Weekly Market Recap

Nothing to see here

22/07/2024

Week in review

- China real GDP falls to 4.7% y/y in 2Q

- Australian unemployment rate rises to 4.1% in June

- ECB holds rates, September rate cut still likely

Week ahead

- U.S. and European composite PMIs

- U.S. 2Q real GDP

- Bank of Canada rate announcement

Thought of the week

Australia’s labour market defied expectations last week, adding 50,000 jobs in June, well above the consensus view of 20,000. Despite this robust jobs growth, the unemployment rate climbed to 4.1% due to a pick-up in the labour supply and an increase in the participation rate. This seemingly contradictory outcome of more jobs but higher unemployment, underscores the challenge in gauging the strength of the economy. The unemployment rate has increased by 0.5%pts in the past year, and forward indicators like business employment intentions point to further increases. The RBA has cautioned that a rising unemployment rate can quickly accelerate, emphasising the risk of a slowing economy turning into a more severe downturn. The latest labour market data is unlikely to sway the RBA’s decision at its August meeting, placing greater emphasis on the second quarter inflation data released at the end of July.

Falling employment intentions point to a rising unemployment rate

Source: ABS, FactSet, NAB, J.P. Morgan Asset Management. Data reflect most recently available as of 19/07/24.

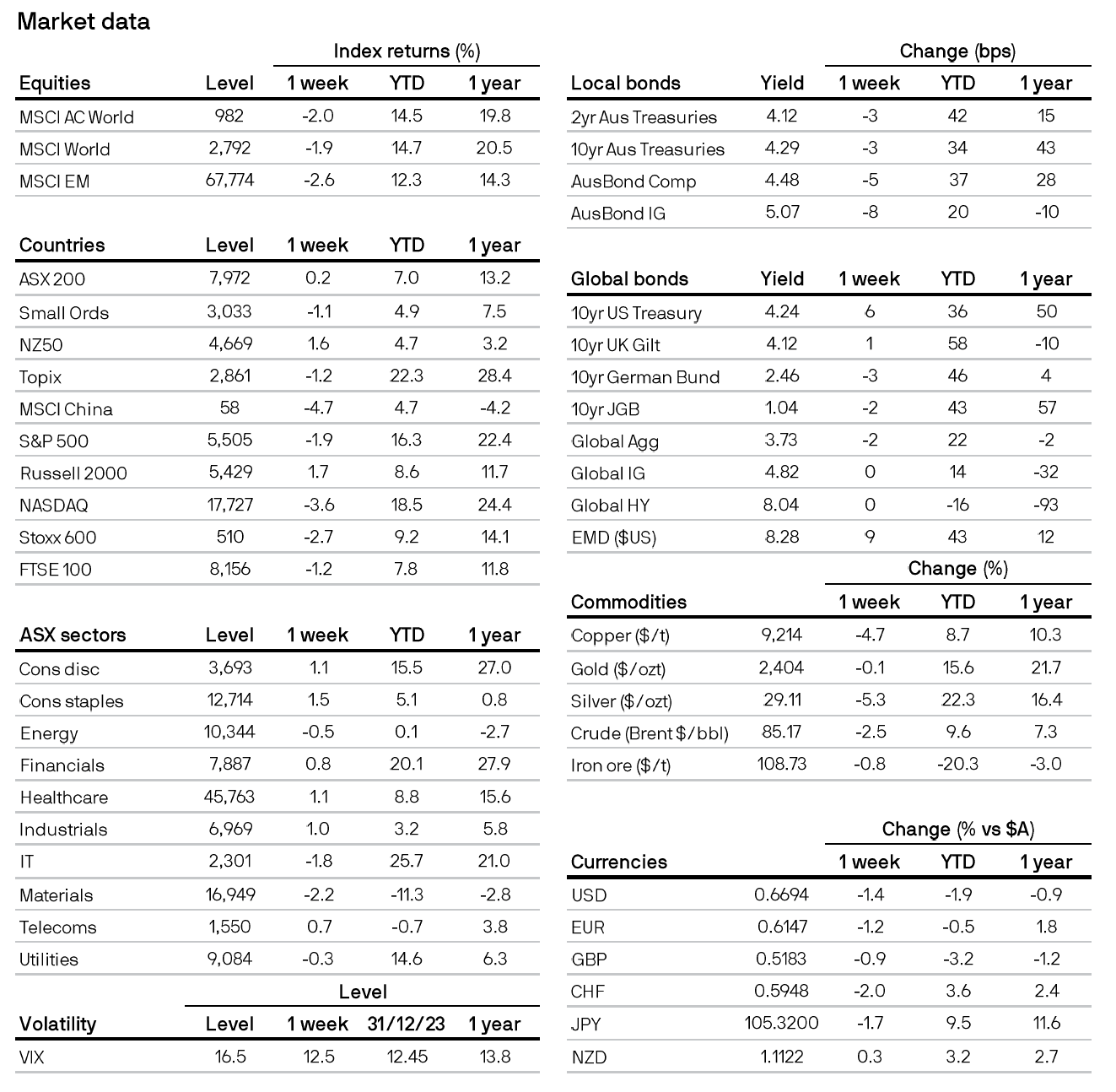

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5