A sweet spot for the Australian dollar

In Brief

- Two trends in the structural position of the Australian dollar have been accelerated by the Covid-19 outbreak.

- First, Australia’s current account deficit has become a surplus, with structural trends exacerbated by cyclical developments.

- Second, with rates converging across the world, the Australian dollar no longer offers higher yields than other developed market currencies. However, we do not believe this is a significant drag.

- Australian investment abroad has continued to rise in recent years. Changing currency fundamentals may require a re-think of optimal currency hedge ratios for Australian investors in global equities.

Australian dollar strength is structural and cyclical

The Australian dollar initially fell sharply as the impact of Covid-19 spread across the world, global stock prices fell and funding markets dislocated. The recovery since the lows in March has been dramatic, with the currency now stronger than prior to the outbreak. This recovery has been in part due to the success of aggressive fiscal and monetary policy easing and central bank liquidity provision in stabilising global asset markets. However, it also reflects some currency-specific developments.

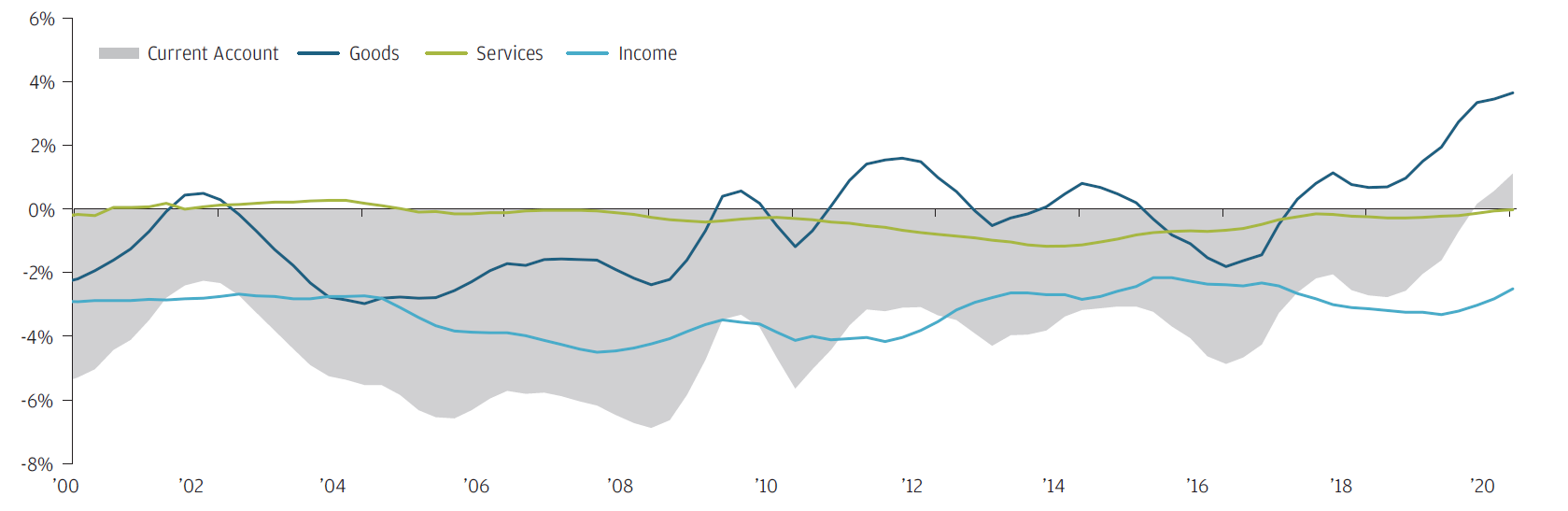

Most importantly, Australia has moved from a current account deficit to a surplus. This structural improvement has been driven by rising export volumes, which are a result of prior investment into the natural resources sector – a trend that has been accelerated by the rebound in industrial commodity prices that are sensitive to Chinese growth, as infrastructure investment is set to form a part of the Chinese recovery plan. Additionally, alternative iron ore producers, such as Brazil, are struggling with supply constraints.

The recent rise in gas exports amid falling energy prices is of particular relevance for Australia’s current account. Several years ago there was an expectation that the profit associated with these exports would be sent abroad, offsetting the gains on the goods balance with losses on the income balance1. However the fall in gas prices has significantly reduced the profitability of this activity even as the value of exports has still risen due to the huge increase in volumes.

EXHIBIT 1: Australian current account (% gdp)

Source: Bloomberg, J.P. Morgan Asset Management; data as of June 2020.

Source: Bloomberg, J.P. Morgan Asset Management; data as of June 2020.

When combined with the falling interest payments to foreign holders of Australian debt, the income balance is actually improving along with the goods balance. Furthermore, the hit to consumption from Covid-19 and related lockdowns has also reduced demand for imports, creating a sweet spot for real economy flows to support the Australian dollar.

While Australia and much of Asia are making far quicker progress than other advanced economies in reducing the spread of Covid-19 and safely exiting lockdown, the challenges faced by tourism and education exports remains significant. On balance we expect the boost to the Australian dollar from close links to the Chinese industrial cycle to exceed the drag from relatively high exposure to these key service sectors, where restarting activity is likely to be most challenging. This view requires careful monitoring.

Valuation support despite less yield support

The Australian dollar had already fallen behind the US dollar as the “AAA carry trade” in the last two years, and now offers little yield advantage even against persistently low yielding currencies, such as the euro and yen.

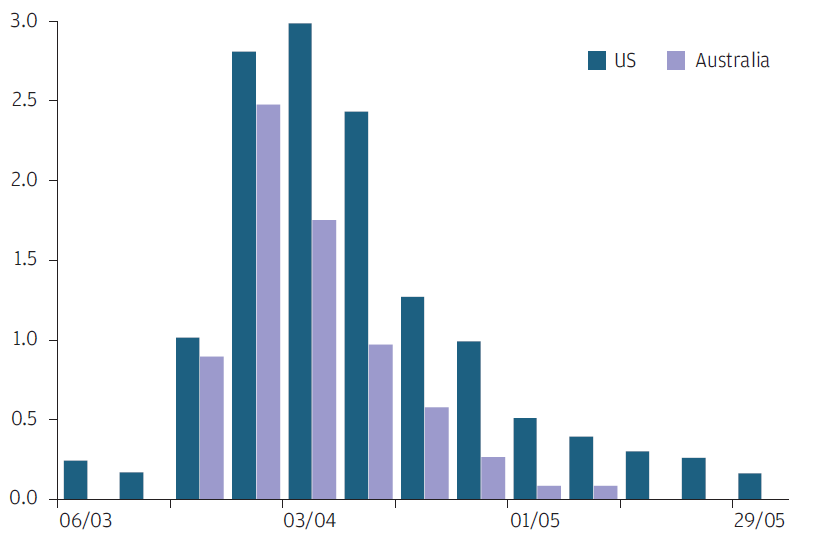

However, we do not expect the lack of a yield advantage to significantly weigh on the currency, mainly due to the implementation of Australian quantitative easing (QE) and the impact of the Federal Reserve’s aggressive easing on the US dollar, along with the adjustment to the Australian dollar’s valuation in recent years. When we evaluate the approach to QE taken in Australia, it is striking how the yield curve control framework has resulted in lower volumes of Reserve Bank of Australia (RBA) purchases when compared to international peers.

Australia’s relatively strong fiscal position compared to other indebted advanced economies may also mean lower volumes of central bank debt purchases are needed as the challenge of paying for the exceptional fiscal support required during the pandemic unfolds over the coming years. If we use the shadow rates framework we have followed over the last few years as a guide to how fixed income flow pressures affect currencies in other QE markets, such as Europe, it suggests the effect of RBA policy on the yield curve has delivered less “easing” than the US, resulting in the shadow rate spread moving in favour of the Australian dollar.

EXHIBIT 2: Central bank weekly government bond net purchase pace (as % of market cap) Source: Bloomberg, J.P. Morgan Asset Management; data as of June 2020.

Source: Bloomberg, J.P. Morgan Asset Management; data as of June 2020.

Optimal hedge ratios for australian investors

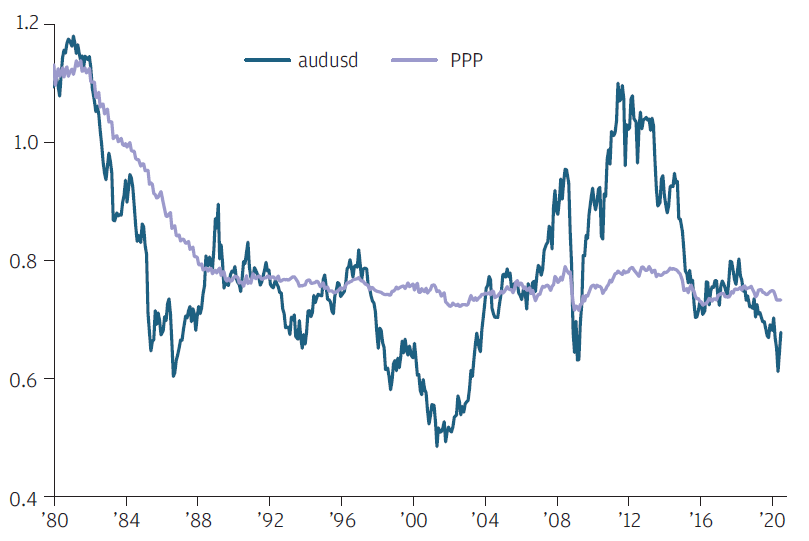

The risks to the Australian dollar from the disruption in US dollar funding markets are likely to remain. With comparatively little debt raised in Australian dollars compared to the international roles of the euro and US dollar, it is unlikely the Australian dollar becomes a safe haven currency. However, more favourable valuations and the change in currency fundamentals do suggest the Australian dollar could be somewhat less exposed to risk sentiment.

This change could have implications for optimal hedge ratios on foreign assets held by Australian investors, particularly in light of the significant increase in foreign equity purchases by Australian investors in recent years. Where previously the expensive valuation and tendency for the Australian dollar to fall at times of market stress made low hedge ratios attractive, we would now expect somewhat higher hedge ratios to deliver a better balance of risk and reward.

EXHIBIT 3: Aud/usd valuation against purchasing power parity (ppp)  Source: Bloomberg, J.P. Morgan Asset Management; data as of June 2020.

Source: Bloomberg, J.P. Morgan Asset Management; data as of June 2020.

Currency management

Since our first segregated currency overlay mandate funded in 1989, J.P Morgan Currency Group has grown to manage a total of USD342 billion (as of 31 March 2020) in bespoke currency strategies. Our clients include governments, pension funds, insurance clients and fund providers. Based in London, the team consists of 18 people dedicated exclusively to currency management with an average of over 15 years of investment experience.

We offer a range of hedging solutions for managing currency risk as well as a tailored optimal hedge ratio analysis:

- Passive currency hedging serves to reduce the currency volatility from underlying international assets. It is a simple, low cost solution designed to achieve the correct balance between minimising tracking error, effectively controlling transaction costs and efficiently managing cash flows.

- Dynamic “intelligent” currency hedging aims to reduce currency volatility from the underlying international assets and add long-term value over the strategic benchmark. A proprietary valuation framework is used to assess whether a currency looks cheap or expensive relative to the base currency and the hedging strategy is adjusted accordingly.

- Active “alpha” currency overlay offers passive currency hedging, if required, combined with an active investment process to deliver excess returns relative to the currency benchmark. Our approach is to build a global currency portfolio combining the output of fundamental models and incorporating the qualitative views of our strategy team.

1 Guy Debelle 2014 https://www.rba.gov.au/speeches/2014/sp-ag-200514.html

0903c02a82937980