Evaluating recessionary impacts and the importance of timing

UK pension plans concerned about how to invest in a volatile, late cycle environment may want to consider two practices: continue effective rebalancing and don’t postpone further duration hedging in anticipation of rising rates.

16-07-2019

Sorca Kelly-Scholte

Thushka Maharaj

“Bull markets don’t die of old age” is a phrase that acknowledges the maturity of the current U.S. expansion – now officially the longest on record, yet likely to continue at least into 2020, according to the consensus. In this article, we explore a question that is top of mind for many UK pension fund investors today: How should one invest during this potentially volatile period, from late cycle through recession?

We examine the impact of a recession scenario on an illustrative UK pension fund, varying the time of onset. We conclude that the overall outcome for funding levels after 10 years is relatively insensitive to the timing of a recession, so long as funds rebalance their exposure effectively through periods of market volatility. We also conclude that there is little merit to delaying further duration hedging: While long-term funding levels are relatively insensitive to the hedge ratio, funding level volatility is highly sensitive to it. What’s more, rates are unlikely to fully normalise until after a recession has been experienced – a long time to endure volatility.

LTCMA base case: Funding levels expected to recover over a 10-year period

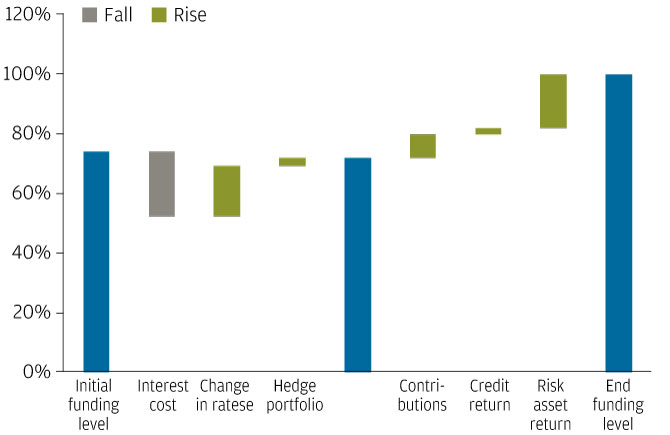

Under our LTCMA base case, our illustrative pension scheme is expected to reach full funding on a Gilts basis in 10 years. This is principally driven by deficit contributions (accounting for an 8 percentage point (ppt) improvement in funding level) and the return on credit and risk assets (adding roughly 20 ppt).

Although the expectation under our LTCMAs is for a rise in yields above what is currently priced into markets, changing yields make a negligible overall contribution to the change in funding level. (In fact, the contribution is slightly negative—about a 2ppt decline.) This is because the fall in liability values in the early years due to rising yields is offset by the interest cost over the full period (the liability value increases from year to year as liabilities move closer to the present and the discount rate unwinds). The effect is further dampened by a roughly 50% hedge ratio1 for our illustrative pension scheme, reflecting current estimates of the total amount of UK liabilities hedged.

Recession scenarios: Funding level expected to fall substantially through drawdown period

Initial funding level improvement in our recession scenarios is slower than in the LTCMA base case due to more muted risk asset returns late in cycle and slower yield normalisation (EXHIBIT 2). As one would expect, the funding level of our illustrative pension scheme falls precipitously through our recession scenario: Whenever the recession occurs, it results in a fall in the funding level of 14ppt to 16ppt. However, in our scenarios, the funding level recovers within two years due to a rebound in risk asset values and in yields. Roughly five years after the recession, that funding level converges back to our LTCMA base case.

Our illustrative pension scheme reaches full funding in 10 years, largely due to contributions and risk asset returns

LTCMA BASE CASE: EXPECTED DEVELOPMENT OF FUNDING LEVEL OVER 10 YEARS

Source: Pension Protection Fund; The Pension Regulator; XPS Investment; J.P. Morgan Asset Management as at 30 April 2019.

0903c02a8262a6a1