Going global in pension real estate portfolios

UK pension funds are moving to globalise their real estate holdings, taking advantage of increased diversification benefits and greater scale of investment opportunities.

16-07-2019

Sorca Kelly-Scholte

Pulkit Sharma

The case for real estate in pension portfolios is well established: Property provides a durable income stream linked to inflation, and a valuable diversifier of equity risk. However, while UK investors have globally diversified their equity and credit portfolios, a strong domestic bias persists in their real estate portfolios. With more vehicles now available to access the global markets, the stage is set for UK pension funds to globalise their real estate holdings to take advantage of increased diversification benefits and greater scale of investment opportunities.

These considerations – increased diversification benefits and scale of investment opportunities – are similar to those that have led investors to diversify their equity and fixed income portfolios more globally, but they are perhaps even more relevant within a real estate portfolio.

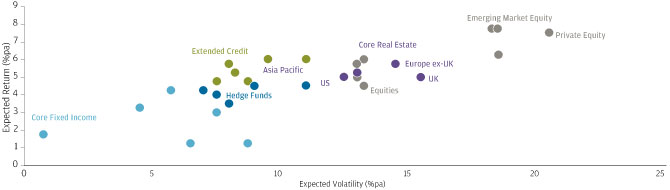

Our 2019 Long-Term Capital Markets Assumptions identifies attractive risk-return opportunities for global real estate assets. The illustration below shows that core real estate offers similar levels of return as developed market global equities, net of standard industry fees and currency effects.

Core real estate offers an attractive risk-return trade-off

EXPECTED RETURN AND RISK FOR SELECTED ASSET CLASSES

Source: J.P. Morgan Asset Management 2019 Long-Term Capital Markets Assumptions *

Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

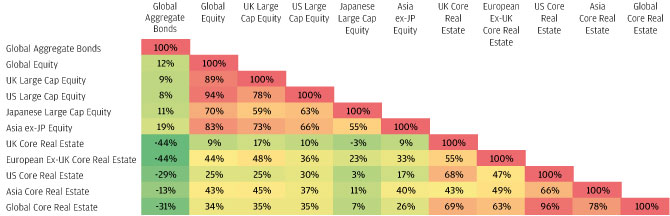

The next illustration demonstrates that real estate provides strong diversification benefits to both global equity and global bonds. Just as important for domestic real estate investors considering a global allocation, correlations among the real estate markets of the U.S., Europe and Asia-Pacific are lower than the correlations among listed equity markets. This suggests that investors who opt for a global allocation may have even greater potential for diversification within their real estate holdings than they do in their equity portfolios.

Real estate assets offer strong diversification to equities and bonds

CORRELATION MATRIX, SELECTED ASSET CLASSES

Source: J.P. Morgan Asset Management 2019 Long-Term Capital Market Assumptions

0903c02a8262a6a1