Among global equity markets, China is one of the worst performers year-to-date. However, this may suggest the weak growth prospects and lack of policy stimulus have already been fully priced in, and any marginal improvement in growth and policy conditions should trigger a turnaround in market sentiment.

In brief

- Chinese inflation continued to decline in June, reflecting sustained weakness in consumption and investment demand.

- GDP and monthly activity data to be published in upcoming weeks may also point to slowing momentum, which may continue weighing on market sentiment.

- Chinese authorities have delivered messages for accommodative policies, while balancing short-term and long-term objectives remains challenging.

- With less demanding valuation, Chinese stock market is now better positioned for both short-term and long-term themes.

After a strong recovery in the first quarter of 2023, Chinese economic momentum slowed down in the second quarter as a result of weak confidence and the absence of strong policy stimulus. Monthly inflation indicators published on July 10 pointed to sustained weakness in domestic demand and rising deflation risk. The quarterly GDP and monthly economic activity data to be released on July 17 may also reflect some disappointing trends. Recent policy statements have delivered messages for accommodative policies, while balancing short-term and long-term objectives remains challenging.

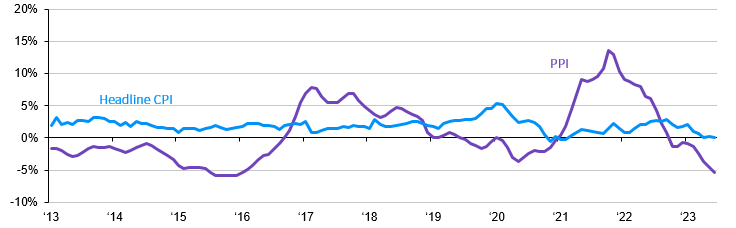

Price indices pointed to cooling demand

In contrast to the sticky and elevated inflation in developed economies, Chinese price indices have remained modest since economic reopening around 2022 year-end. According to price indices published by the National Bureau of Statistics on July 10, the Chinese headline consumer price index remained flat in June, and producer prices declined by 5.4% y/y. The weakness in prices points to mounting pressure on domestic consumption and investment demand.

On a more detailed level, food inflation was the major contributor to consumer prices, rising 2.3% year-over-year (y/y) partially due to regional high temperatures during the month. At the same time, service prices increased by 0.7% y/y, as pent-up demand for offline services continues to be released. Tourism prices rose 6.4% y/y with holiday season approaching.

On the other hand, the price index of consumer goods declined 0.5% y/y, reflecting cooling consumer demand on a broader basis. The softening sub-indices in manufacturing PMI, such as new orders and inventory, reflects a similar trend.

A more concerning signal is from producer prices, which have been in deflationary territory since last October. Producers’ price index for raw materials declined 9.5% y/y, probably due to a deceleration in investment activities. Since fixed asset investment, particularly infrastructure investment, is playing a key role in the recent recovery, this signal of slowdown points to accumulating pressure on that end.

Exhibit 1: Price indices in China

Year-over-year growth

Source: CEIC, National Bureau of Statistics, J.P. Morgan Asset Management.

Guide to the Markets – China. Data reflect most recently available as of 11/07/23.

Confidence matters and policy rebalancing is expected

In the coming couple of weeks, relevant authorities will publish a variety of critical economic indicators, covering domestic activities, foreign trade and monetary policy. Following disappointing economic readings in April and May, these new data releases may continue to weigh on market confidence.

To be published on July 17, Chinese real GDP growth is expected to reach a level around 7% y/y in the second quarter (1Q23: 1.5% y/y), mostly because of the low base during nationwide lockdowns in the same period last year. However, this only translates into a modest quarter-over-quarter growth of 0.2%, far below the rate of 2.2% achieved in 2Q23.

Besides GDP readings, monthly activity indicators may also reflect sustained headwinds in the economy. Particularly, as mentioned in previous notes, fixed asset investment by private sectors and in the property sector may remain major drags as business confidence stays depressed. Another major challenge comes from the labor market. As the youth unemployment rate will likely stay above 20% in June, social stability may become a more urgent concern for policy makers.

After several months of slowdown in economic activities, it has become even more urgent for policy makers to stabilize expectations. That said, it is also increasingly difficult to balance between short-term stimulus and long-term objectives, such as common prosperity and housing market reform, and hence the introduction of supportive policies fell short of market expectations. Although the People’s Bank of China cut the interest rate of its mid-term lending facilities and guided down loan prime rates by 10 basis points, investors and businesses remain cautious about growth outlook.

After the release of several key economic data in mid-July, Politburo of China Communist Party, the country’s top policy making group, will hold a meeting to discuss economic policies. The policy pendulum may swing back to short-term stabilization measures at this meeting, with emphasis on coordinated monetary and fiscal measures to boost expectations. The central government may expand its spending to support domestic demand, backed by central bank credit tools. Facilitated by the soft inflation readings, further cuts to deposit and lending rates are also expected to help public and private sectors with lower funding costs. Meanwhile, there may be marginal relaxation of property policies, mainly focused on supporting first-time home buyers.

Investment implications

Among global equity markets, China is one of the worst performers year-to-date. However, this may suggest the weak growth prospects and lack of policy stimulus have already been fully priced in, and any marginal improvement in growth and policy conditions should trigger a turnaround in market sentiment.

In the near term, cyclical sectors, such as consumer discretionary, materials and property, may be major beneficiaries of potential policy stimulus and improving market sentiment. Their less-stretched valuation also provides an attractive margin of safety.

On the longer investment horizon, we continue to prefer sectors which should benefit from expanding domestic market and sustained policy support, such as advanced manufacturing, robotics, automation and renewable energy. As a result of recent market corrections, valuations have become attractive in these sectors. There is a wide universe of stocks within these industries, creating plenty of opportunities for active managers to generate alpha in the Chinese market.