We still believe the Fed may opt to leave rates unchanged in this upcoming meeting. However, the probability that this is just a pause, instead of the end of the hiking cycle, is on the rise.

84%

Probability of a 25bps hike in June or July

In brief

- Resilient economic data, lifting of the debt ceiling and reduced banking sector stress all allows the Fed to raise rate one more time

- The end of the hiking cycle is still near, given the already high nominal policy rate putting more pressure on the economy in the months ahead.

- Asset allocation in preparation for weaker growth still makes sense. Focus on high quality fixed income and equities that could weather more economic volatility.

The U.S. Federal Reserve (the Fed) is scheduled to meet on June 13-14 to discuss monetary policy. For the first time since the rate hike cycle began in March 2022, the discussion would revolve around whether the Fed should stop raising interest rates. Economic data, the vulnerability of the banking sector and the government debt ceiling saga have all influenced this decision. We still believe the Fed may opt to leave rates unchanged in this upcoming meeting. However, the probability that this is just a pause, instead of the end of the hiking cycle, is on the rise.

Investors are struggling to decide

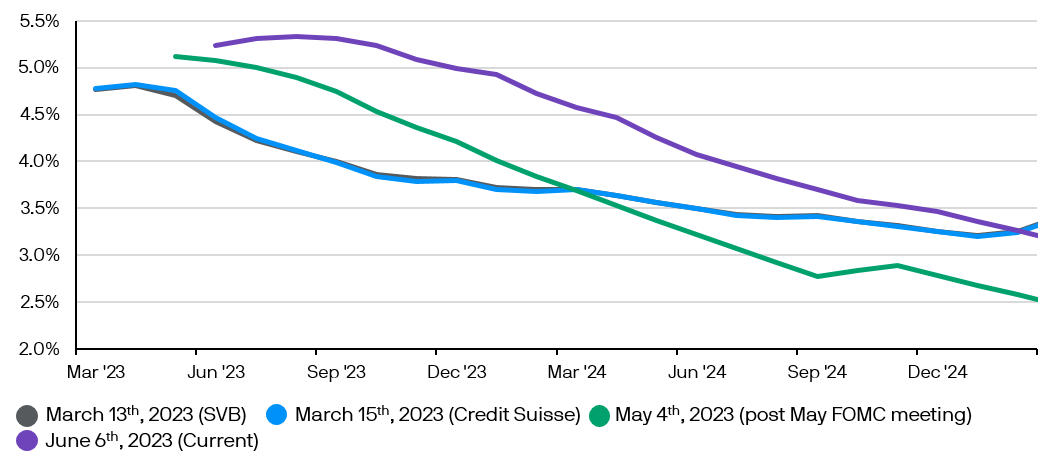

The Fed Funds futures market, which reflects investors’ expectations of what the Fed will do in the months ahead, has swung wildly in recent weeks. Not only has this indication shifted on whether the Fed will raise rates in the coming months, but investors have also seemed to change their minds on whether the Fed will cut rates later this year.

After the May 2-3 FOMC meeting, the futures market was pricing the end of the hiking cycle and the Fed would start to cut rates in H2 2023, starting in September, with a total of 100 basis points cut by January 2024. However, as of June 5, the same market pricing is showing an 84% chance that the Fed would raise rates by another 25bps by the July meeting, and the first rate cut won’t come until December.

Exhibit 1: Expectations for the Fed Funds rate

U.S. implied policy rate based on Overnight Index Swap rates

Source: Bloomberg, J.P. Morgan Asset Management.

Data reflect most recently available as of 06/06/23.

What has changed? The troubles surrounding U.S. regional banks seem to have stabilized, for now. This helps to calm investors’ nerves about a possible banking crisis. The federal government debt ceiling was raised with some drama, but without accident. Moreover, recent inflation and economic data are still showing considerable resilience in the U.S. economy.

April’s personal consumption expenditure (PCE) deflator data was up by 0.4% month-on-month, the strongest rise since January. This reflects that the Fed’s concerns over inflation are not over yet, especially in services such as healthcare and professional services. The job numbers for May were also much stronger than expected. 339,000 jobs were created in the month, versus a market expectation of just 195,000, and the April data was also revised higher. This shows the limited cooling effect from higher interest rates on inflation and demand for workers, which could encourage hawkish Fed officials to advocate more rate increases.

Why wait?

Given the reduced risk of a banking crisis and a government default, as well as robust economic data, why shouldn’t the Fed just raise rates anyway in June? Instead of on auto-pilot like the last 15 months, there are several factors at play that we think the Fed will need to consider.

Policy rates have already risen rapidly in the past 15 months and few central bankers would disagree that we are already in restrictive monetary policy territory. Looking at the March 2023 Summary of Economic Projections , which collated forecasts on the economy and policy rates by senior Fed officials, 10 out of 18 officials predicted policy rates would remain at the current level until the end of 2023, only 7 forecasted rates would end the year higher. While this could still change in the upcoming June update, these forecasts suggest most officials believe we are approaching the end of the hiking cycle.

Even as current economic data, especially the job market and consumption, are still showing considerable signs of resilience, some other leading indicators are flashing signals of caution. In particular, banks are tightening their lending standards either because they are constrained by deposit outflows or because risk managers are becoming more prudent with the economic outlook. This tightening, which began back in late 2022, has been a reliable forward looking indicator of economic recessions in the U.S., and the Fed could need to be mindful of not tightening too much that would force the economy into a sharp recession. After all, high interest rates don’t break things right away. It works with a time lag, and policymakers will need to think not just about the next few months ahead but also the quarters to come to gauge the right level of interest rates.

Investment implications

Government bond yields have tracked higher on the back of firm economic data. However, even if the Fed does deliver a rate hike in the June meeting, we think the risk to government bond yields remain on the downside. We still see a growth slowdown as a more likely scenario and this would point towards high quality fixed income (government bonds and investment grade corporate debt) and more defensive sectors for U.S. equities.