Buy and maintain credit – What can pension funds do differently from insurers, and should they?

Pension funds don’t face the many constraints that make buy and maintain strategies so well-suited to insurers, and can make use of these freedoms when designing portfolios to meet the liability-aware investment needs of pension funds.

16-07-2019

Sorca Kelly-Scholte

Bryan Wallace

Liability-aware buy and maintain strategies for fixed income investing can be relevant for both insurers and pension schemes: both can use this approach in fixed income to match the duration and cash flows of defined liabilities. These strategies are well established in insurance, enhancing returns and minimising turnover given the accounting considerations and regulatory constraints under which insurers operate.

But, are they equally suitable for pension schemes which typically have greater flexibility in their fixed income investments? We examine these strategies and explain why we believe that buy and maintain strategies can be designed to meet the liability-aware investment needs and risk profiles of pension schemes across a wide range of plan maturities.

Defining buy and maintain investing

Liability-aware investing in fixed income is very different from the typical way investors think about constructing their credit portfolios. Its duration- and income-driven strategies have tailored duration profiles and steady cash flows designed to match a defined set of cash liabilities over a relatively long period. The approach chooses specific bonds to match those cash liabilities rather than managing relative to a general market index. The resulting strategies are particularly relevant for insurance companies and pension funds.

“Buy and maintain” strategies represent the most common type of liability-aware fixed income investing. Here, the portfolio manager seeks to hold bonds to maturity subject to credit deterioration, minimising turnover and transaction costs. The requirement to maintain stable credit quality means all credit risks in the portfolio must be continuously monitored and actively managed in order to minimise downgrades and defaults.

Liability-aware fixed income is an established insurer strategy

Insurance companies often adopt a buy and maintain approach to managing their portfolios given their need to focus on stable income, low turnover and minimal downgrades. Apart from seeking to match their liabilities, insurance companies are incentivised to construct credit portfolios that optimise their return vs. capital requirements, which leads to building much more customised portfolios.

Further, accounting considerations often drive an imperative to reduce turnover and manage realised gains and losses passing through the income statement. Buy and maintain approaches allow insurance investors to customise their portfolios to these needs and constraints, contributing to more stable balance sheets, more efficient use of capital and less volatile earnings from P&L fluctuations.

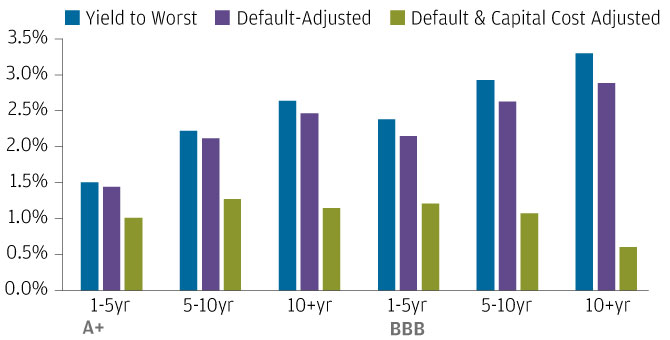

For pension funds, the potential rewards for taking risk in BBB vs A+ rated bonds is not penalised as it is for insurers

COMPARABLE EXPECTED RETURN OF A+ VS. BBB GDP CORPORATE BONDS, ADJUSTING FOR DEFAULT AND COST OF SOLVENCY II REGULATORY CAPITAL (APPLICABLE TO INSURERS)

Source: Bloomberg, Moody’s Corporate Default and Recovery Rates 1920-2017, J.P.Morgan Asset Management; market data on yield-to-worst are as of 31 March 2019. Capital cost adjustment reflects the annualized cost of capital buffer required for the average UK insurance company with a target Solvency Capital Ratio of 155% to hold against basic market risk Solvency Capital Requirement (ex-interest arte module). Annual Weighted-Average-Cost-of-Capital is assumed to be 8.45% based on Bloomberg.

0903c02a8262a6a1