The measures announced thus far have provided the conditions for improvement, but a trigger for more optimistic sentiment is still needed, both for the property market and broader Chinese assets.

5.7%

of bank loans were made to developers in 1Q23

16.7%

of bank loans that were mortgages in 1Q23

In brief

- While exposure to the real estate sector is sizeable, the Chinese banking sector has a buffer against credit deterioration

- Lower producer prices in China could lead to lower consumer prices in the west, assuming retailers pass on the benefit to consumers

- Commodity markets are already reflecting a weak China recovery, implying potential upside if Beijing steps up stimulus. Yet, this operates against the backdrop of softening momentum in Europe and the U.S.

The disappointing recovery in China has led to further questions on the potential repercussions within the domestic financial sector as well as the global economy.

Could the property sector put more pressure on the financial system?

Sluggish sales in residential properties have created pressure on developers, especially those in the private sector. Country Garden, which was considered to have a stronger financial fundamentals amongst private developers, is also facing liquidity challenges in making interest payments to creditors. Meanwhile, local government fiscal revenue is being undermined by weak land auctions, and there are rising concerns that their related financial vehicles could see a greater chance of default.

While exposure to developers and mortgages varies by individual banks, 5.7% of bank loans in 1Q 2023 were made towards property developers and 16.7% to mortgages, according to the People’s Bank of China. The overall exposure to the real estate sector (developers + mortgages) tends to be higher for larger banks, around 30-35%, in line with higher regulatory limits permitting their loan share towards these sectors. Yet, these larger banks also have a higher level of capital than smaller banks, providing a larger buffer against potential losses.

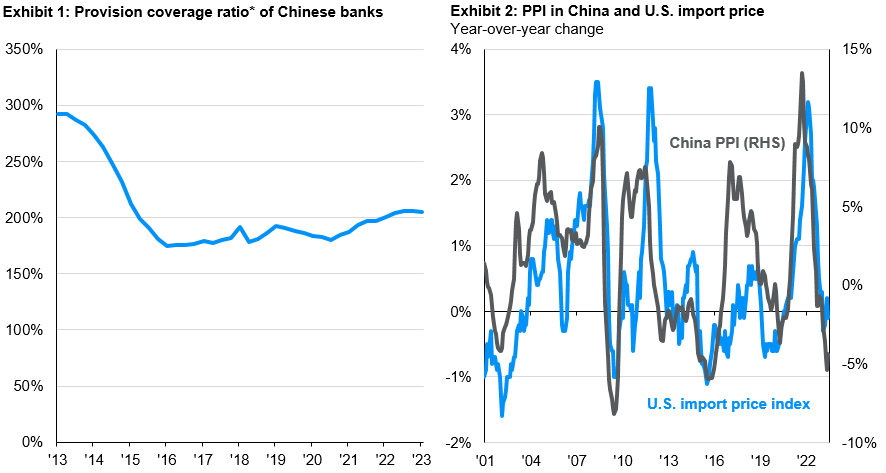

Moreover, Chinese banks have also made sizeable loan-loss provisions. As seen in Exhibit 1, the provision coverage ratio, the percentage of low-quality assets that banks must make provision for, is around 200%.

Overall, we see a bigger risk to banks’ long term profitability instead of a systemic risk to the financial sector. Current mortgage borrowers could demand lower rates. One proposal to resolve the local government financial vehicle (LGFV) liquidity challenge is to lengthen loan tenor with cheaper interest rates. All these could help to improve liquidity at the expense of lenders’ interest margin.

Ultimately, we still see stronger confidence in the housing market as the key in resolving the current round of financial stress. In addition to policies relaxing purchases, greater tolerance of property price movements would be needed to reset potential buyers’ expectations that real estate will be a worthy asset to own.

Could China export deflation?

China’s producer price index (PPI) has been on a year-on-year decline since October 2022 and this has raised questions on whether this could lead to lower consumer good prices elsewhere in the world. As seen in Exhibit 2, we did see a close relationship between China’s PPI, its export price index and the U.S. import price index. Hence, in theory, a decline in China PPI could help to cool U.S. inflation through the goods channel. Core good’s contribution to inflation has weakened in recent months. That said, sticky U.S. inflation today is more from services and the residual impact from rising rent. Moreover, with corporate profits under pressure, it remains to be seen how much of the lower input costs would be passed on to U.S. consumers.

Soft growth momentum is likely to suppress global demand of selected commodities. In terms of gross goods imports, nearly 20% of Chinese imports are mineral fuels and oils. China’s growth deceleration will therefore be a major headwind for Asia’s commodity exporters such as Malaysia and Indonesia. As for Australia, 45% of China’s ores, slag and ash imports come from the region, so continued weakness in China’s property market will challenge Australia’s exports to China in this category. Given Australia’s economic reliance on its exports of coal and iron ore, weaker commodity demand signifies lower demand for commodity currencies like the Australian dollar.

Source: Wind, J.P. Morgan Asset Management. (Left) China Banking and Insurance Regulatory Commission; (Right) China National Bureau of Statistics, US Department of Labor. *Provision coverage ratio is the % of low-quality assets that a bank must cover with its own funds. Data reflect most recently available as of 17/08/23.

Investment implications

The banking sector has capacity to absorb deterioration in lending standards via its balance sheet and earnings. There are also measures available to ease the liquidity issues facing Local Government Financing Vehicles, developers and their suppliers. However, the turnaround in these stress would require a stabilization in the real estate sector, and market confidence. The measures announced thus far have provided the conditions for improvement, but a trigger for more optimistic sentiment is still needed, both for the property market and broader Chinese assets.

On August 27, Chinese regulators announced a series of market reforms including reducing stamp duties, lowering margin ratios for leveraged trades etc., which we do see as a positive sign that authorities are attempting to lift market sentiment. Equity markets rallied initially, but only briefly, indicating that a sustained market rally requires stronger measures to address key areas of concern in the real economy.

Weak demand from China may facilitate lower global inflation via cheaper exports and subdued demand for commodities. The outcome depends on whether retailers fully pass on the lower costs to their customers. On commodities, we believe the current valuations in industrial metals and energy has taken into account the soft growth scenario. While this argues for some potential upside if Beijing implements more concrete policy to revive confidence, this would take place against the backdrop of softening momentum in Europe and the U.S.