Even as central banks are right in wanting to put inflation away, they need to keep an eye on the downside risk to growth.

In brief

- DM central banks are aiming to keep high rates for an extended period of time to bring inflation back to target.

- This plan could be challenged by weakening growth momentum and risk events adding to downside risk to growth.

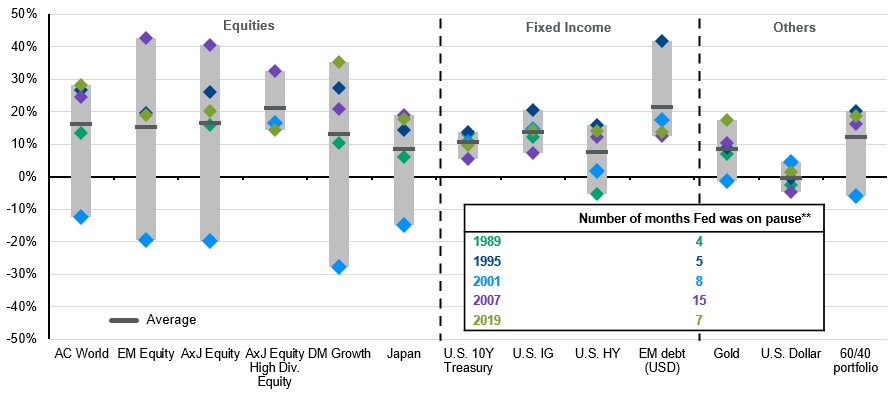

- The end of the hiking cycle typically marked the peak of government bond yields. This offers an opportunity to lock in high rates and also explore assets that outperform during a falling yield environment. This would include growth stocks and high dividend stocks.

Earlier in the year, we argued that the rate hike cycles in developed markets (DM) was like reversing a car into a parking spot. The driver needs to proceed with more caution once the car is closer to the wall or barrier. The latest round of central bank meetings in the U.S., UK and euro area confirmed that we are approaching the end of the hiking cycle, if not there already. Japan is in a different place altogether, but its action in the months ahead could also influence other DM central banks given Japanese financial institutions overseas allocation.

These central banks are facing similar conditions. Inflation is decelerating but still some distance away from their official targets. The recent rise in energy prices is posing some upside risk to headline inflation. Traditional thinking is that more expensive energy is a threat to consumption. Households have to pay more for gasoline and heating, and hence less money to spend on other discretionary items. Central banks may worry more about the threat to growth.

Moreover, economic growth momentum is decelerating, especially with the manufacturing sector. The manufacturing purchasing manager indices (PMI) for the U.S., eurozone and the UK are all below 50. The service sector PMI is also declining. This reflects that the high interest rate environment is starting to cool the economy.

With this backdrop in mind, these three central banks are strongly indicating that the rate hike cycle is coming to an end. The futures market echoes this view. The European Central Bank raised its policy rate on September 14 by 25 basis points to 4%. It did hint that this could be the end of the hiking cycle as rates have reached a level that would contribute to bringing inflation back towards its 2% target. The Bank of England surprised the market by staying put, partly due to the unexpectedly soft inflation data in August.

The end of the hiking cycle does not imply that rate cuts could come any time soon. The Federal Reserve’s (Fed’s) latest “dot plot” of policy rate forecast still shows 10 out of 19 Fed officials expect policy rate to stay above 5% by the end of 2024.

Exhibit 1: Asset class returns following the end of rate hikes

Average returns a year after the past five rate hike cycles ended

Source: FactSet, U.S. Federal Reserve, J.P. Morgan Asset Management. *Total returns in local currency are used, unless otherwise specified. **Refers to the duration between the last rate hike and the first rate cut, specifically Feb '89 - Jun ‘89, Feb '95 - Jul ‘ 95, May '00 - Jan ‘01, Jun '06 - Sep ‘07, Dec '18 - Aug ‘19.

Guide to the Markets – Asia. Data reflect most recently available as of 26/09/23.

Both comments from Fed Chair Jay Powell and other senior officials suggest the Fed’s priority remains on cooling inflation. The “higher for longer” stance could prevail in the months ahead. However, since the Fed opted to stay put in the last meeting, the September inflation data would need to be exceptionally strong to justify another hike again in the next meeting on November 1.

This belief that the economy can withstand high rates could be soon challenged. The UK and European economies are already facing headwinds in growth momentum, as higher borrowing costs weaken corporate investment and increase interest payments for mortgage borrowers. In the U.S., the housing market and corporate spending are already slowing down. Yet, the strong job market and robust consumption is keeping the economy on a steady growth path. That said, the Fed needs to be mindful of the potential pitfalls ahead.

At the time of writing, the strikes by the United Auto Workers are still ongoing. The U.S. government is heading for a shutdown on October 1 if both chambers of the Congress fail to pass a spending plan. Although neither event would be enough to tip the U.S. economy into a recession on their own, consumer and business sentiment could weaken further into the new year. The Fed will need to start taking into account some of the potential downside risk in the economy when making policy, especially when real yields (nominal government bond yield minus inflation) has risen substantially.

For Japan, investors have been speculating when its central bank would need to start raising interest rates. In last week’s monetary policy meeting, Bank of Japan Governor Kazuo Ueda still insisted on seeing inflation being accompanied by sustained wage growth before taking action to tighten monetary policy. This implies the next decision point may not come until next spring. The Japanese yen is likely to remain under pressure given the interest rate differential between Japan and other major currencies.

Investment implications

Even as central banks are right in wanting to put inflation away, they need to keep an eye on the downside risk to growth. Not only from higher borrowing costs that would pressure households and businesses, but also from risk events, especially those induced by elections around the world in the next 12 months which could also raise the risk of recessions.

Overall, this points towards lower government bond yields in the next 6-12 months, despite the recent spike in U.S. Treasury yields. This could benefit long duration assets including long-dated government bonds, as well as valuation sensitive equities, such as those in growth stocks and technology sector. In Asia, the possible decline in cash rates could also make high dividend stocks attractive once again, as investors look to generate consistent income flow from beyond fixed income.