Late cycle investment: How much does the timing of a recession matter?

UK pension plans concerned about how to invest in a volatile, late cycle environment may want to consider these two practices.

In an already tightly held market for sterling corporate bonds, even modest moves by UK pension funds to adopt buy and maintain strategies could create stiff competition for these assets.

16-07-2019

Sorca Kelly-Scholte

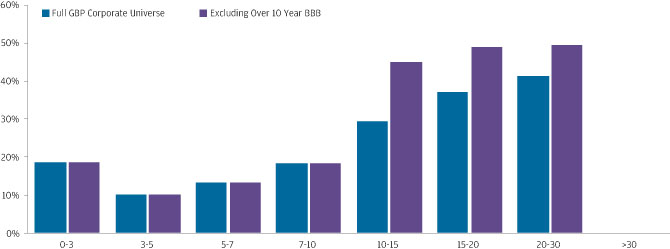

This chart shows the share of each maturity bucket within the sterling corporate bond market that pension funds would own if they were to allocate just 5% of their assets to liability-aware fixed income and use this allocation to match their liabilities pro-rata.

These assets would match just 3.5% of the total estimated buyout liability and result in pension funds owning 36% of the 15- to 20-year bucket and almost 40% of the 20- to 30-year bucket, for example. We exclude the over 30-year bucket because pension funds, collectively, could need to own more than 100% of this bucket. Since there would literally not be enough to go around, we assume that gilts would remain the primary venue for hedging longer-duration risk.

If we also excluded BBB securities with maturities over 10 years, then pension funds would need to own nearly half of the remaining available securities in the 15- to 20-year and 20- to 30- year buckets, and 45% of the 10- to 15-year bucket. (see ‘Buy and maintain credit – What can pension funds do differently from insurers, and should they?’ in this edition of Pension Pulse, where we note the lack of visibility on the credit quality of these longer-tenured BBB bonds over extended horizons).

In a nutshell, even fairly modest moves by UK pension funds into buy and maintain credit could create intense competition for assets in an already tightly held market. New sterling issuance is routinely oversubscribed, with bidders generally allocated between 50% and 80% of what they request.

Pension funds seeking to implement buy and maintain liability-aware strategies will need to find capacity outside the sterling market in order to build out appropriately diversified portfolios. The U.S. corporate credit market, in particular, is over ten times the size of the sterling market, offering both capacity and diversification opportunities.

Source: Pension Protection Fund Annual Report 2018, Bloomberg, J.P. Morgan Asset Management as at 31 December 2018.

0903c02a8262a6a1

UK pension plans concerned about how to invest in a volatile, late cycle environment may want to consider these two practices.

UK pension funds are globalising their real estate holdings, taking advantage of diversification benefits and greater scale of investment opportunities.

Pension funds don’t face the many constraints that make buy and maintain strategies so well-suited to insurers.