more of a “risk asset” than “safe haven”.

- A couple of key trends in capital flows suggest the role of euro funding is growing, and we outline the near-term implications for currency markets.

- We also consider the longer-term risks from growing financial imbalances.

The attractions of euro funding

The attraction of the euro as a funding currency goes beyond the negative yields in Europe. The two other properties that, in theory, make the euro such an ideal funding currency are the very low levels of volatility, which are priced to persist for some time, and the positive historical correlation of the euro to higher yielding emerging market currencies.

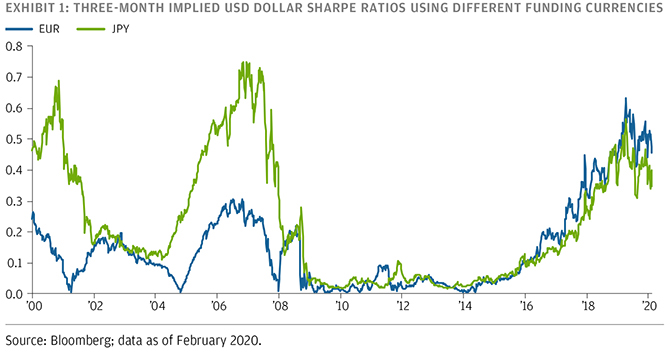

Our research has shown that nominal yields tend to be a better guide to developed market currency excess returns than real yields; however, yields in the eurozone are among the lowest in the world. While yields everywhere are generally low, we still find that the yield differences between higher yielding currencies, such as the US dollar, and the euro are meaningful in a historical context when adjusted for the low levels of currency volatility (Exhibit 1). It is this balance of carry compared to risk that is important for hedging decisions.

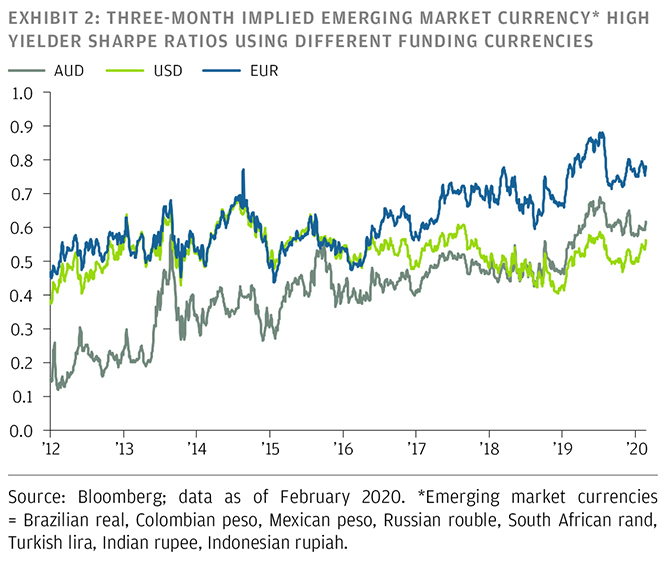

Finally, the euro is particularly suited to funding investments into emerging market currencies due to the natural hedge against movements in the US dollar, which tends to drive capital flows into and out of emerging market assets (Exhibit 2).

Trends in capital flows

The recent trends in capital flows validate our view that the euro is increasingly being used as a funding currency. While reliable real time data on currency exposures is not available, we use a few sources to identify the growth in euro funding.

First, the European balance of payments data shows a rise in net bond outflows, consistent with the trend during the initial period of European Central Bank quantitative easing and in line with the flows we would expect given the level of longer-dated yields in Europe. We have previously shown that there is a disproportionate impact on bond outflows from very low long- term yields as a result of unconventional monetary policy, which is something we monitor using the academic concept of shadow rates. Both flows and the performance of the euro remain consistent with our framework.

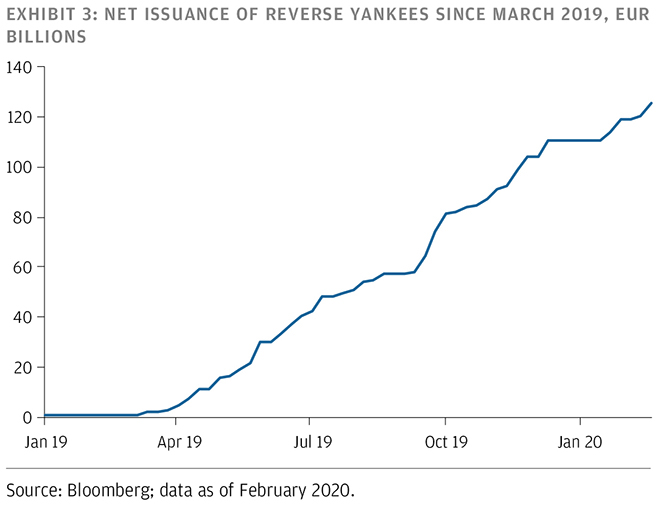

Second, we have tracked a significant rise in the issuance of corporate debt in euros by US companies in the last year, known as reverse Yankee issuance (Exhibit 3). Changes to tax and accounting treatment are some of the factors enabling this rise and a key reasons why we suspect the majority of flows are not currency hedged. We believe that the stable currency and low rates available to borrowers in euros are also contributing to this trend.

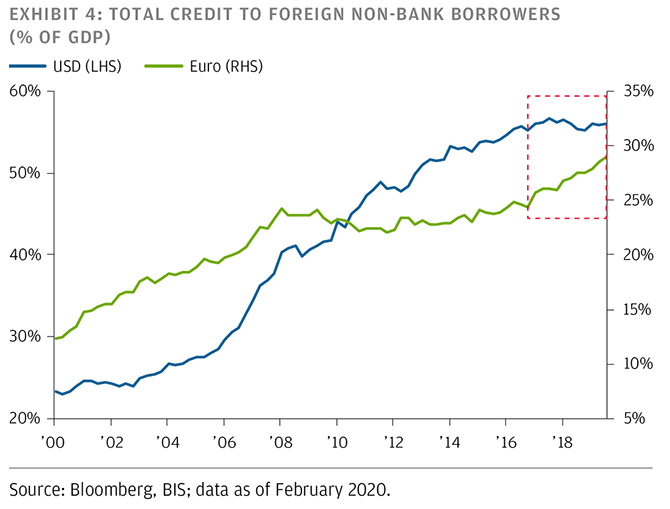

Finally, using the Bank of International Settlements’ Global Liquidity Indicator data, we can see a rise in cross border debt in euros and a stabilisation in dollar funding (Exhibit 4). While this data is less timely than other indicators it has a very wide scope, covering both debt securities as well as bank lending and other non-market based private transactions that are only reported to regulators.

In the near term, the factors behind the rise in euro funding remain as powerful as ever. From a currency market perspective we view these trends as sufficient to offset the support the euro receives from a large current account surplus.

Longer-term risks are mounting

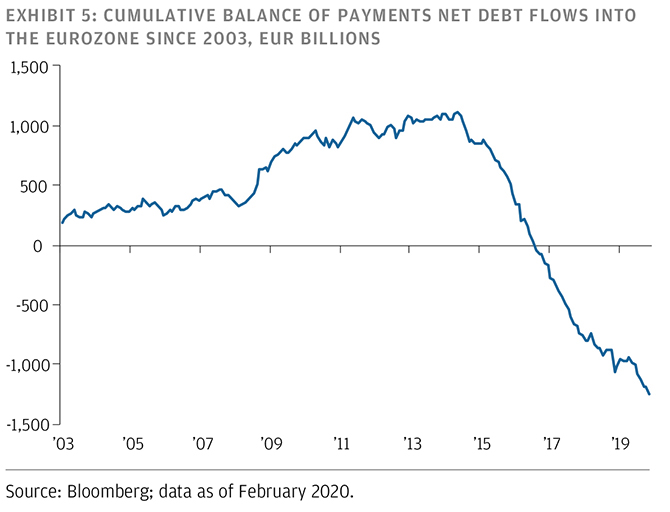

While currently more focused on the flows associated with euro funding we are aware that the stock of assets funded in euros is getting large enough to start thinking about what could happen if an unexpected shock were to occur.

Estimating the total exposure to euro funding is a challenging task, but the more rapid recent increase in the use of euro funding coming after a long period of gradually rising exposure is beginning to feel a little more concerning to us. Some of the recent flows feel more vulnerable to any increase in currency market volatility from multi-decade lows.

Currency market history is littered with the victims of carry trade unwinds, with the role of the yen during the financial crisis the textbook example. Between 2004 and 2008, yen-funded carry trades proliferated with retail and institutional investors and cross-border lending in yen expanded rapidly. When the financial crisis hit, and the Federal Reserve (the Fed) cut rates and risk appetite declined sharply, there was a rush to exit from these strategies. The result was a disorderly appreciation of the yen and an unwelcome tightening of financial conditions in Japan.

The most obvious events that could trigger an unwind of euro funding include any move towards significant fiscal stimulus in Europe or any move to resume cutting interest rates by the Fed. Both remain plausible, if not particularly likely in the near term based on recent commentary from the Fed and the German government. We continue to monitor these risks carefully.

Currency Management

Since our first segregated currency overlay mandate funded in 1989, J.P Morgan Currency Group has grown to manage a total of USD 330 billion (as of 31 May 2019) in bespoke currency strategies. Our clients include governments, pension funds, insurance clients and fund providers. Based in London, the team consists of 20 people dedicated exclusively to currency management with an average of over 15 years of investment experience.

We offer a range of hedging solutions for managing currency risk as well as a tailored optimal hedge ratio analysis:

- Passive currency hedging serves to reduce the currency volatility from underlying international assets. It is a simple, low cost solution designed to achieve the correct balance between minimising tracking error, effectively controlling transaction costs and efficiently managing cash flows.

- Dynamic “intelligent” currency hedging aims to reduce currency volatility from the underlying international assets and add long-term value over the strategic benchmark. A proprietary valuation framework is used to assess whether a currency looks cheap or expensive relative to the base currency and the hedging strategy is adjusted accordingly.

- Active “alpha” currency overlay offers passive currency hedging, if required, combined with an active investment process to deliver excess returns relative to the currency benchmark. Our approach is to build a global currency portfolio combining the output of fundamental models and incorporating the qualitative views of our strategy team.

0903c02a82821d2c