Dividend is crucial in Asia as dividend yield has contributed more than 60% of the cumulative total returns since 2000.

In brief

- Asia high dividend equities outperformed since the Fed pivot at the Dec FOMC meeting as well as the second half of 2023.

- Near term tailwinds, such as weaker U.S. dollar as well as the bottoming of the tech cycle, coupled with supportive macro factors, robust Asian corporate fundamentals and attractive valuations, should continue to bode well for Asia dividend stocks amidst global slowing macroeconomic conditions and lower interest rate environment.

Asia high dividend equities once again outperformed since the Fed pivot

The Federal Reserve opened the possibility of policy easing during the last December 2023 meeting. The more dovish Fed backdrop suggests investors will likely be facing a U.S. soft landing with slower economic growth, moderating inflation as well as the prospects for falling interest rates this year. Since the Fed pivot, the MSCI AC Asia Pacific ex-Japan High Dividend Yield index gained 5.0%, outperforming that of the S&P 500 (+1.4%) and MSCI AC Asia Pacific ex-Japan Index (+4.2%), as high dividend plays benefit from a potentially lower interest rate environment. During the second half of 2023, the MSCI AC Asia Pacific ex-Japan High Dividend index (+9.1%) also topped S&P 500 (+8.0%) and MSCI AC Asia Pacific ex-Japan Index (+3.3%).

What are the key factors that support the outperformance?

(1) Robust corporate fundamentals

As global growth continues to slow, dividend investing can be considered as defensive while providing more income certainty. Asia corporates are supported by robust balance sheets and lower debt levels relative to their historical average, which bodes well for dividends in addition to providing a shelter from deteriorating economic conditions. While companies within MSCI USA have a cash to debt ratio of 30.8%, MSCI Asia Pacific ex-Japan and MSCI Japan companies have a cash to debt ratio of 62.6% and 39.1% respectively. Adequate cash levels suggest that Asian companies will be able to continue paying dividends even if the global economic condition worsens.

(2) Supportive macro factors

From a macro perspective, Asian economies are likely to enjoy a healthy growth differential relative to the U.S., and the region’s monetary policy continues to be supportive on a comparative basis. In particular, China is embarking on policy easing to counter growth headwinds, while Japan is likely to maintain its easy monetary policy at least for the next few months.

Meanwhile, a potentially weaker U.S. dollar as the Fed embarks the rate cutting cycle, should prompt greater inflow into Asian equities. This should benefit export-oriented markets like Taiwan and Korea as the continuous recovery in the export and semiconductor cycle should be supportive of Asian equity earnings and dividends. Earnings growth of MSCI Taiwan—accounting for 15.4% of the MSCI Asia Pacific ex Japan index market capitalization—exhibits a significant degree of correlation with exports and semiconductor billings.

Taiwan’s latest November tech exports continued to show solid growth, reflecting strong expansion in exports of artificial intelligence-related products, while the tech sector’s de-stocking pressure begins to ease. While there are concerns about a decline in U.S. capital expenditures, the latest from the 3Q U.S. earnings season suggests that U.S. corporate margins are still holding up above historical averages, which could provide a buffer for capital expenditure and demand for Asian exports in the near term.

Further stabilization in China’s economic momentum and deployment of fiscal support to strengthen sentiment should also be a boost to Asian equity earnings, as MSCI Asia Pacific ex-Japan has a revenue exposure of around 33% to China.

Asia earnings may also be protected by domestic factors as Asian corporates have a substantial exposure to domestic revenues. MSCI Asia Pacific ex Japan companies derive more than 75% of their revenues domestically. This should help cushion Asian earnings from a slowdown in the U.S.

(3) Attractive valuations on both absolute & relative basis

From a valuation perspective, Asian equities are also trading at relatively attractive levels. From a 12-month forward price-to-earnings perspective, most MSCI Asia Pacific ex-Japan regions (except for Korea, Taiwan, Thailand and India) are trading below 15-year average levels. From a price-to-book (P/B) perspective, most regions are trading more than 1 standard deviation below 15-year average levels. Historically, with MSCI APAC ex-Japan trailing price-to-book ratio trading at 1.6X, the next 12- month return for Asian equities tend to look positive.

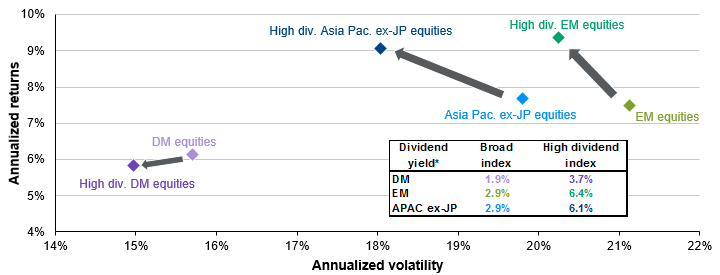

Exhibit 1: Risk return profile of high dividend equities

Based on net total returns from Dec. 2000

Source: FactSet, J.P. Morgan Asset Management. *Dividend yield reflects latest dividend yield. High div. means high dividend, DM means developed markets, Asia Pac. ex-JP means Asia Pacific ex-Japan. Past performance is not indicative of current or future results. Guide to the Markets – Asia. Data reflect most recently available as of 31/12/23.

Investment implications

Dividend is crucial in Asia as dividend yield has contributed more than 60% of the cumulative total returns since 2000. In addition, MSCI Asia Pacific ex-Japan High Dividend index tends to provide a better risk-adjusted return relative to the broader MSCI Asia Pacific ex-Japan index, since there are usually a greater number of higher-quality companies with strong fundamentals to deliver dividends, as shown in Exhibit 1. Given the macroeconomic uncertainties and the likely decline in cash rates over the next 6 to 12 months, it will be increasingly essential to find the complementary pairing of fundamental resilience and stable dividends to preserve and enhance the total return of a portfolio. In our view, the near term tailwinds, such as weaker U.S. dollar as well as the bottoming of the tech cycle, coupled with supportive macro factors, robust Asian corporate fundamentals and attractive valuations, should continue to bode well for Asia dividend stocks amidst global slowing macroeconomic conditions and lower interest rate environment.