Overall, while earnings are likely to reflect the continued resilience in the economy albeit with some modest loss in momentum, current valuations will be difficult to justify.

In brief

- The U.S. equity market has rallied significantly in 2023, primarily driven by a concentration of mega-cap names fueled by the hype around AI.

- The overall valuation of the S&P 500 looks rich, and investors should be wary of potential price vulnerability of mega-cap stocks if equity volatility picks up.

- Staying selective within equities, positioning in quality, low beta stocks, and considering other sources of exposure to the AI theme, such as Asian public equities and private equity, could be beneficial for investors.

The current state of the U.S. equity market has left investors questioning whether equities have rallied too much. The S&P 500 is up over 18% year-to-date (YTD), which is a significant divergence from the expectations at the beginning of 2023. However, the sustainability of this rally is questionable, as it has been primarily driven by a concentration of mega-cap names, fueled by the hype around artificial intelligence (AI).

Investors should be wary of the potential price vulnerability of mega-cap stocks if high short-end rates were to translate into equity market volatility. Therefore, it would be prudent to consider opportunities outside the biggest names that sport more favorable price tags. While the fundamentals of mega-cap names remain solid, the current valuation premium suggests it may be best for investors to consider other sectors or regions with less demanding valuations or other asset classes to express their positive view on the AI trend.

Looking beyond mega-cap names?

It is worth noting that the recent rotation into the broader indices has led to the equity market rally broadening out. In the first five months of 2023, the market cap weighted S&P 500 returned 9.7% whereas the equal weighted index declined -0.6%. However, as of the end of last week, while the YTD returns of the market cap weighted index gained further to 18.4%, the YTD return of equal weighted index has rebounded to 8.7%.

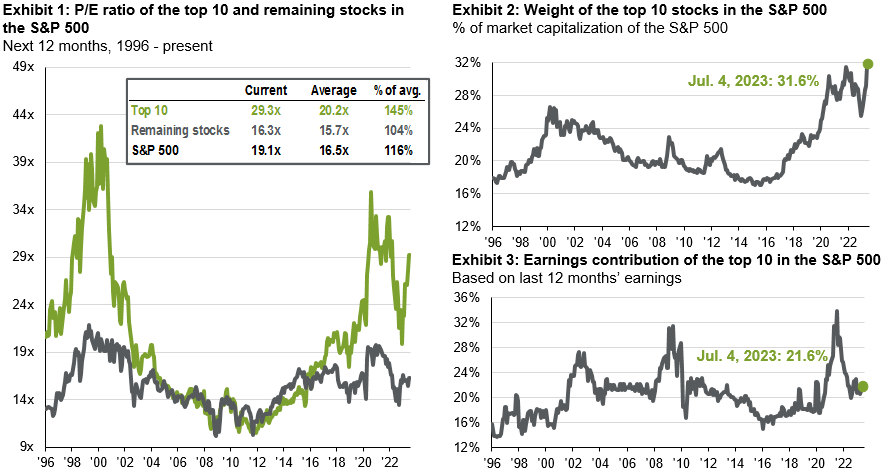

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management.The top 10 S&P 500 companies are based on the 10 largest index constituents at the beginning of each month. The remaining stocks represent the rest of the 494 companies in the S&P 500.

Guide to the Markets – U.S. Data are as of July 4, 2023.

The overall valuation of the S&P 500 looks rich, at 19.1x forward price-to-earnings. The top ten stocks, which are predominantly mega-cap equities, are 45% more expensive than their long-term average, compared to the rest of the S&P 500, also trading at a 13% premium relative to its long-term average. This means the valuations for stocks beyond AI and technology related names are also not depressed from a historical context.

With short-term rates at 15-year highs, but equity volatility staying meaningfully below long-term average, volatility levels seem disconnected from interest rates at the moment. A material pick-up in volatility could lead to a downward re-pricing in multiples, particularly in those stocks deemed inflated. Investors should remain highly selective within equities, with financials and utilities within the S&P500 remaining the sectors with less demanding multiples. Furthermore, a quality bias and positioning in low beta and defensive sectors remain a preference given the likelihood of rates staying higher for longer and the expected weakening of growth momentum for the rest of the year.

2Q23 earnings will also matter

Currently, the weight of the top 10 stocks in the S&P 500 is at 32%, a record concentration dating back at least three decades. However, the earnings contribution to the index of those top 10 stocks is just 22%. In 2021, weight and earnings contribution were essentially commensurate, but these names are no longer pulling their weights in terms of profits.

The trajectory of U.S. equities will therefore also be contingent on the ongoing 2Q23 earnings season. While the downside to Q2 earnings will likely be limited by better-than-expected economic data and declining input prices, there are also headwinds. While the labor market has shown early signs of cooling, job opening, and wages remain above average and will likely weigh on margins. This could be a potential headwind for companies, particularly those that are heavily reliant on labor.

At a sector level, financials are set to have relatively strong growth. Year-over-year growth will benefit from favorable comparables, while the quarter-over-quarter decline in earnings will provide a better snapshot of the sector’s health. Net interest income (NIM) likely peaked in 1Q23, as higher deposit betas and weaker loan growth drove compression in NIMs in 2Q23. Consumer related stocks would have benefited from spending resilience, but margins may have dropped off due to sluggish demand and shifting spending habits.

Within technology and communication services, prudent cost management measures taken over the past few quarters could boost sequential results. There are also suggestions that these sectors benefited from an increase in subscribers and downloads in 2Q23. The key will be whether this was enough to offset the decline in advertising revenues. While tech hardware experiences a slowdown, profits in software will likely be supported by digitalization trends and adoption of AI capacities to boost efficiency and reduce costs.

Overall, while earnings are likely to reflect the continued resilience in the economy albeit with some modest loss in momentum, current valuations will be difficult to justify.

Investment Implications

Investors should be wary of the potential price vulnerability of mega-cap stocks should equity volatility pick up. Staying selective within equities, positioning in quality, low beta stocks in the face of an economic slowdown makes sense in this context. Investors can look to capitalize on the AI theme through other sources of exposure, such as Asian public equities and private equity. Private equity, in particular, could yield many emerging opportunities in AI, with triple the exposure to tech than the Russell 2000.