Asian domestic-oriented companies have delivered more consistent earnings growth and subsequently, return to long-term investors.

In brief

- The drivers of Asia’s economic growth and corporate earnings are evolving—moving away from exports and more towards the region’s own consumers.

- Asian markets, such as Thailand, Indonesia and India, with a greater domestic consumer base should be the ones to lead the way performance wise until we see more comprehensive improvement on the trade front.

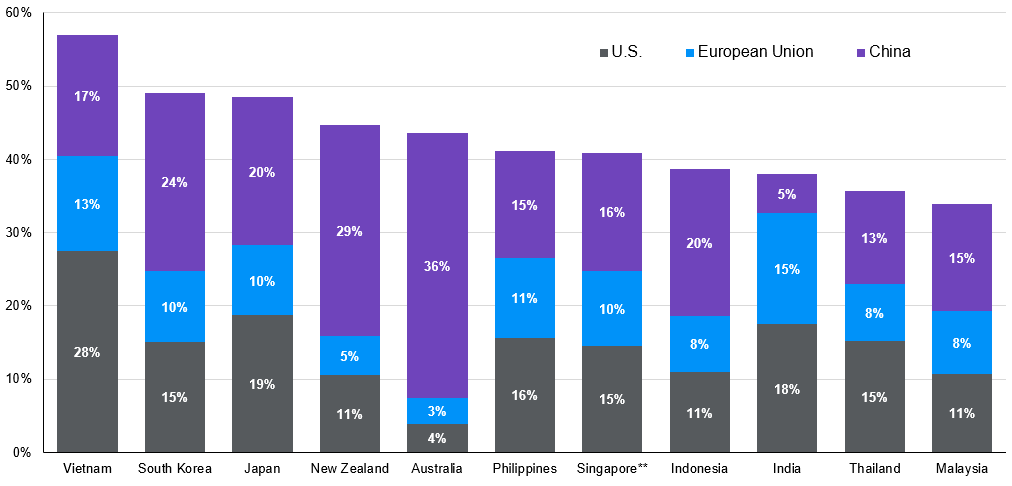

Despite the recent upgrades to the U.S. economic outlook and growing expectations for the Federal Reserve to orchestrate a soft-landing scenario, a slowdown in the U.S. economy, coupled with downside risks stemming from Europe and China mean that the slowing external demand continues to be a risk for Asian economies. Amongst the six largest ASEAN economies (Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) export exposure to the U.S., European Union and China range from 34-57%. The rest of Asia Pacific are equally exposed as shown in Exhibit 1. With expected sluggishness in export demand, will domestic demand be able to stand in for a slowdown in Asian exports?

Exhibit 1: Exports to the U.S., European Union and China

% of total exports*

Source: IMF Direction of Trade Statistics, World Bank, J.P. Morgan Asset Management. *Average monthly percentage of total exports from Jan 2019 onwards to account for the shift in export dynamics following on the onset of the U.S.-China trade war in 2018. **Singapore uses non-oil exports to discount for re-exports. Data reflect most recently available as of 12/09/23.

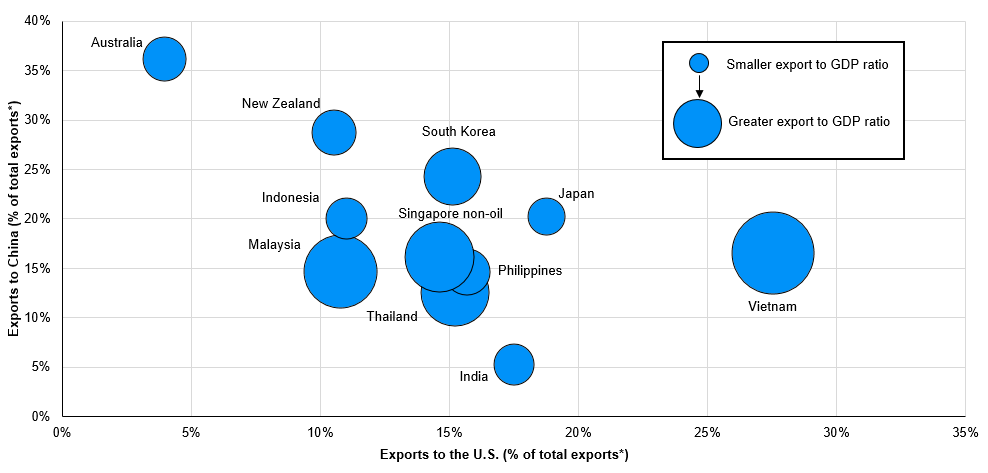

As shown in Exhibit 2, economies with a high export to GDP ratio and substantial exposure to the U.S., Europe and China are likely to experience a material drag from a slowdown in external demand. Vietnam’s export to GDP ratio of 87%, as well as a 28% export exposure to the U.S. suggest that it is particularly vulnerable to a slowdown in global goods demand. Given Vietnam’s role as a major exporter of electronic goods, the expected lull in demand for technology hardware is likely to weigh on the market’s export growth. As highlighted in our previous paper, the softening in U.S. capital expenditure may also hurt exports from economies such as Japan and Korea, given their reliance on exports of capital goods such as machinery, vehicles and semiconductors. While Australia’s exposure to the U.S. and export to GDP ratio is less significant, its exposure to China, accounting for 36% of its total exports, and the prevalence of the mining industry to its economy means a continued disappointment in China’s economic recovery may weigh on Australia’s near-term economic trajectory.

Exhibit 2: Exposure to U.S., China, and export to GDP ratio

Source: IMF Direction of Trade Statistics, World Bank, J.P. Morgan Asset Management. *Average monthly percentage of total exports from Jan 2019 onwards to account for the shift in export dynamics following on the onset of the U.S.-China trade war in 2018.

Data reflect most recently available as of 12/09/23.

While the slowing effects of the softening in global growth are likely to be felt by most Asian economies, Southeast Asian economies such as Indonesia, Malaysia, Thailand, Philippines as well as India are well placed to weather the deceleration in external demand for a number of reasons ranging from favorable political developments, the recovery in tourism, demographic and structural shifts, as well as increased scope for easier monetary policy as the U.S. Federal Reserve comes to the end of its hiking cycle. In particular, we see Thailand, Indonesia and India with more favorable positive catalysts.

Thailand: Three months of political vacuum after the election, coupled with rising cost of living resulted in a fall in consumer confidence as well as a decline in durable goods spending. However, Thailand Prime Minister Srettha Thavisin and his list of cabinet ministers received royal endorsement on September 2nd. The formation of new government should help clear the political uncertainty and bode well for fiscal spending as well as other proposed policy changes.

The benefits of further recovery in international tourism (particularly from China) are still ahead. Even though Chinese tourists have been lower than the Bank of Thailand’s expectations year-to-date, this should further improve in the near term as Thailand is likely to ease visa rules for Chinese and Indian travelers while allowing longer stays for visitors from all nations, according to news sources. This will continue to help boost economic growth, drive earnings recovery and support Thailand’s current account, currency and equity markets.

Indonesia: Domestic demand did most of the heavy lifting so far this year, particularly helped by the ongoing deepening of the metals supply chain that has lifted capital goods imports. The challenge ahead will be to ensure that these income gains can be broadly distributed beyond the metals supply chain. These will likely be achieved through government policy support, such as fiscal redistribution or via other incentives.

In the latest earnings seasons, profitability was much better for food producers as lower input costs and price hikes boosted margins. Consumer demand dynamics may improve in the near term due to higher government spending disbursement, which tends to be backloaded.

India: Public investment, real estate and higher-end consumption have been the key drivers of the economy. However, amid the fiscal constraints and initial signs of slowdown in higher-end consumption, as seen in the slowing of passenger vehicle sales, domestic demand will have to broaden further to rural areas while more private investment has to be encouraged so as to sustain the growth momentum.

The recent disappointing monsoon points to continuous headwinds for agriculture and rural consumption and the economy may still need to rely on the public sector for the bulk of the support.

However, we stay hopeful of a recovery in mass market consumption as India’s long-term structural tailwinds, such as demographics and structural reforms, will likely lead to an acceleration in manufacturing and higher income growth. This can help create a powerful new generation of consumers within the market, with 640 million people expected to join the middle class over the next ten years. Recent steady improvement in consumer sentiment, which is firmly off pandemic lows, is also encouraging. Meanwhile, the return of credit card growth should continue to benefit from rising card penetration.

A rebound in Chinese consumer confidence may drive further tourism rebound

An important determinant of the trajectory of Asia’s economic growth is the momentum of China’s consumption recovery. While domestic consumption will be the main driver of economic growth while external demand remains weak, tourism is also contributing significantly to economic activity in the region. Economies, such as the Philippines, Thailand and Vietnam, are more geared towards tourism, with an average tourism revenue to GDP ratio of 11.4%, 7.1% and 7.8% between 2015 to 2019, respectively.

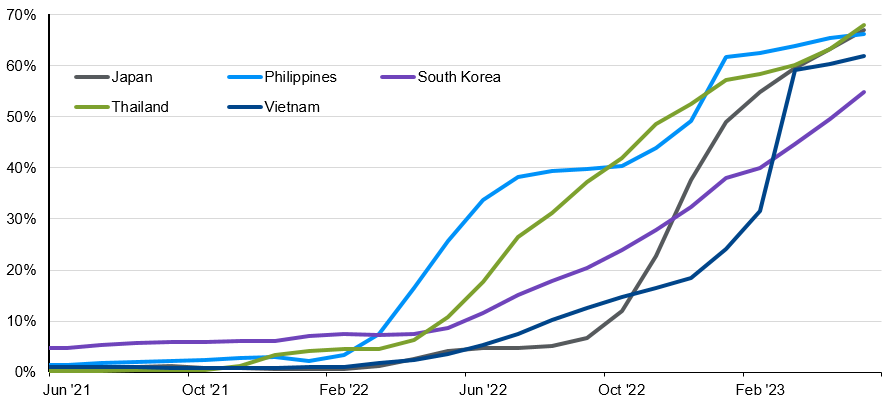

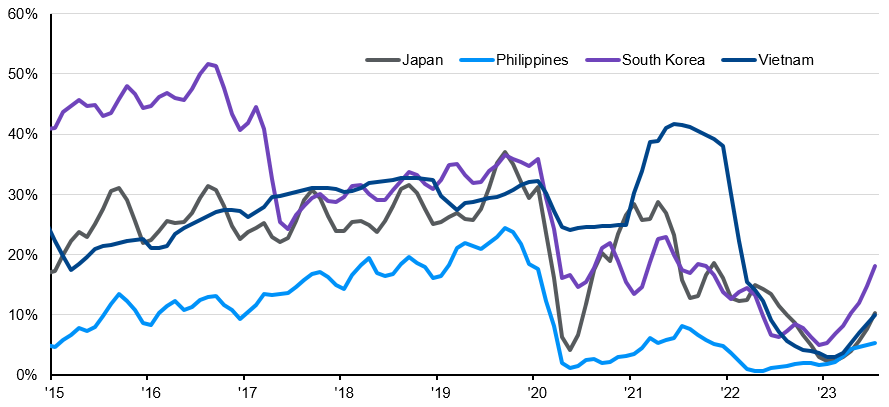

As of May 2023, as shown in Exhibit 3, for most Asian economies, the number of tourist arrivals have reached around 70% relative to pre-COVID levels. That said, the number of Chinese tourists, a major contributor to tourist spending in the region, has yet to fully recover. For Philippines and Vietnam, while Chinese tourists accounted for 21% and 28% of total tourist arrivals in 2019, that figure has only reached 4% and 7% in 2023 (Exhibit 4). For other economies such as Japan and South Korea, the number of Chinese tourist arrivals are also more than 20% below pre-COVID levels.

Exhibit 3: Tourism recovery

Tourist arrivals relative to corresponding month in 2019

Source: Bank of Thailand, CEIC, Japan National Tourist Organization, Korea Tourism Organization, Philippines Department of Tourism, Vietnam General Statistics Office. Data reflect most recently available as of 12/09/23.

Exhibit 4: Chinese tourists recovery*

Chinese tourists as % of total tourists

Source: Bank of Thailand, CEIC, Japan National Tourist Organization, Korea Tourism Organization, Philippines Department of Tourism, Vietnam General Statistics Office. *Chinese tourist figures for Thailand not published since 2019. Data reflect most recently available as of 12/09/23.

Further stimulus in China and a potential rebound in consumer confidence will therefore also be supportive for tourism industry within the Asia region.

Further room for monetary easing

With the Federal Reserve close to the end of its hiking cycle, Asian central banks will also be able to cut rates in support of their economy without the overhanging concern of a strengthening U.S. dollar. With markets pricing in a higher for longer rates scenario, the U.S. dollar index has rallied since July, but with the markets now expecting a maximum of another 25 bps hike between now and the end of the year, strength in the greenback is likely to be limited from hereon. This gives Asian central banks more leeway to cut rates should their economies require more monetary easing. This could help offset some of the headwinds from slowing external demand. According to JP Morgan economic research estimates, a handful of central banks are likely to hold rates still in their next meeting, while the Bank of Korea and the Reserve Bank of India are likely to cut rates by 25 bps each, respectively.

Investment implications

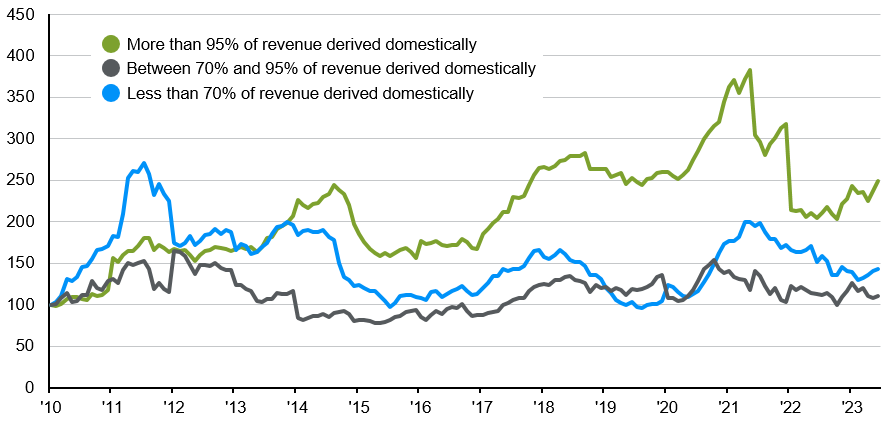

The drivers of Asia’s economic growth and corporate earnings are evolving—moving away from exports and more towards the region’s own consumers. Asian domestic-oriented companies have delivered more consistent earnings growth (Exhibit 5), and subsequently, return to long-term investors, especially in the past few years, as market volatility remains quite elevated. In particular, markets that have a greater domestic consumer base, such as India, Indonesia and Thailand, should be the ones to lead the way performance wise until we see more comprehensive improvement on the trade front. While overall 2023 earnings per share for the MSCI Asia ex-Japan is expected to decline by 8.3%, food and beverage as well as services related industries for the aforementioned economies are still holding up in positive territory despite recent downward revisions.

Exhibit 5: Domestic vs. export-oriented Asian companies*

MSCI AC Asia Pacific ex-Japan, earnings per share, Jan. 2010 = 100

Source: FactSet, J.P. Morgan Asset Management. Earnings per share (EPS) used is next 12 months’ aggregate estimate. *Universe of stocks within the MSCI AC Asia Pacific ex-Japan index are split into three buckets depending on their revenue exposure to their domestic market. Over the time period examined (29/01/10 – 30/06/23), monthly adjustments are made to the buckets to reflect changes in a company's operations over time. Subsequently, EPS for each bucket is calculated by summing the market value-weighted EPS for each company on a monthly basis over the examined period. Each EPS series is then indexed to 100 on 29/01/10. Past performance is not a reliable indicator of current and future results.

Guide to the Markets – Asia. Data reflect most recently available as of 30/06/23.

For those economies that are dependent on technology exports, they may benefit from near-term artificial intelligence (AI) / tech boom (see our previous paper). As more companies adapt to AI, increasing benefits should also feed through to consumers while companies that can tap into this opportunity can benefit even further.