Principles for Successful Long-term Investing

Using Market Insights to achieve better outcomes

Market insights was founded in 2004 in the wake of the fallout from the tech bubble. At a time when investors needed it most, the first Guide to the Markets provided clarity and perspective, and helped to reinforce key habits of successful long-term investors. Today, more than a decade later, it is in that same spirit that we are pleased to offer, “principles for successful long-term investing”.

We believe that a combination of these principles, sound financial advice and deeper insights can help make every investor better off.

1. PLAN ON LIVING A LONG TIME

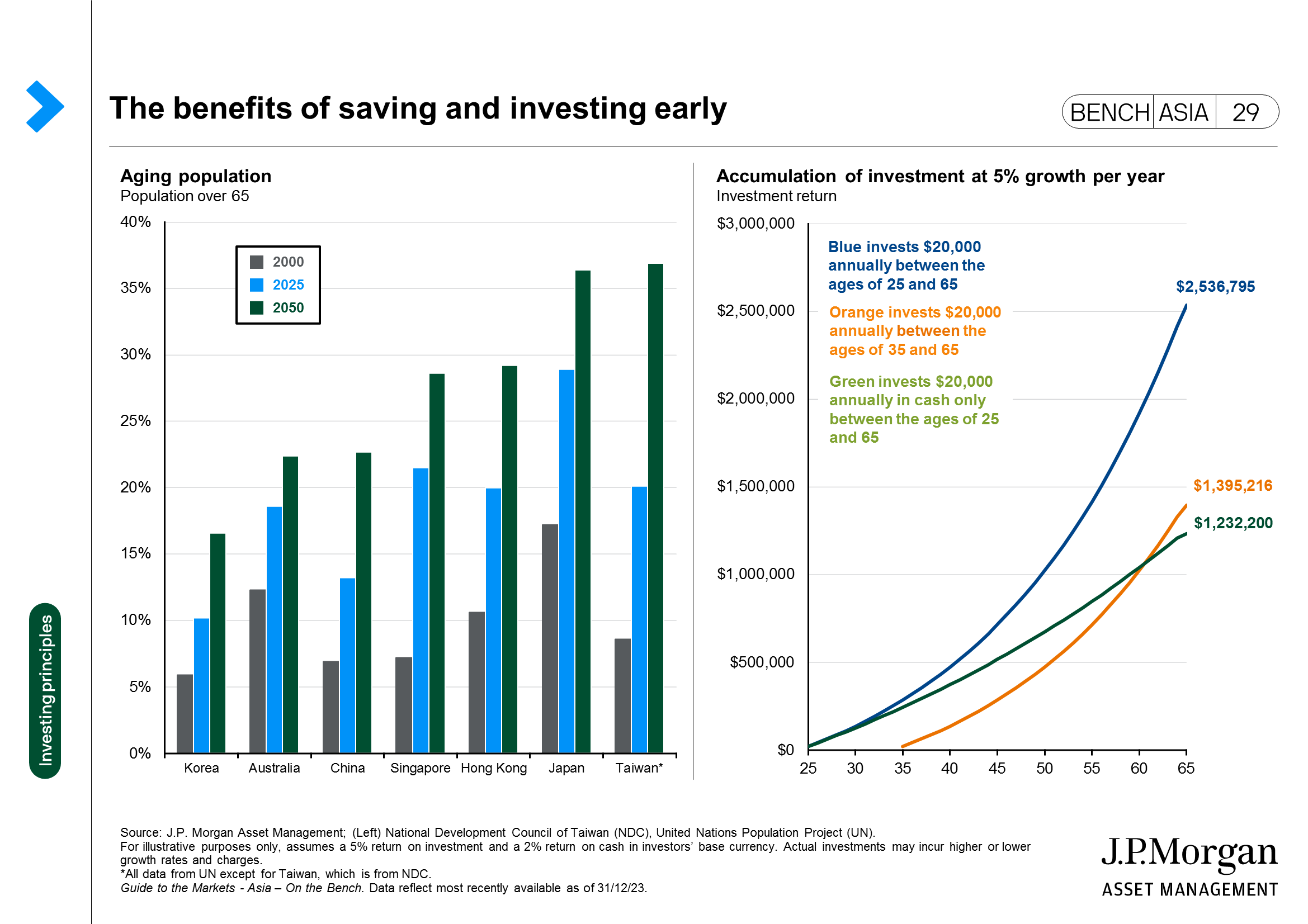

LEFT: We are living longer

Thanks to advancements in medicine, people are living longer and healthier lives. This chart shows that the share of population in retirement age will rise sharply across Asia over time.

RIGHT: The benefits of saving and investing early

It is important for investors to start saving and investing early in order to maximize the benefits of compounding. This chart illustrates three different scenarios: one in which the investor starts savings early, but keeps those savings in cash only; one in which the investor both saves and invests in financial assets early; and one in which the investor starts later, but still allocates these savings to financial assets. The investor who started early and invested in a well-balanced portfolio is far better prepared for retirement than those who started late or invested only in cash.

2. CASH ISN'T ALWAYS KING

|

Cash pays less

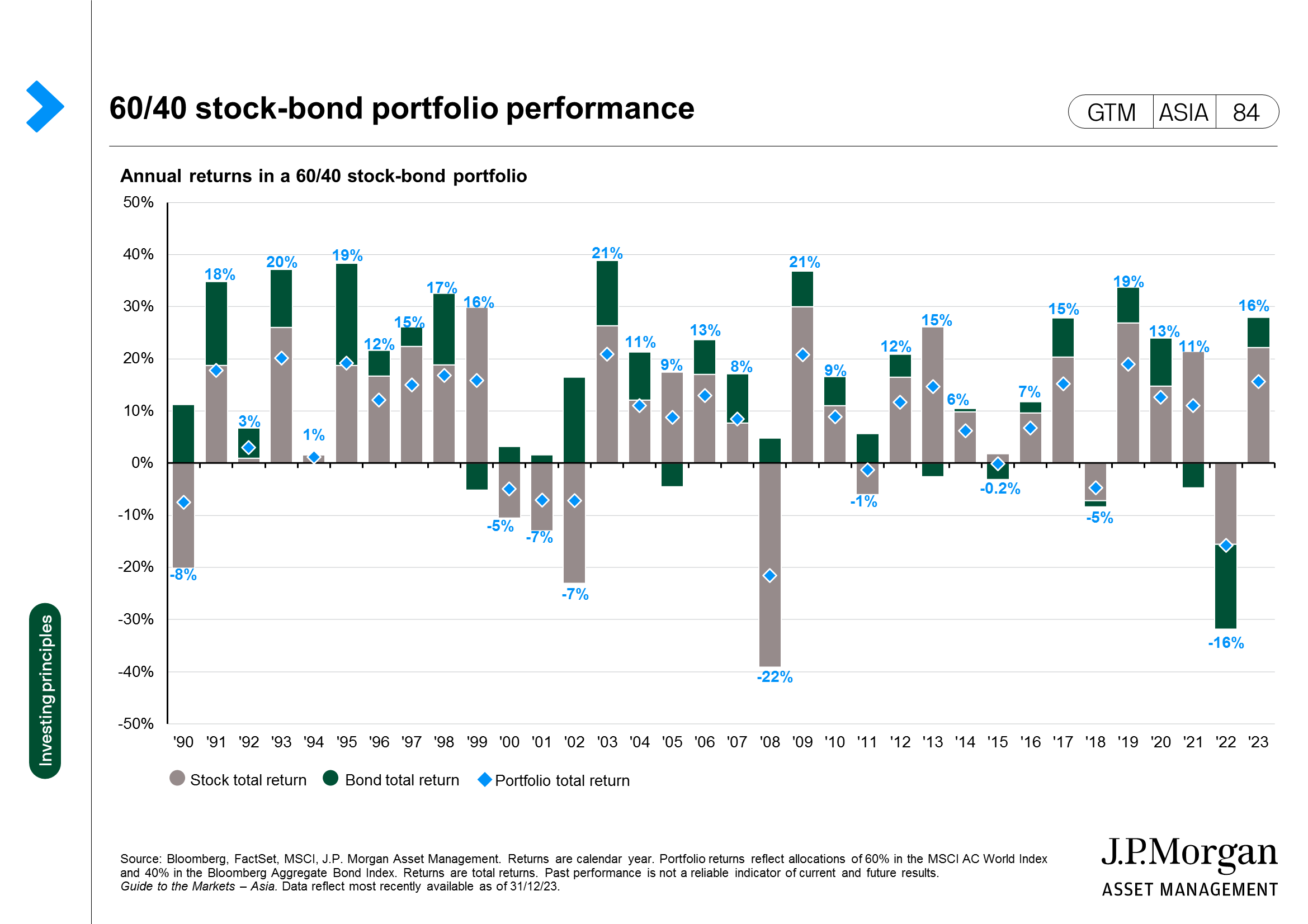

Investors often think of cash as a safe haven. Many investors shy away from the stock market, fearing capital losses and unwanted risks in what appear to be volatile markets.

Even at times when the equity market is struggling, the bond market can offer an attractive return compared to cash. Fixed income comes with its own risks when rates are rising, but bonds have a role in portfolios to lower overall volatility and provide steady income.

As an example, since 1990 there have been only a handful of years where the total return for bonds was negative, and they were typically much less in magnitude than any time equities saw poor performance.

3. HARNESS THE POWER OF DIVIDENDS AND COMPOUNDING

|

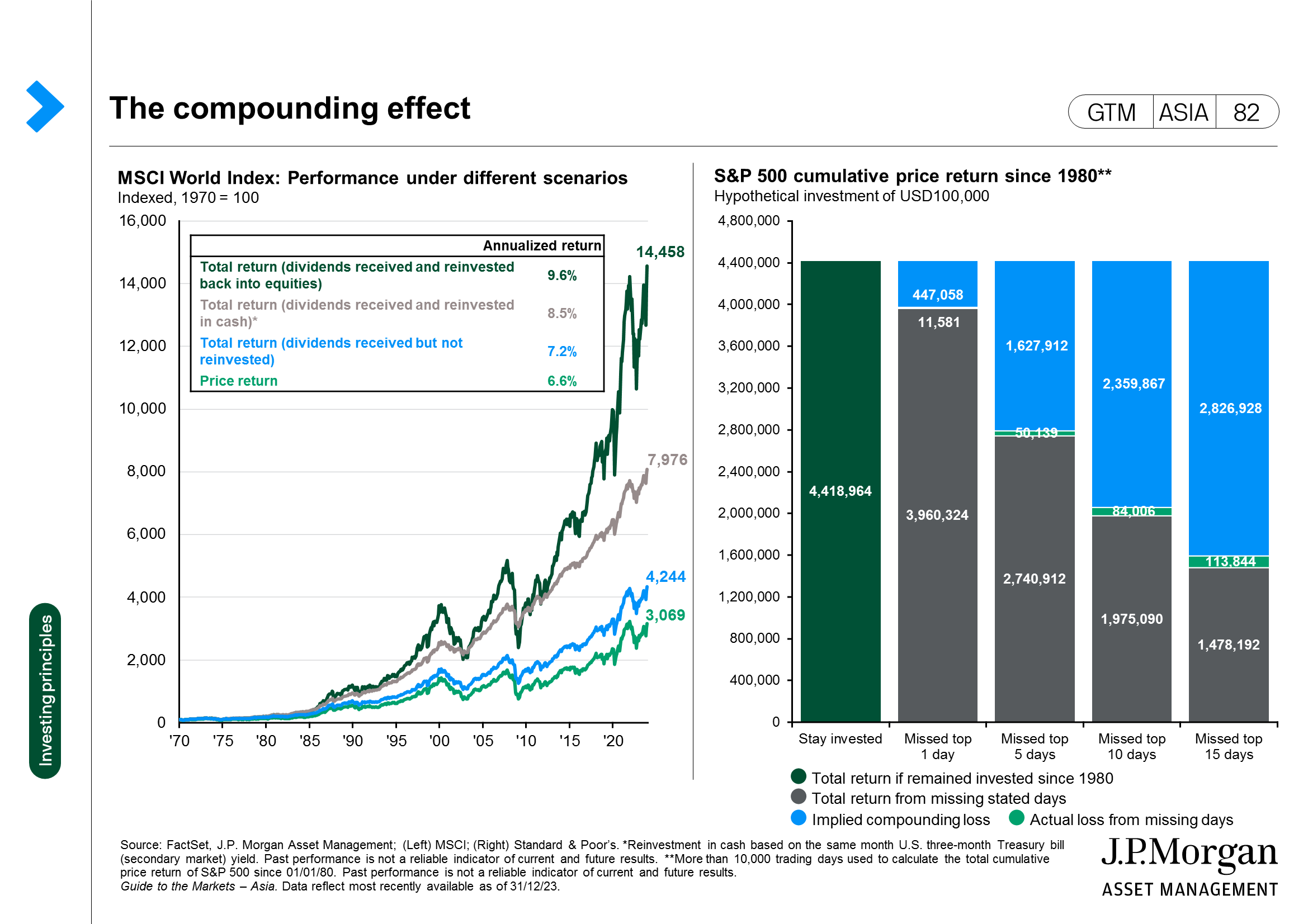

LEFT: The power of dividends and compounding

Harnessing the power of compounding can greatly impact investor returns. Placing an initial $100 into the MSCI World Index in 1970 would have given an investor nearly $3,000 today if we merely looked at the price returns.

The compounding effect could greatly increase these returns if the same investor reinvested the dividends paid out by this equity market over time. Investing the same $100 in the MSCI World Index in 1970, but reinvesting the dividends received, would have grown this $100 to over $14,000 today.

4. AVOID EMOTIONAL BIASES BY STICKING TO A PLAN; AND STAYING INVESTED MATTERS

|

RIGHT: Avoid emotional biases

Almost all investors are challenged by their emotions and natural biases when making investment decisions. The impulse to get in when things look good and out when things look bad can be overwhelming, but history shows us that investors tend to pick exactly the wrong time to do so.

Investors get caught up in the fear of missing out and put their money in right when the market is at its most expensive—and vice versa. Missing out on the best days of market performance has quite a significant cumulative effect over the years.

|

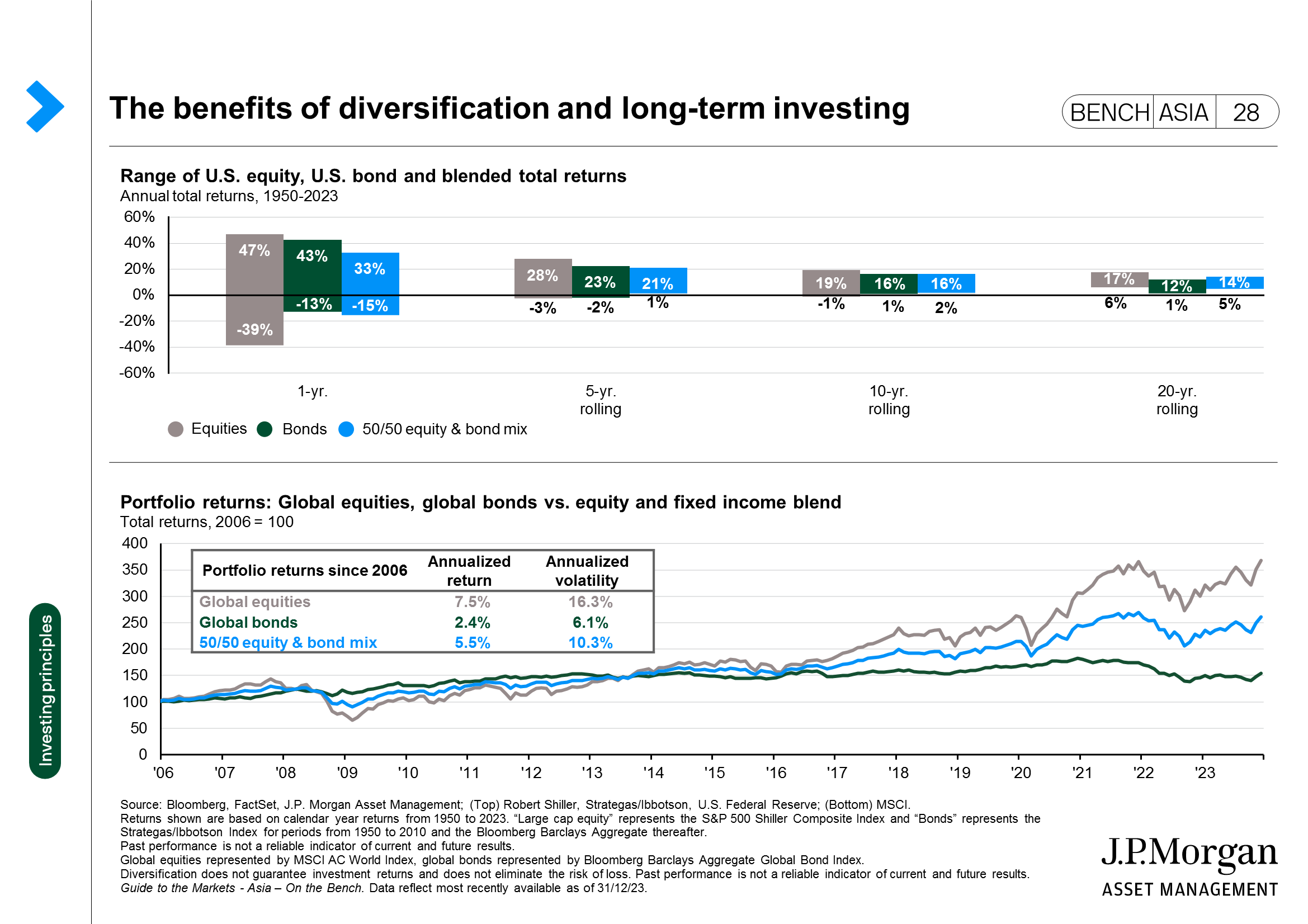

TOP: Good things come to those who wait

While markets can always have a bad day, week, month or even year, history suggests investors are less likely to suffer losses over longer periods.

This chart illustrates the concept. While the range of one-year stock returns has varied widely since 1950 (+47% to -39%), a blend of stocks and bonds has not produced a negative return over any five-year rolling period in the past 70 years.

However, investors should still keep in mind the time horizon of their goals. Does your situation call for higher returns and the higher risks that come with it? Or does your plan involve making use of the return from your investments very soon?

5. VOLATILITY IS NORMAL; DON'T LET IT DERAIL YOU

|

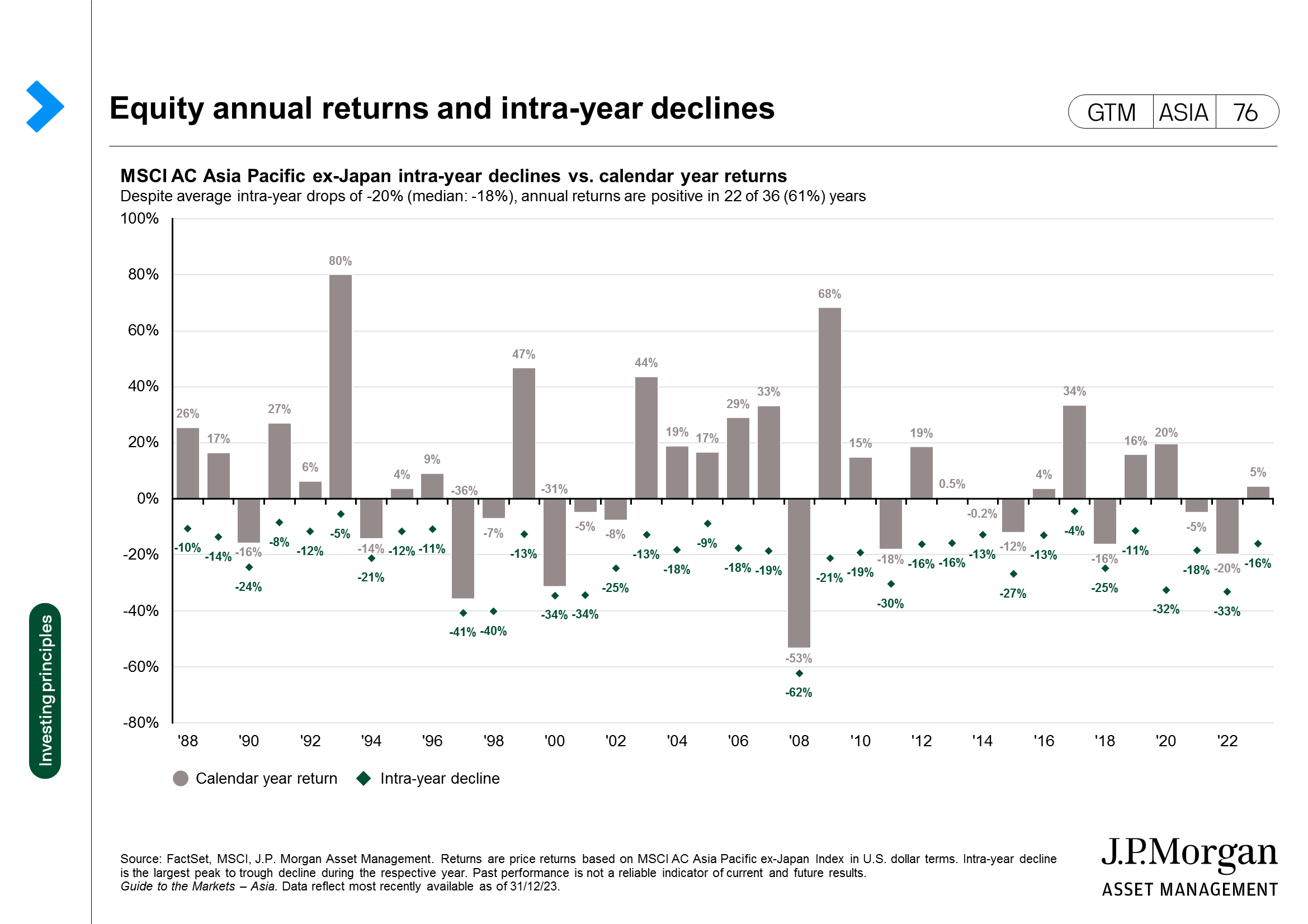

Volatility is normal

Investors should remember that volatility is normal. Investing naturally involves significant drawdowns from time to time.

Markets move in cycles and through peaks and troughs—it is almost unheard of for performance to only ever move upward. However, when popular signals start to indicate difficult times ahead, it can still pay to remain invested.

Looking at previous drawdowns, the length of bear markets has typically been less than that of subsequent bull runs, with any losses sustained during the bear market eventually reversed with time.

Investors should be aware of the volatility they can handle, but troubled times aren’t a sign to sell everything.

6. DIVERSIFICATION WORKS

|

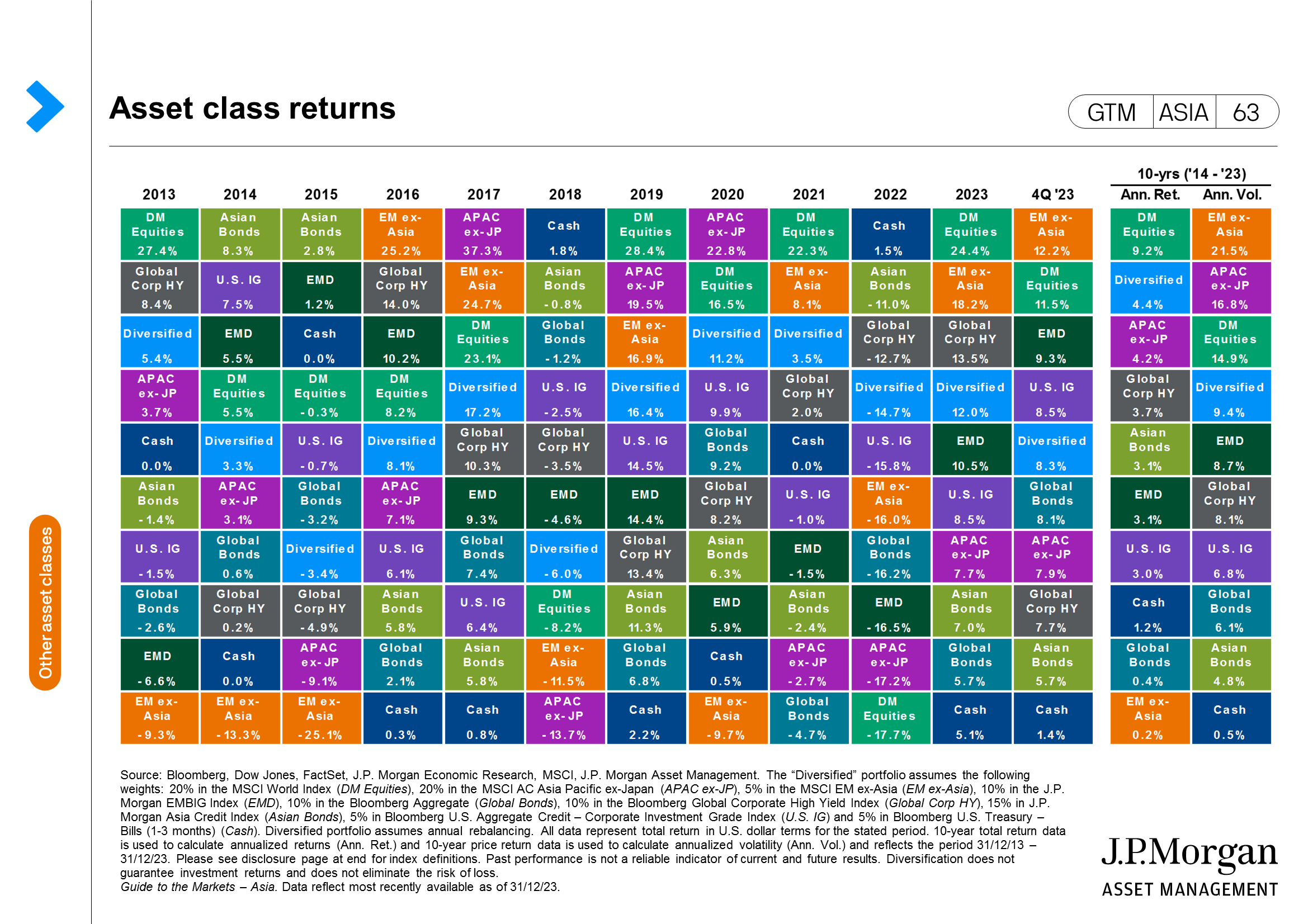

Diversification works

The last 10 years have been a tumultuous ride for investors, with numerous natural disasters, geo-political conflicts, pandemics and market downturns. The next 10 years are likely to also be volatile, with multiple sources of uncertainty. While a recession could be avoided, investors should still familiarize themselves with the implications of an economic downturn, and be ready in case it materializes.

Despite all of the difficulties faced by markets over the past 10 years, cash was rarely one of the best performers. Over the same period, a well-diversified portfolio of stocks and bonds returned an average of 3.9% per year with lower volatility than a pure equity portfolio.

Markets can be volatile and even negative in any given day, week, month or year. But history shows that both time and diversification can go a long way toward a smoother investor experience.

0903c02a824088d9