With several growth factors in place in emerging markets, we think that once the Fed starts to cut and the U.S. dollar turns, this sector will enjoy a strong market rally, with well-justified returns.

In brief

- Shifting expectations for the start of the Federal Reserve (Fed) cutting cycle and U.S. dollar strength intact, have left emerging market (EM) assets struggling to find solid footing.

- Our expectation for Fed cuts beginning mid-2024 creates space for EM central banks to start easing or extend current easing cycles.

- All said, compelling valuations, recovering economic activity, an easing policy backdrop and the concomitant weakening in the U.S. dollar are likely to benefit EM assets through renewed capital inflows in the near term.

- In the longer term, there are pockets of opportunities given the diverse growth drivers across Asia such as favorable demographics, further supply chain diversification into some economies and their importance as major chip manufacturing hubs.

Waiting on the Fed to change

Throughout last month, markets were repricing the Fed policy rate cuts on the back of economic data that conveyed a resilient U.S. growth backdrop and Fedspeak, that hinted at a delayed start to the monetary easing cycle. As a result, EM equities returned 1.3% year-to-date (YTD) in U.S. dollar (USD) terms, underperforming developed markets’ (DM) 6.7% returns, amid the continued U.S. dollar rally. With a lofty 26% weight in the EM index, the weakness in Chinese stocks in recent quarters has been another major headwind for broad EM indices. EM ex. China fared slightly better, with returns of 3.3% YTD and 16.8% in 2023 (versus 7.0% for EM). Putting aside the challenges in China, however, the EM macro backdrop appears constructive with growth remaining supportive and the disinflation process gaining traction. This begs the question: what will drive EM returns this year? In our view, the start of the Fed rate cut cycle represents a turning point in generating positive (and sustainable) EM asset returns through strong capital inflows. There are also varying themes within the EM space, which we will explore further in this article. The diversity of growth levers in EM in our view offers investors a host of investment opportunities.

In the near term, however, the uncertainty of Fed rate cuts implies volatility in EM asset performance accompanied by retreat in EM currencies. The longer-term risk is the persistent U.S. exceptionalism, resulting in rates staying higher for longer and weaker capital inflows into EM economies.

EM holding its own

Over the course of the COVID pandemic, domestic demand in EM economies was buoyed by the buildup in private sector savings, thus offsetting the decline in external demand. Akin to the experience of DM, EM central banks had hiked policy rates to varying degrees. The concern was that EM economies were unable to withstand the high policy rates, with the transmission into the real economy threatening the ongoing expansion. In terms of sequencing, this would imply that unfavorable EM growth differentials with the U.S. could manifest in strong capital outflows, echoing the 2013 taper tantrum.

However, the relatively healthier starting conditions of the EM economies ahead of the pandemic, with higher net savings and low leverage levels cushioned the impact of higher rates. This is evident by the EM commercial banks’ healthy loan-to-deposit ratios and private sector savings-investment gap (i.e. current account balance) being even higher than in 2019.

In the medium to long term, economic growth in EM is well-supported by structural trends boasting some of the world’s largest youth population and middle class, some of the main foreign direct investment (FDI) beneficiaries of supply chain diversification and some of the world’s most important manufacturing hubs for Artificial Intelligence (AI) components and chips.

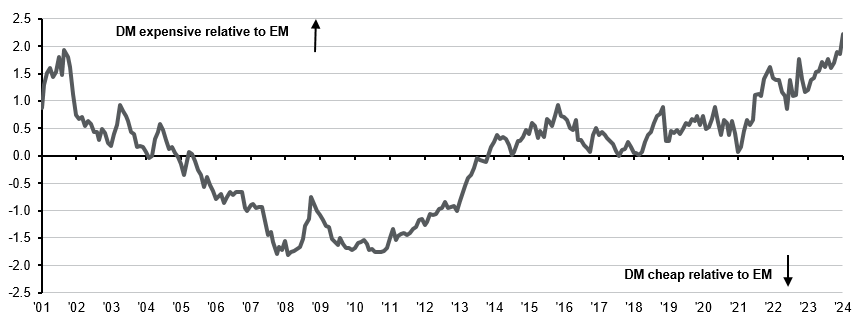

Exhibit 1: Equity market valuations – Price-to-earnings

Forward P/E ratios

Source: FactSet, MSCI, J.P. Morgan Asset Management. Argentina is not a member country in the MSCI Emerging Market index and thus has been excluded from the above chart. EM stands for emerging markets. Data are as of March 5, 2024.

Source: FactSet, MSCI, J.P. Morgan Asset Management. Argentina is not a member country in the MSCI Emerging Market index and thus has been excluded from the above chart. EM stands for emerging markets. Data are as of March 5, 2024.

Taking stock of EM valuations and growth drivers

Exhibit 1 shows that while MSCI EM is valued in line with 15-year average at a price-to-earnings (P/E) ratio of 12.1, the dispersion is quite wide across the board. Among the largest emerging markets, Asian markets such as India, Taiwan and Thailand are more expensive than their long-term averages, given their recent equity strength, while most emerging Europe and Latin America (LATAM) markets are relatively cheap.

LATAM: Continued easing in monetary policy in LATAM can provide further relief to their economies and sustain the current recovery in select markets. The retreat in inflation in the region has opened the policy space for some central banks to cut (Brazil, Chile, Colombia and Peru) amid a softening in the global growth outlook.

Elsewhere, structural trends are likely to continue to support LATAM with Mexico as a primary beneficiary of the nearshoring/friendshoring trend, with the potential to attract capital inflows and manufacturing activity once the government supports further expansion of industrial real estate and infrastructure. With strong wage growth in the U.S., remittances back to Mexico have also reached record levels, providing strong support for domestic consumption and the peso.

With most LATAM countries seeing valuations below 15-year averages, investors’ interest in LATAM is building momentum. In the months to come, politics will be a key area to watch, particularly for the new Argentinian government’s ability to push reforms through Congress as well as the outcome of the June 2024 presidential election in Mexico. These elections hold important implications towards addressing various fiscal challenges and particularly for Argentina, the weakening economy and hyper inflation.

Emerging Europe: This region had a challenging 2022, stemming from the Russia-Ukraine conflict and the fallout on energy prices, but has since emerged on a strong footing, with fiscal support from the european union cohesion and post-pandemic recovery funds continuing to provide investment support in the mid to long term. Several countries such as Poland are already enjoying the benefits of the global supply chain diversification efforts, as seen by increased FDI into semiconductor and electric vehicle battery manufacturing.

Emerging Europe was a bright spot within emerging markets, returning 25.2% in 2023, and outperforming MSCI EM’s 7.0%. This is partly a recovery from an especially brutal -72.2% in 2022, and also a result of receding risks on the political and inflation front. However, the recovery has been arguably uneven. Czech Republic and Poland currently see valuations in line with history, but Hungary and Turkey see depressed ratios near 15-year lows.

On the macroeconomic front, however, an extended eurozone’s slowdown and stubborn inflation remain key risks. In CE-3 (Czech Republic, Hungary and Poland), core services disinflation momentum has slowed while core goods prices are rebounding given the pass-through from weak currencies.

Emerging Asia: While inflation has returned to target across most Asian economies, central banks remain sensitive of external conditions, particularly the manifestation in domestic currencies. The weakening in the U.S. dollar will create space for the central banks to cut benchmark rates. However, the shallower policy rate hike cycle adopted across most EM Asian ex. China central banks offers a limited buffer to a sharper deterioration in economic growth.

In EM Asia, healthy AI demand has reignited the regional tech cycle, with Taiwan and South Korea the main beneficiaries as manufacturers of semiconductor and memory chips. An added tailwind for South Korea is the move towards implementing the Corporate Value-up Programs to improve companies’ valuations. Meanwhile, growth concerns tied to the ongoing property market slump and the erosion of private sector confidence in China have resulted in a major sell-off in domestic equities this year, with the CSI 300 down 6.3% in January alone. As we outlined in a previous publication, active management will be key towards areas of policymakers’ policy priorities such as high-end manufacturing. In India, while the recent GDP print and structural trends paint a constructive multi-decade growth backdrop, valuations are screening expensive with the P/E ratio currently at 22.7, high relative to the long-term average.

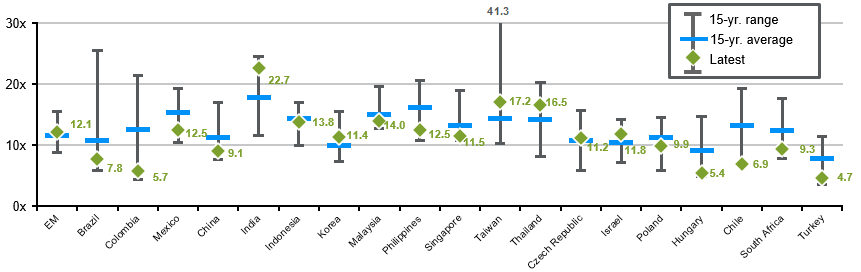

Exhibit 2: MSCI DM vs. MSCI EM valuations

Fwd. P/B ratio, % of std. dev*. over/under average

Source: FactSet, MSCI, J.P. Morgan Asset Management. *Std. dev. is standard deviation, which is a measure of dispersion relative to the mean. Data are as of March 5, 2024.

Investment Implications

We see emerging markets now at a sweet spot, with strong earnings growth potential amid fair valuations. EM earnings growth is expected to reach 18% in 2024, compared to 11% in the U.S. and 5% in Europe. In Exhibit 2, we see that EM relative to DM price-to-book (P/B) valuation discount is now over two standard deviations wider than historical average, in fact, at a level unseen since the Dot-Com bubble in late 2001. Interestingly, as an aggregate, EM valuations are in line with the long-term average, but since 2014, the persistent expansion in DM valuations have led to the widening of the gap. Within emerging markets, it is worth noting that the decline in Chinese valuations has likely offset the strong rallies in selected LATAM and emerging Europe markets.

Looking forward, we see the recovery momentum in parts of emerging Asia and LATAM picking up, with receding inflation and purchasing managers’ indices recovering. Several EM central banks have started easing monetary policy and this will likely broaden out to the rest this year, supporting economic activity. Long term structural growth drivers of solid demographics, supply chain diversification benefits and manufacturing opportunities from AI will give emerging markets the potential to outshine developed markets.

With several growth factors in place in emerging markets, we think that once the Fed starts to cut and the U.S. dollar turns, this sector will enjoy a strong market rally, with well-justified returns. That being said, EM economies are diverse, with various idiosyncrasies in terms of inflation, growth and political risks. The dispersed valuation adds to the complexity. Thus, active management is needed to flexibly allocate across such diverse markets and sectors.