Our view of the USD downtrend in the medium to long term should remain intact due to interest rate differentials and expensive valuation.

10.2%

Drop from its 2022 highs in the U.S. Dollar Index (DXY)

In brief

- The Fed has taken pause in their rate hike cycle, which was not unexpected.

- Higher interest rates in the U.S. throughout 2022 have helped drive the USD higher, but we maintain our long-term outlook for a weaker USD.

- In the shorter term, sentiment and economic data releases may continue to drive the dollar higher.

The Fed pauses. What now for the U.S. dollar?

The U.S. Federal Reserve’s (Fed’s) tightening moves have been one of the major drivers of U.S. dollar (USD) strength across 2022. 2023 movements have been less pronounced. Now that the Fed has enacted what is being termed as a “hawkish pause”, does this cause us to change our view for the USD?

We stick to our view of USD down in the long term

In our publications earlier in the year, we were of the view that we expect the USD to remain on a depreciation path in the longer term. We still hold this view and believe that most of the reasons for doing so are still valid. The Fed pause was not unexpected and does little to change our overall outlook on the dollar.

The dollar is still overvalued. Looking at the current level of the dollar index and the real effective exchange rate, the USD is still far above its 10-year average. Other determinants of “fair value” for the currency, such as an increasing current account deficit, also suggest a USD depreciation.

Our outlook on interest rate differentials also remains in place. Higher interest rates and yields offered by the U.S. were a major driver of USD strength. The Fed’s aggressive moves quickly took U.S. interest rates to their highest level since 2007. This has benefitted the USD, but other central banks are also on the tightening path in an attempt to control inflation. The gap between U.S. rates and other developed markets is likely to shrink once the Fed has determined they are done with the current hiking cycle. This might now happen later rather than sooner, based on the most recent statements that has the market describing the action as a “hawkish pause”. The Fed unexpectedly appears to be projecting 2 more rate hikes to come this year. Market consensus is pricing in only one more rate hike before cuts occur, in opposition to the Federal Open Market Committee’s dot plot and outlook. Our own view is that we do not think further tightening is appropriate at this stage given U.S. growth is slowing and labor markets are already loosening. We anticipate another soft inflation print driven by base effects, normalizing rent inflation and used car prices. We still expect this shift in the interest rate backdrop and policy pivot to occur eventually.

Sentiment, expectations and geopolitical concerns also continue to evolve. Part of the move into the U.S. dollar was due to risk aversion as it is seen as a safe haven. Several worries bothering the markets last year have since shifted. Energy shocks from the Ukraine-Russia conflict have abated and concerns over whether the world would fall into a U.S. led recession have also shifted further out.

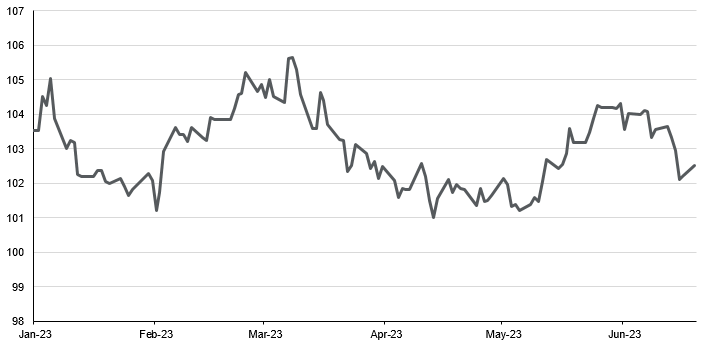

Exhibit 1: USD trends so far this year appear less obvious

U.S. Dollar Index level

Source: FactSet, J.P. Morgan Asset Management. Data reflects most recently available as of 06/19/23.

But short term is another matter

While these longer-term drivers still hold, the shorter-term outlook of the next six months into next year is another matter. There are several factors that we see that could still prompt modest USD strength.

Some sentiment or geopolitical factors supporting a weaker USD continue, but others could still shake out in favor of a rising dollar. Initially, the risk of U.S. recession appeared more likely than not during the earlier part of 2023 according to consensus and even some of our own models. This has since pulled back, but the economic situation could still deteriorate quickly. A “hard landing” could pan out if the Fed could make a policy mistake, tightening too much or be forced to tighten further if inflation continues to rise, leading to consumers and business facing the pressure of even higher rates. Risk-off attitudes and investor flight to safety may also return if banking sector or other unexpected issues arise.

Another support for longer-term USD weakening that has recently turned is the growth outlook. Widening growth differentials which were previously thought to be in favor of non-U.S. economies have not held. Earlier in the year, it appeared that that growth numbers in Europe and China would accelerate and widen the gap against the U.S. Instead, these regions have seen disappointing economic performance recently. Initially a key theme, China’s weak momentum has fallen short of the original hope that re-opening would lead to a surge in activity.

Investment implications

Although some factors have shifted, we maintain our view that the USD could still face some upward short-term pressure in the event of risk-off sentiment making a return and non-U.S. economic activity slowing. Our view of the USD downtrend in the medium to long term should remain intact due to interest rate differentials and expensive valuation.

As before, in the event of a weakening dollar, USD based investors not in the U.S. stand to benefit, with EM and Asian assets performing more favorably. U.S. multinationals with a greater proportion of geographically foreign based earnings should also see earnings rise.