Against a favorable macro backdrop, continued support for high-quality tech names and a ripe environment for active management, investors still have plenty of reason to step out of cash and into risk this year.

In brief

- S&P 500 profit growth was likely flat in 2023, but analysts estimate earnings will grow 11% in 2024.

- Margins could stabilize this year, but revenues may slow due to disinflation and a moderating consumer.

- In 2023, the Magnificent 7 drove S&P 500 returns and profit growth, but that profit leadership is projected to broaden out this year.

Brighter prospects ahead

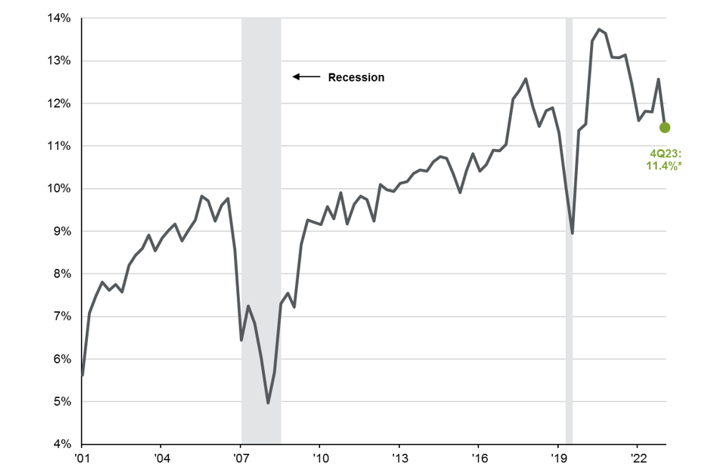

Markets achieved a trifecta of good news in 2023: an economy that not only avoided recession but reaccelerated, meaningful progress on disinflation, and the Fed pivot markets had been impatiently waiting for over a year. The S&P 500 notched 26% gains for the year. On the other hand, profit growth rounded out a dismal year, likely ending 2023 roughly flat. Yet, expectations are optimistic for 2024, with analysts expecting a profit growth of 11%. However, while margins may stabilize, investors should heed gloomier commentary from company management and carefully watch for a potential slowdown in revenues.

Thus far, 67% of market cap has reported earnings, with the current estimate for 4Q23 S&P 500 operating earnings per share (EPS) at $51.92. If realized, this estimate represents 3.1% year-over-year (y/y) growth and quarter-over-quarter (q/q) decline of -0.6%.

The divergence between operating earnings estimates and pro-forma earnings estimates persists. Current 4Q23 pro-forma estimates are tracking growth of 1.3% y/y and declines of -8.0% q/q. Overall, 2023 pro-forma earnings per share (EPS) estimates are set to decrease -0.1%, with revenue growth contributing 3.1 percentage points, margin growth subtracting -3.0 percentage points, and buybacks subtracting -0.3 percentage points.

It can be useful for investors to monitor both measures, as operating earnings are unadjusted and therefore tend to be a better indicator of “economic profit,” while the market prices off pro-forma earnings, which are therefore more useful to explain market moves.

Defying an overwhelming chorus for recession in 2023, economic activity remained robust, supporting revenue growth. Real GDP increased 3.3% q/q seasonally adjusted annual rate (SAAR) in the fourth quarter, marking six consecutive quarters of above-trend real GDP growth. In addition, revenues were also boosted by favorable FX conditions, as the U.S. dollar weakened 3.4% y/y on average during 4Q. Nevertheless, higher wages and inflation coupled with supply chain issues stemming from geopolitical turmoil have kept costs elevated and weighed on margins.

These dynamics have been echoed in earnings and revenue surprises, with only 68% of companies beating on earnings (vs. 72% on average) but 55% of companies beating on revenues (vs. 52% on average). This highlights the continued strength of revenues over margins, a dynamic which may begin to flip in 2024 as revenues are confronted with disinflation and a moderating consumer.

Exhibit 1: S&P 500 quarterly pro-forma profit margins (earnings/sales)

Source: FactSet, Standard & Poor's, J.P. Morgan Asset Management. Data is as of February 1, 2024.

Magnificent 7, revisions, and market cap: what to expect in 2024

In 2023, 68% of S&P 500 returns were attributable to multiple expansion, leaving valuations somewhat rich. In 2024, profits, which are projected to grow by 11%, should be a key determinant of returns.

Last year, the Magnificent 7 essentially drove all the S&P 500’s returns and profit growth, with profits up an estimated 29% in the Magnificent 7 in 2023 compared to profits contracting 4.8% in the rest of the S&P 500. This year, that leadership should broaden out, with an estimated 3.7 percentage points of the overall 10.9% profit growth coming from the Magnificent 7 and 7.1 percentage points coming from the rest of the S&P 500. However, to achieve this level of profit growth, the Magnificent 7 would need to grow EPS 21% this year after growing 29% last year, a high but not insurmountable hurdle. Last year, the Magnificent 7 EPS rebounded after declining 1% in 2022, and profits surged on developments in AI. This year, the bar is higher for profit growth given last year’s results, and while AI may become a staple of these companies’ profitability, it could be difficult to replicate last year’s growth rates. In addition, the rest of S&P 500 profits would need to grow by nearly 9%, which is not unreasonable after 2023’s contraction in profits, but pressures on revenues could present headwinds as the economy’s above-trend growth rates fade and disinflation continues. Therefore, there is some downside risk to the consensus estimates for earnings.

Still, consensus 2024 EPS estimates have remained reasonably steady at 11% since the beginning of the fourth quarter. However, as more companies publish results and guidance this earnings season, these estimates may deteriorate. So far, 17% of reported companies have revised their EPS guidance for 2024 upward, while 34% have made downward revisions and 49% have maintained their projections.

Along the market cap spectrum, mid-caps are expected to post 8% y/y EPS growth in 2023 and 2024, while small caps are anticipated to rebound from profit declines of 10% in 2023 to 23% growth in 2024. However, estimates have only been revised down slightly for large and mid-caps for 2024, while small cap estimates have already been revised down 9% in the last three months.

Investment implications

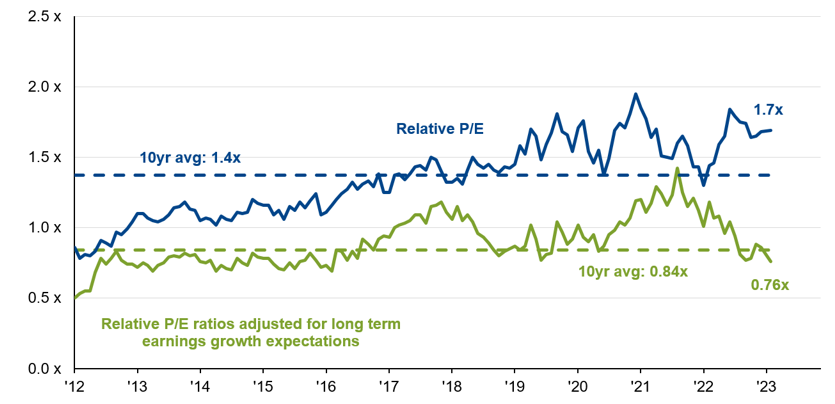

Against a favorable macro backdrop, continued support for high-quality tech names and a ripe environment for active management, investors still have plenty of reason to step out of cash and into risk this year. Despite higher valuations, we do find that the leading U.S. tech companies continue to offer some of the highest quality growth exposure, boasting robust cash balances, capex spending and profitable business models. Markets also tend to over-appreciate the near-term implications of transformative technologies while underappreciating the long-term, which can lead to market corrections if patience is not a virtue. Indeed, while the Magnificent 7 stocks appear expensive relative to the rest of the market on a one-year forward price-to-earnings (P/E) basis when accounting for long-term expectations for earnings growth, relative valuations are much more in-line with recent averages, as seen in Exhibit 2.

Looking at the broader market, although profits should experience healthy growth this year, there are downside risks to double-digit earnings growth as the economy slows back to trend. In this environment, we continue to prefer quality, which suggests large and mid-caps over small caps, and diversification within large caps to maintain exposure to the Magnificent 7 but also ensure adequate exposure to the rest of the S&P 500 as profit leadership broadens out.