Have the tables turned?

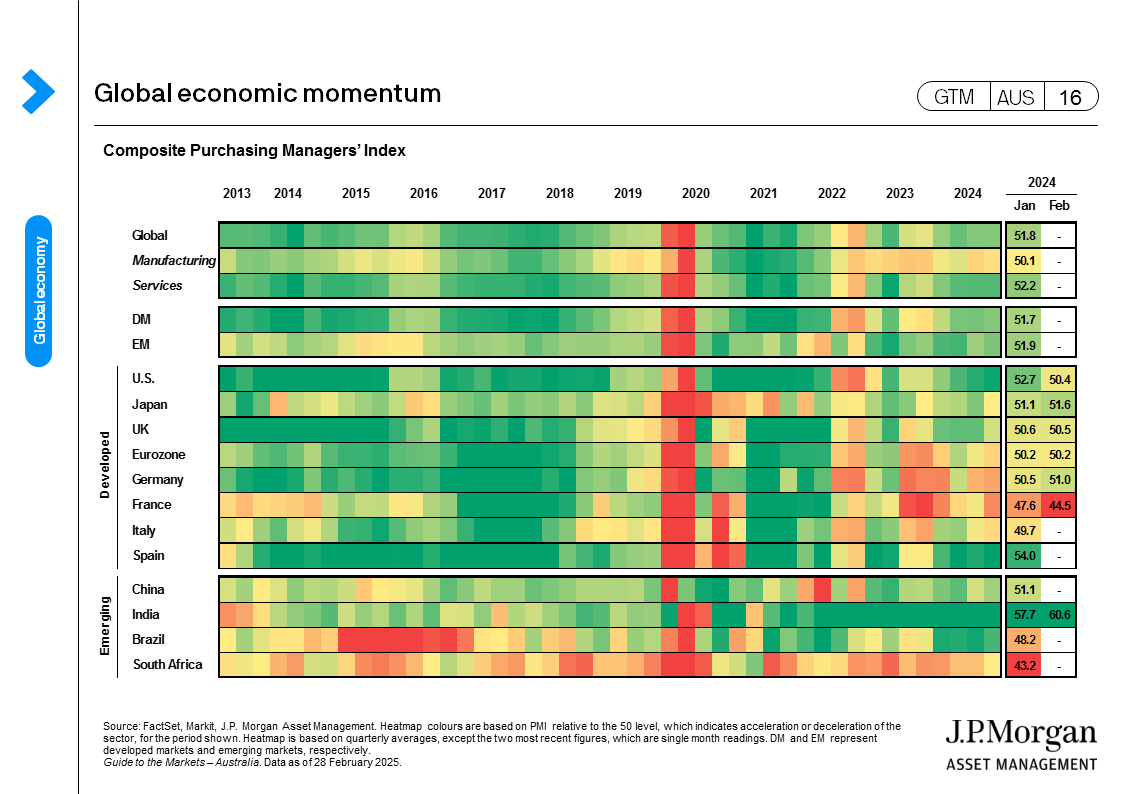

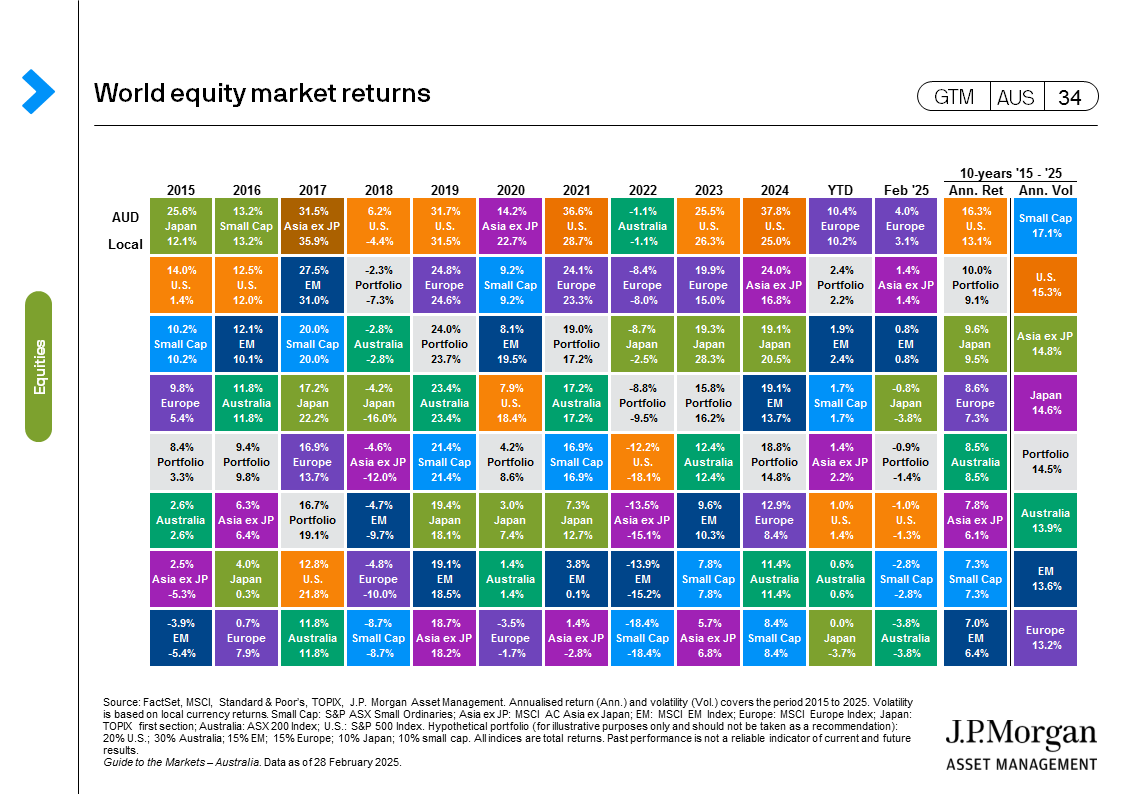

Risk-off gripped markets in February, from U.S. stagflation concerns following a combination of soft economic data and sticky inflation data, as well as uncertainties over U.S. trade, tax, and immigration policy. Meanwhile, Europe’s better earnings results, hopes of a Ukraine–Russia peace deal and China’s technology-driven rally all contributed to the rotation out of U.S. markets. With U.S. equities leading the slide, the MSCI World index fell 0.9% over the month, while the MSCI Emerging Markets index and the Bloomberg Global Aggregate index rose 0.8% and 1.4%, respectively (total returns in local currency).

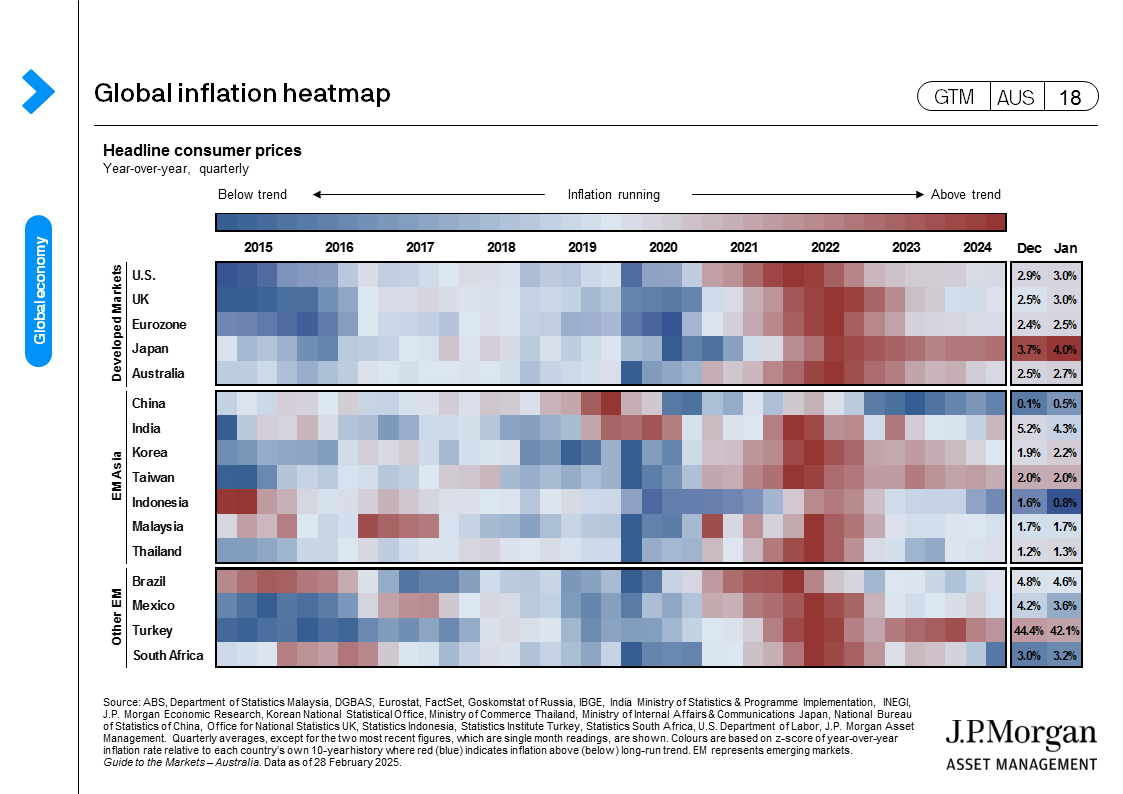

A raft of U.S. tariff announcements continues to drive market volatility. While the aggregate tariff impact on the U.S economy remains highly uncertain, recent survey data showed that consumer confidence has dropped and consumer expectations for inflation have surged due to expectations of higher import prices. The rebound in the latest U.S. inflation print, combined with softer housing data and a drop in key business surveys, reinforced the concerns around whether the U.S. economic momentum heading into this year was slowing faster than anticipated.

The Federal Reserve (Fed) chair Jerome Powell remains cautious, juggling between slowing growth concerns and heightened inflation. However, markets shifted to risk-off as bond yields fell and U.S. equities sold off, leaning towards the deeper consequences of less growth rather than more inflation. As such, markets have priced in an additional rate cut by the Fed, to nearly three in total for the rest of 2025, with the next rate cut firmly priced for June. The Reserve Bank of Australia (RBA) has started its easing cycle, as highly anticipated, although the messaging remains relatively hawkish with only a slow pace of easing expected. Elsewhere, the easing bias in monetary policy is stronger. Asian central banks are cutting rates ahead of a potential tariff-induced weaker growth.

The technology-driven optimism boosted Chinese markets, with the MSCI China index up 11.8% in U.S. dollar (USD) terms. This follows President Xi’s meeting with Chinese technology leaders, spurring expectations for more official support towards the private sector. Solid earnings from Chinese platform companies and pledges to increase artificial intelligence (AI)-related capex added to the rally. Looking ahead, the National People’s Congress meeting in early March should swiftly shift attention back to policy announcements to support the economy.

European equities also grabbed attention over the month, as the MSCI Europe index gained 3.1% and is up more than 10% this year. The potential for fiscal expansion following Germany’s election outcome, a low bar for earnings, and relative valuation discounts all contributed to the rebound.

February highlighted the importance of challenging consensus views and maintaining a well-balanced exposure across markets and asset classes, especially during periods of low policy visibility and heightened uncertainty.

Australian economy:

- The RBA lowered the cash rate by 25 basis points (bps) to 4.10% in its February meeting. The broad message was relatively mixed. On one hand, the statement toned down its previous dovishness by adding that “disinflation could stall” if monetary policy is eased too early or too much, and Governor Bullock also noted the market is “too confident” in pricing additional cuts. On the other hand, the RBA’s estimates of the neutral rate continue to shift downward, while Bullock also acknowledged that the sustainable rate of unemployment could be lower than expected. Overall, the RBA appears to demonstrate a non-committal stance on the future rate path, with its next move continuing to be data-dependent.

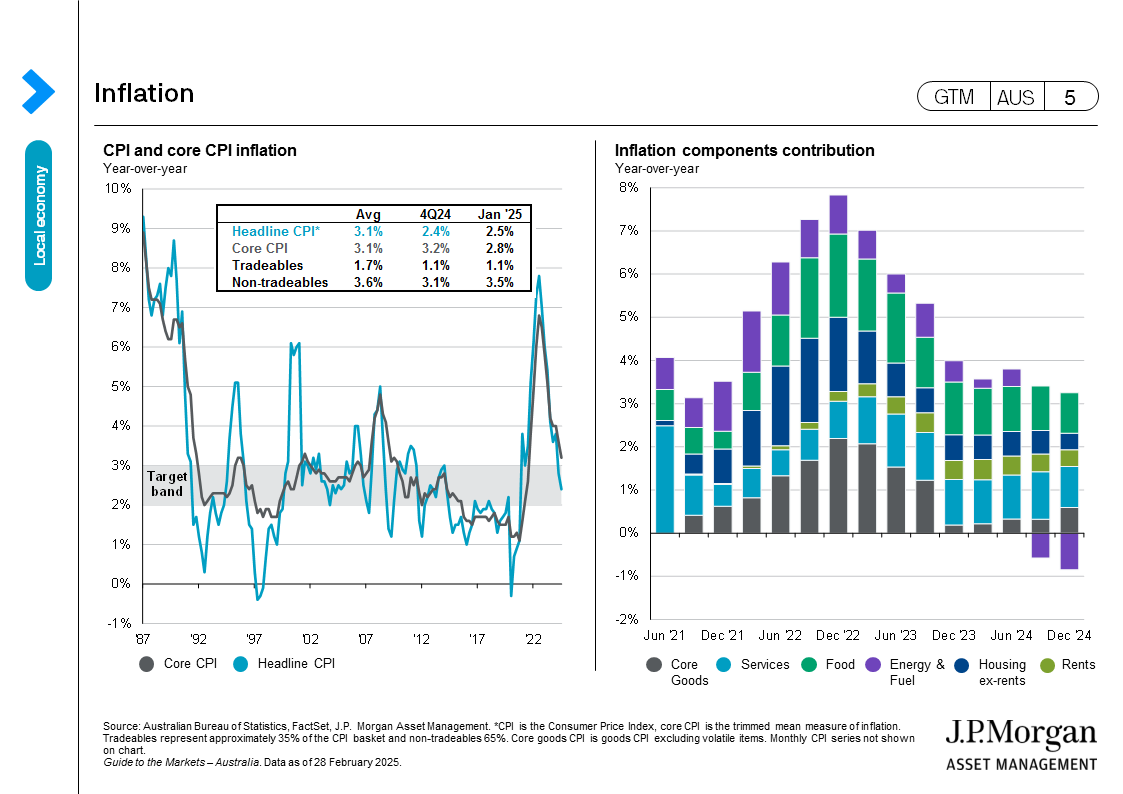

- The monthly consumer price index (CPI) rose 2.5% year-over-year (y/y) in January, a touch lower than consensus expectations. The details were constructive, with larger housing-related items and rental inflation continuing to decelerate, while some services items showed disinflation progress.

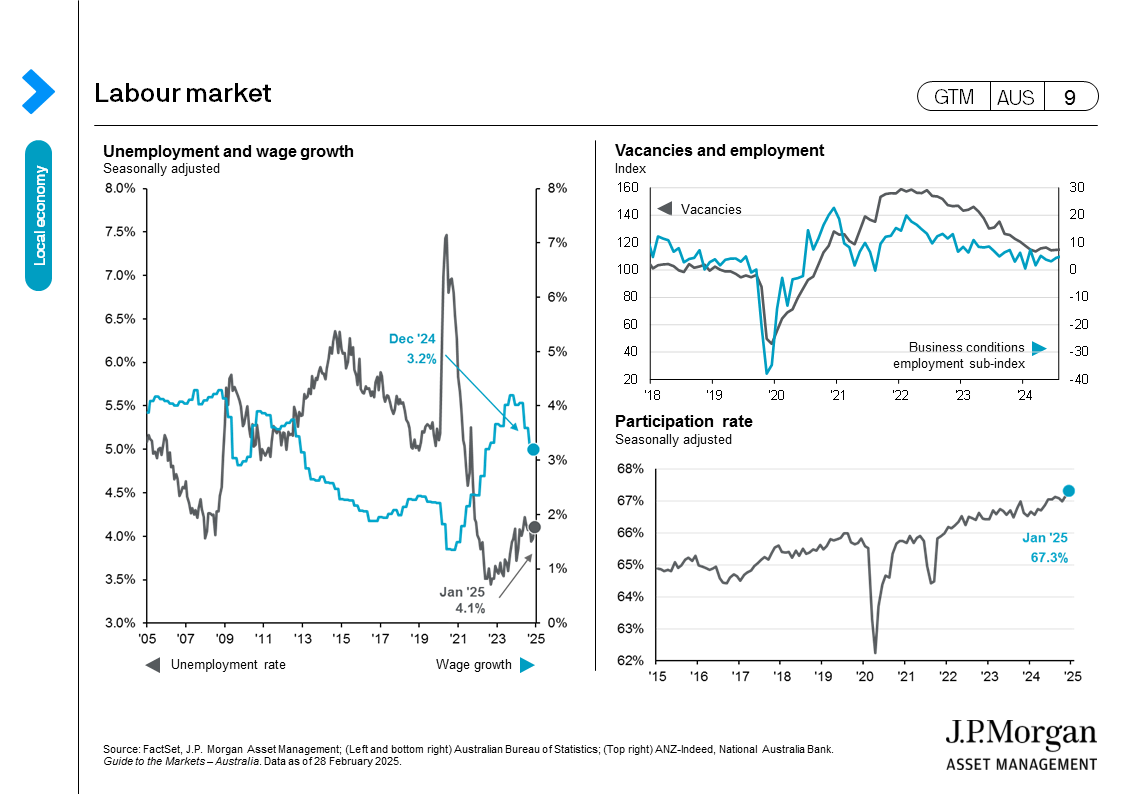

(GTM AUS page 5) - Wage growth, nevertheless, slowed further to 3.2% y/y in 4Q, echoing the RBA’s comment that lower quit rates help ease wage pressures. Furthermore, the unemployment rate edged up to 4.1% in January, as the labour force continues to outpace total employment, which increased by 44,000, while the participation rate reached another record high of 67.3%.

(GTM AUS page 9) - Retail sales dropped 0.1% month-over-month (m/m) in December, but better than consensus estimates following a strong print last month. That said, year-end promotions have added to seasonal distortion, especially on household goods spending.

- Consumer sentiment saw a modest increase to 92.2 in February, as, despite a cautious stance on stretched household finances, consumers’ expectations on inflation and interest rates have improved.

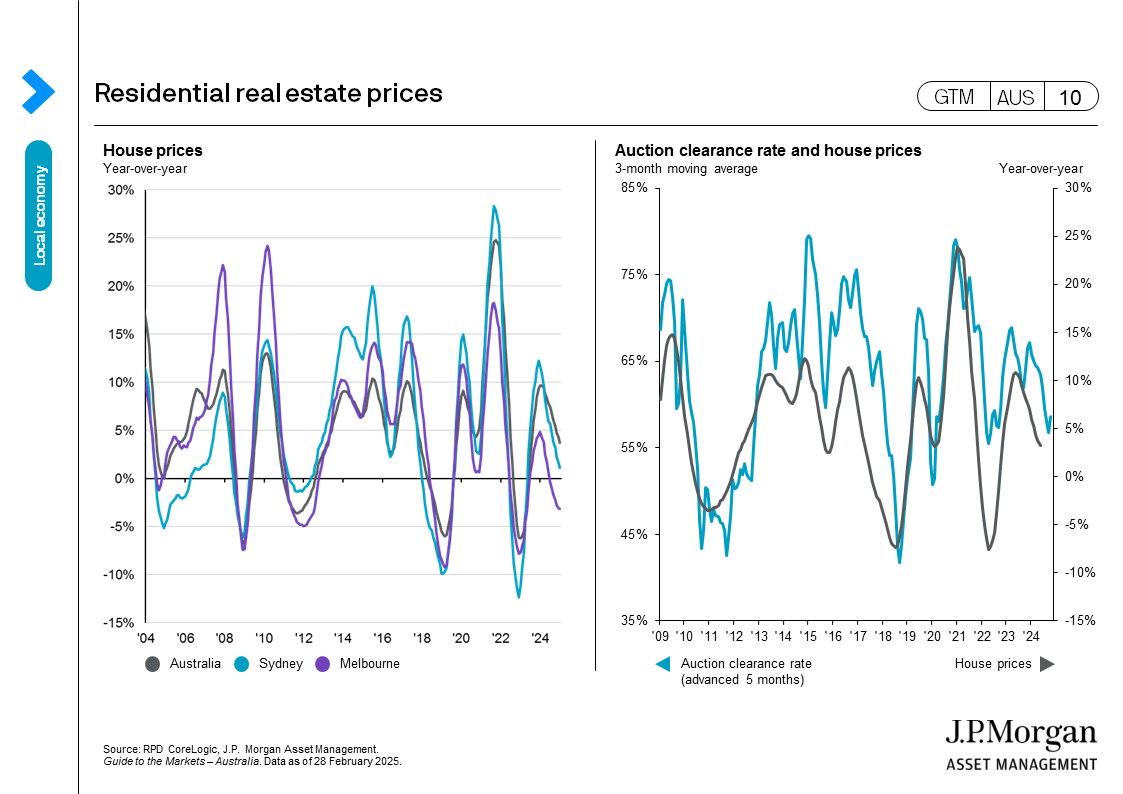

(GTM AUS page 6) - Housing prices rose 0.3% m/m in February, reflecting expectations of lower interest rates and improved buyer sentiment.

(GTM AUS page 10)

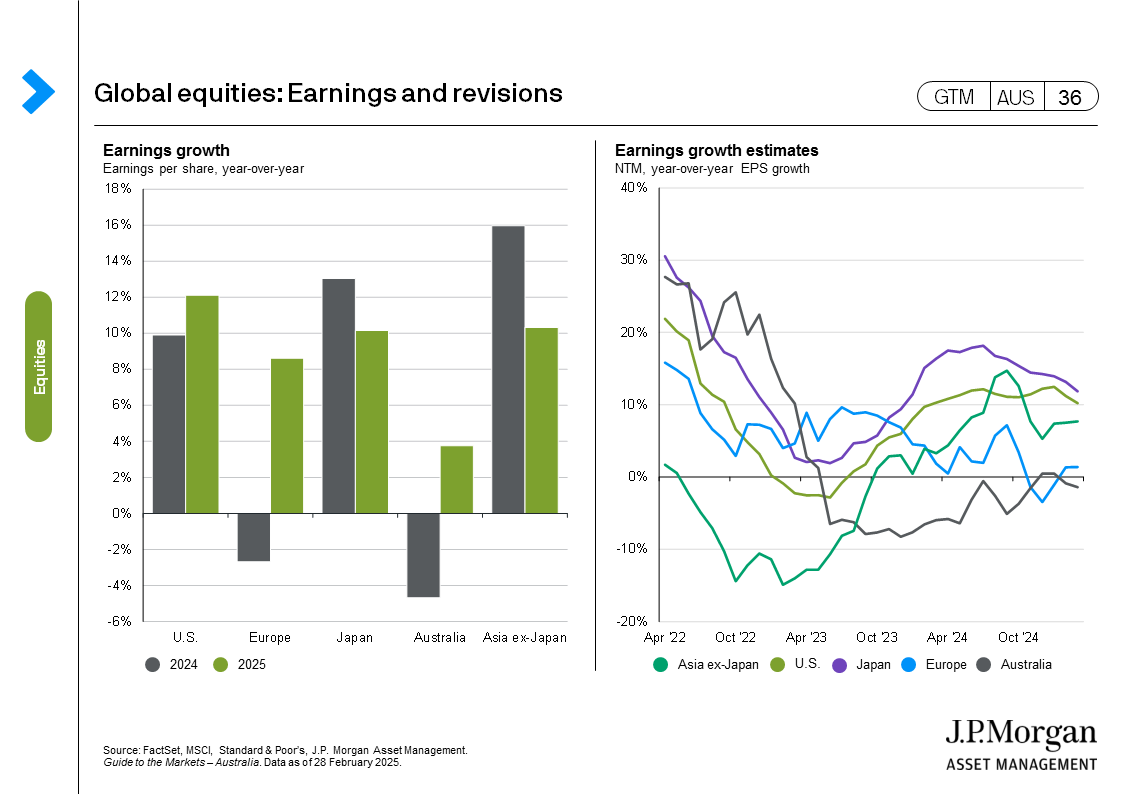

Equities:

- The ASX 200 dropped 3.8% in February amidst a flurry of Trump tariff policy announcements and a strong employment print supporting a tight labour market. Cyclical sectors led the losses, with technology (-12.3%), financials (-4.4%) and consumer discretionary (-3.1%) all suffering, while defensive sectors such as consumer staples (+1.5%) and utilities (+3.2%) fared better.

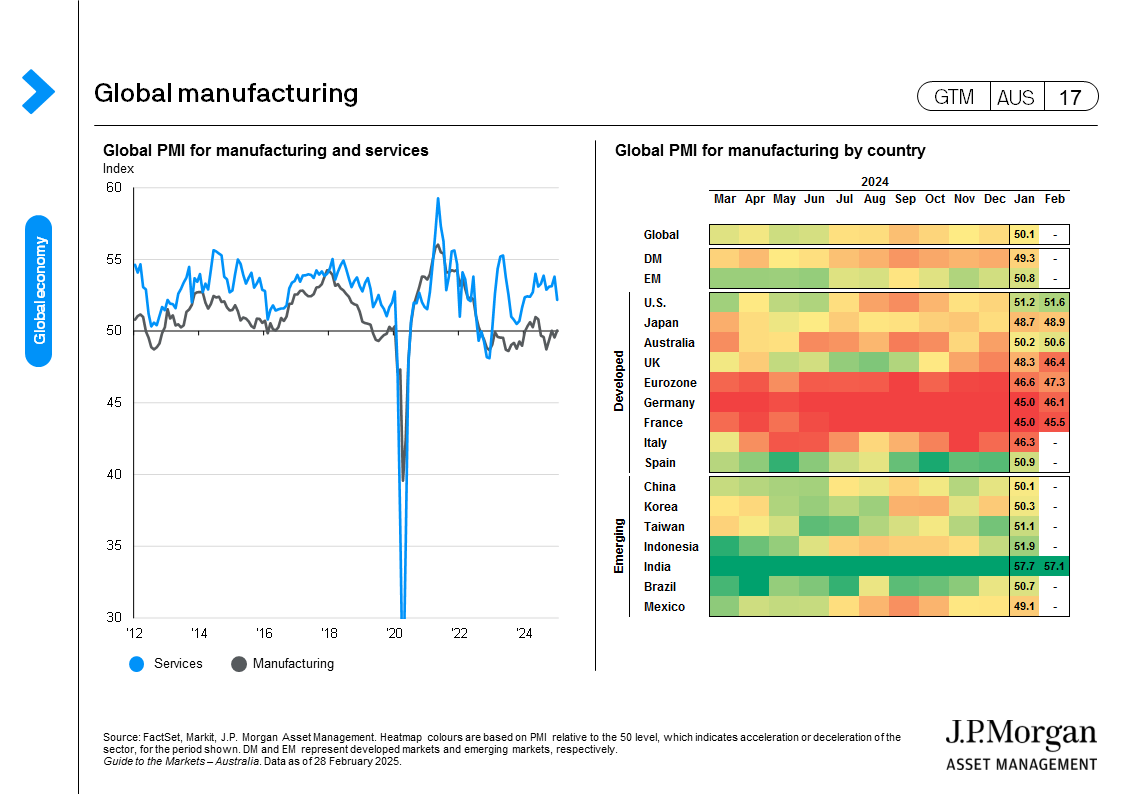

- The MSCI AC World fell 0.8% in February. Developed markets underperformed with a -0.9% return, dragged lower mainly by the U.S. Europe rallied further in February, as strength came from recovering cyclical data such as consumer confidence, manufacturing PMI and financial conditions.

(GTM AUS page 34) - In the U.S., the S&P 500 hit record highs mid-month, but reversed earlier strength towards the end of the month. Defensive stocks outperformed. This risk-off rotation was driven by heightened scrutiny around the soft-landing narrative. Emerging markets’ outperformance was driven by a strong China market, with MSCI China and Hang Seng delivering 11.7% and 13.4% returns, respectively, buoyed by continued tailwinds from the AI theme and President Xi’s meeting with technology leaders.

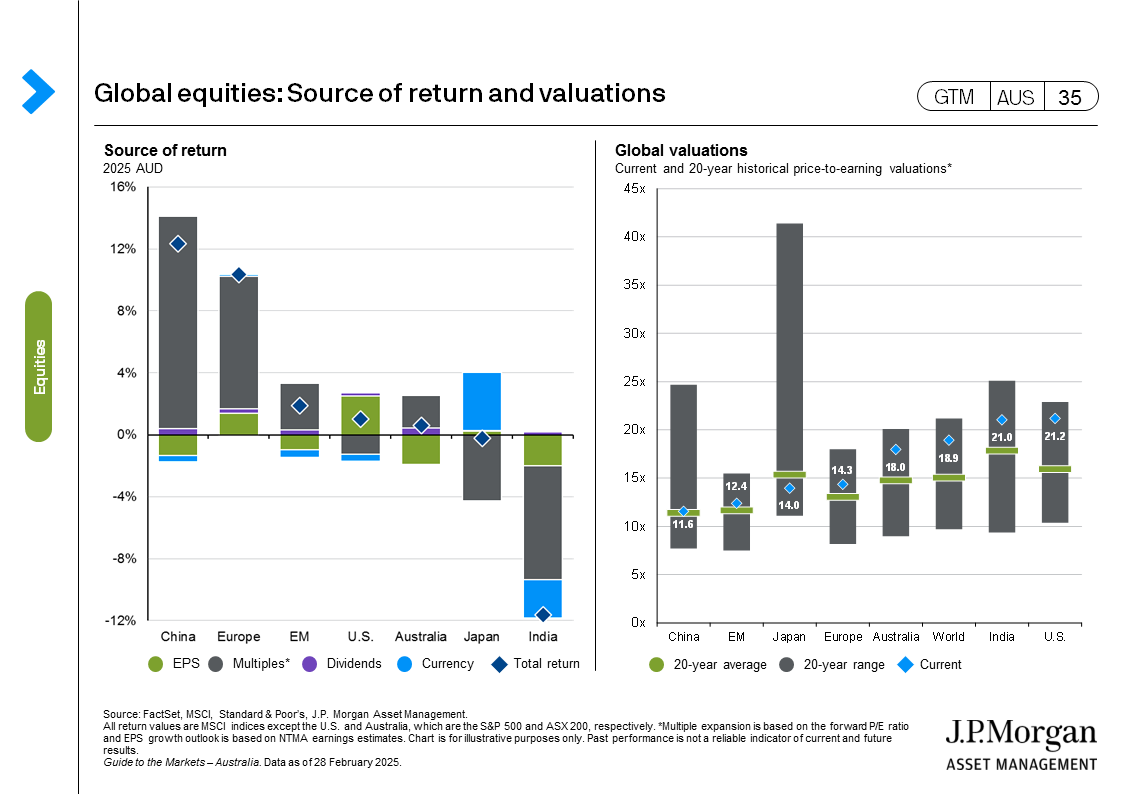

- Equity valuations retreated over the month to 18.0x forward price-to-earnings (P/E) ratio on the ASX 200 and 21.2x on the S&P 500, though still above their 10-year averages, while the MSCI Europe (14.3x) and Japan TOPIX (13.2x) remain relatively cheaper.

(GTM AUS page 35)

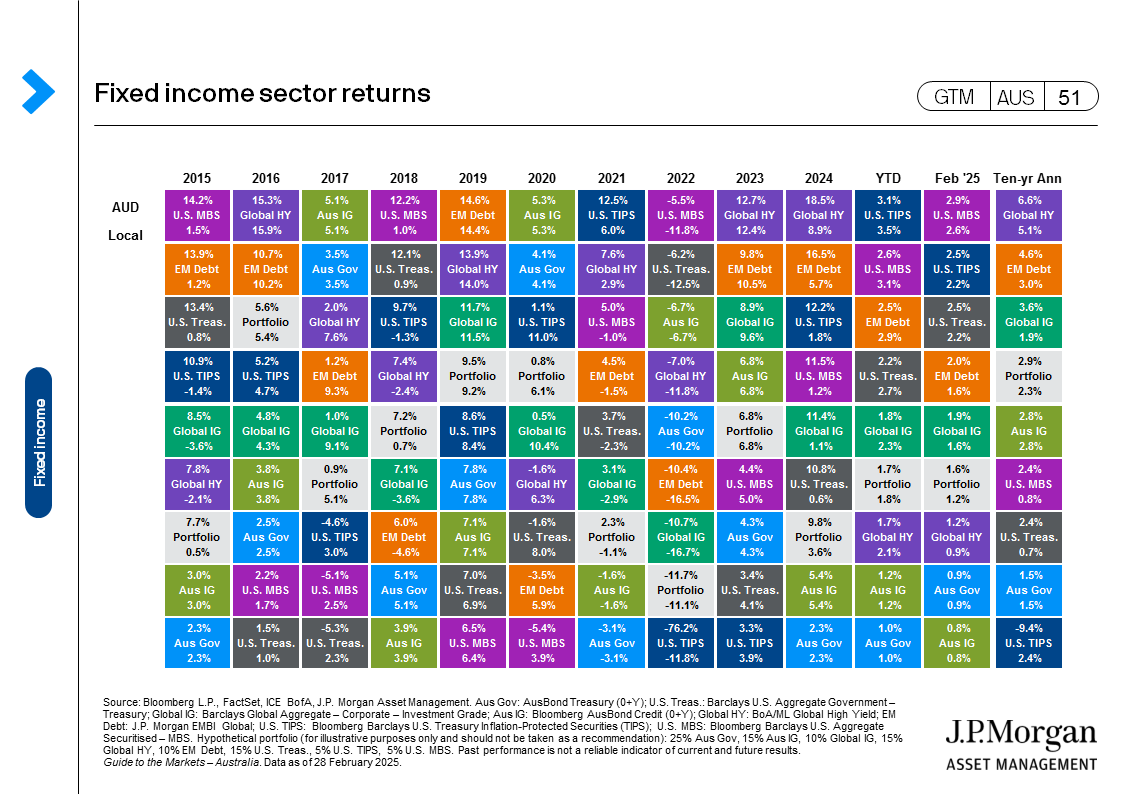

Fixed income:

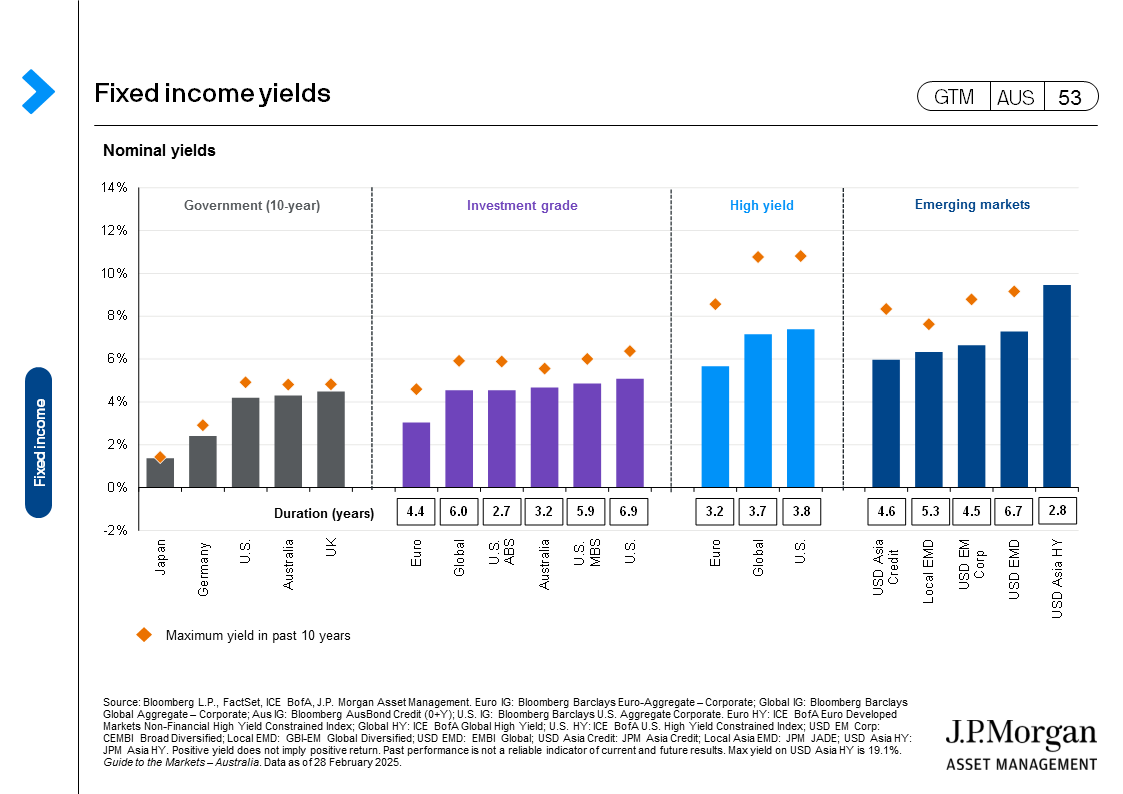

- Australian government bond yields were lower over the month, with 10-year yields down 13 bps to 4.30%. While U.S. 10-year Treasury yields fell 35 bps to 4.19%, the yield curve flattened, as the refunding announcement and Bessent’s comments on yields have eased concerns over term premium, while elevated inflation expectations continue to push back expectations on the next rate cut. Duration on Australian yields relative to the U.S. remains attractive.

(GTM AUS page 51) - Japanese government bond 10-year yield marked another decade high of 1.37% on strong wage and inflation data.

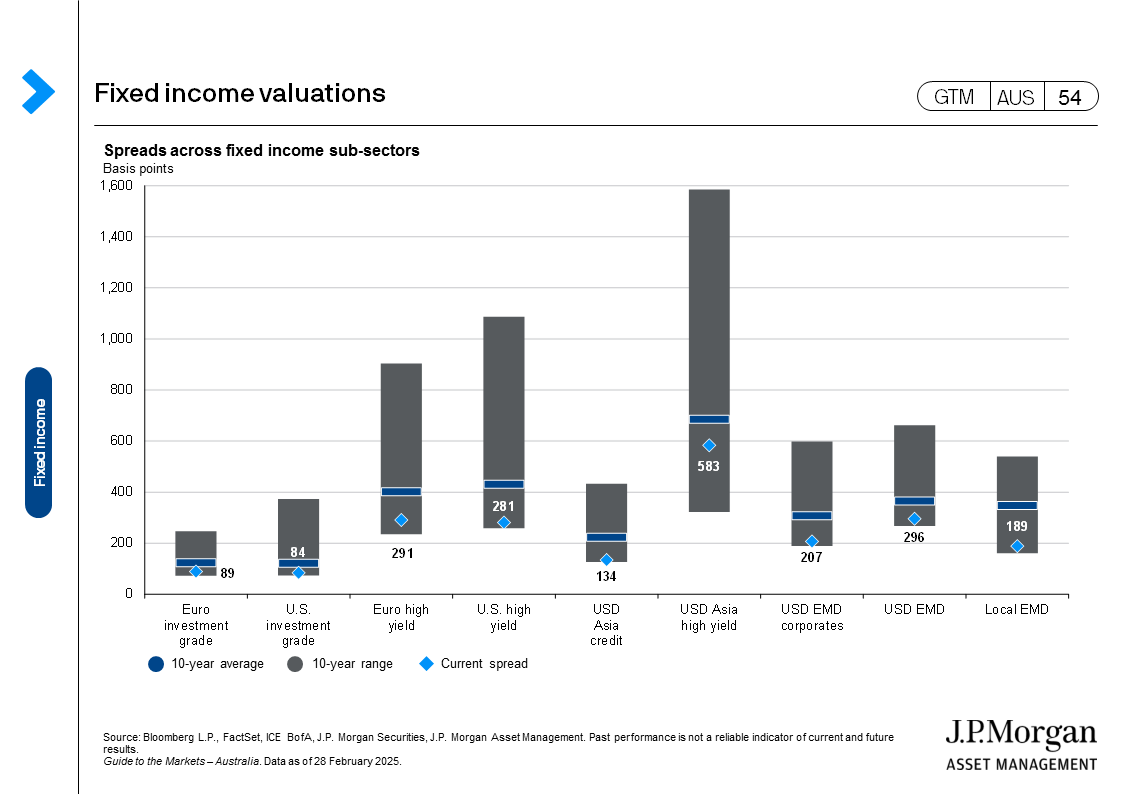

- Spreads on U.S. investment grade bonds were largely unmoved but slightly widened on high yield bonds, returning 2.0% and 0.7%, respectively.

(GTM AUS page 54)

Other assets:

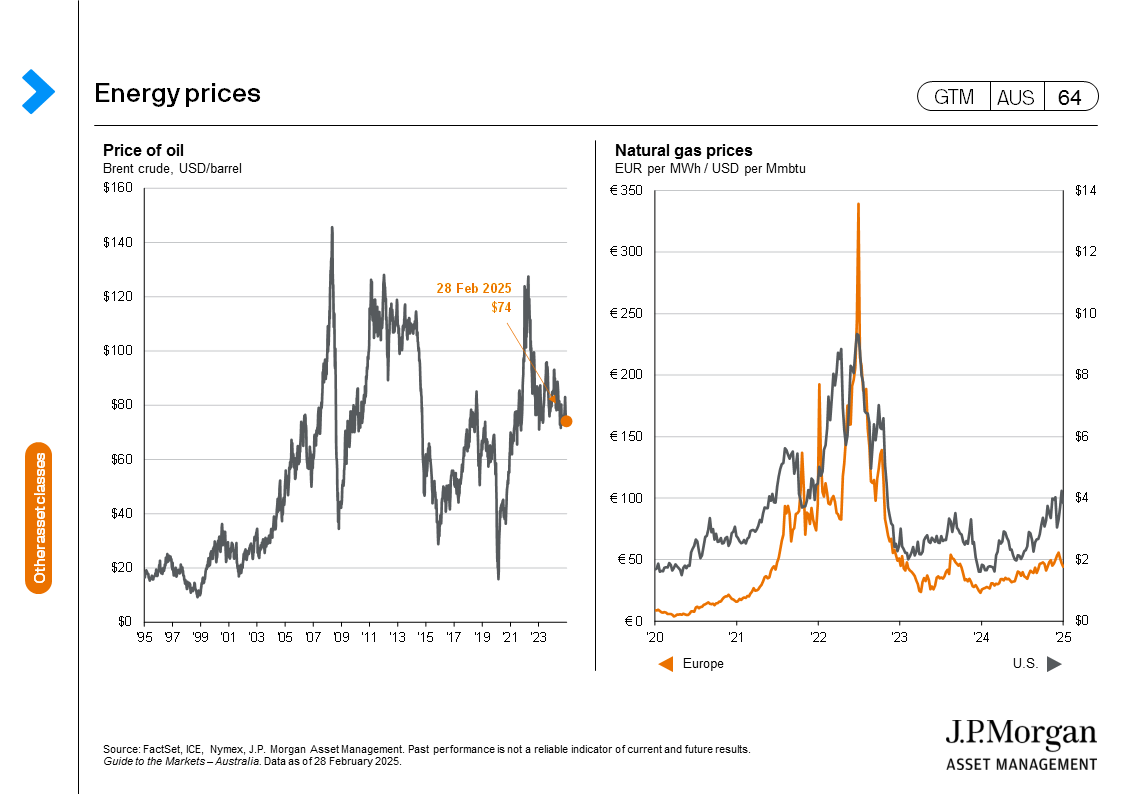

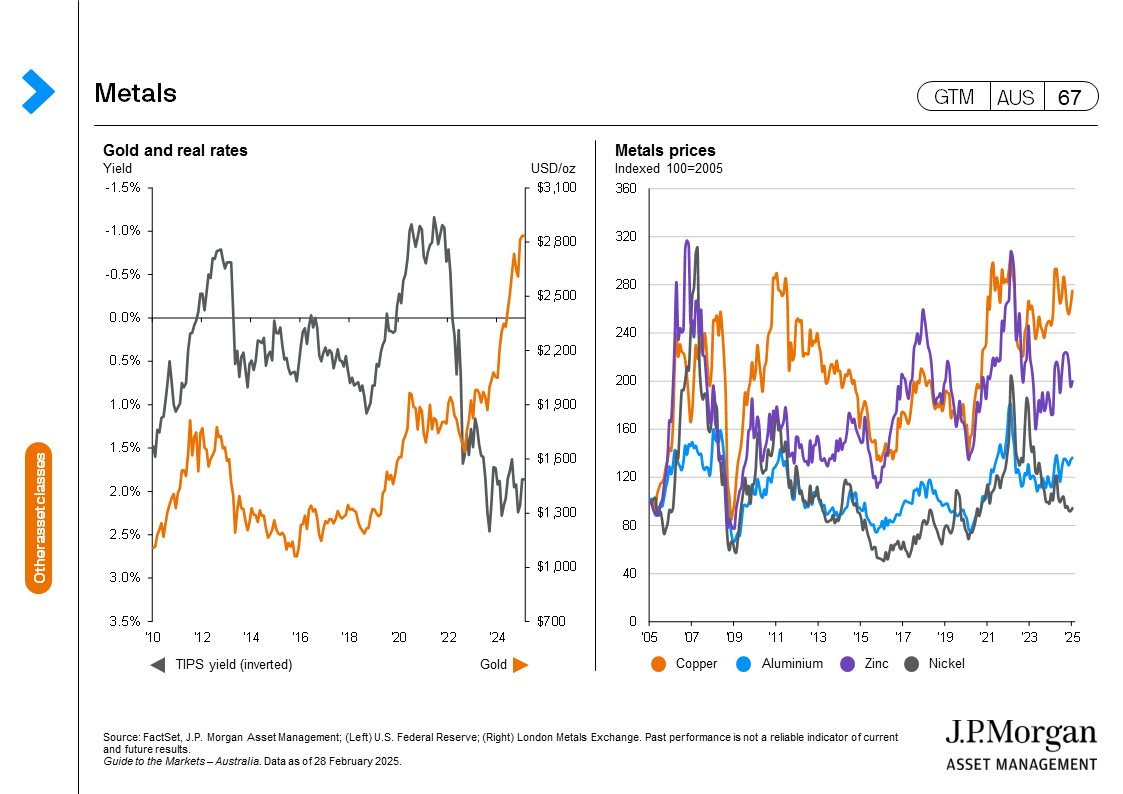

- Gold prices hit another record high of USD 2,835/oz at month-end as tariff risks fueled demand for the safe-haven asset. Brent crude fell 4.0% to USD 74.05 per barrel as a potential Russia-Ukraine truce helps supply expectation.

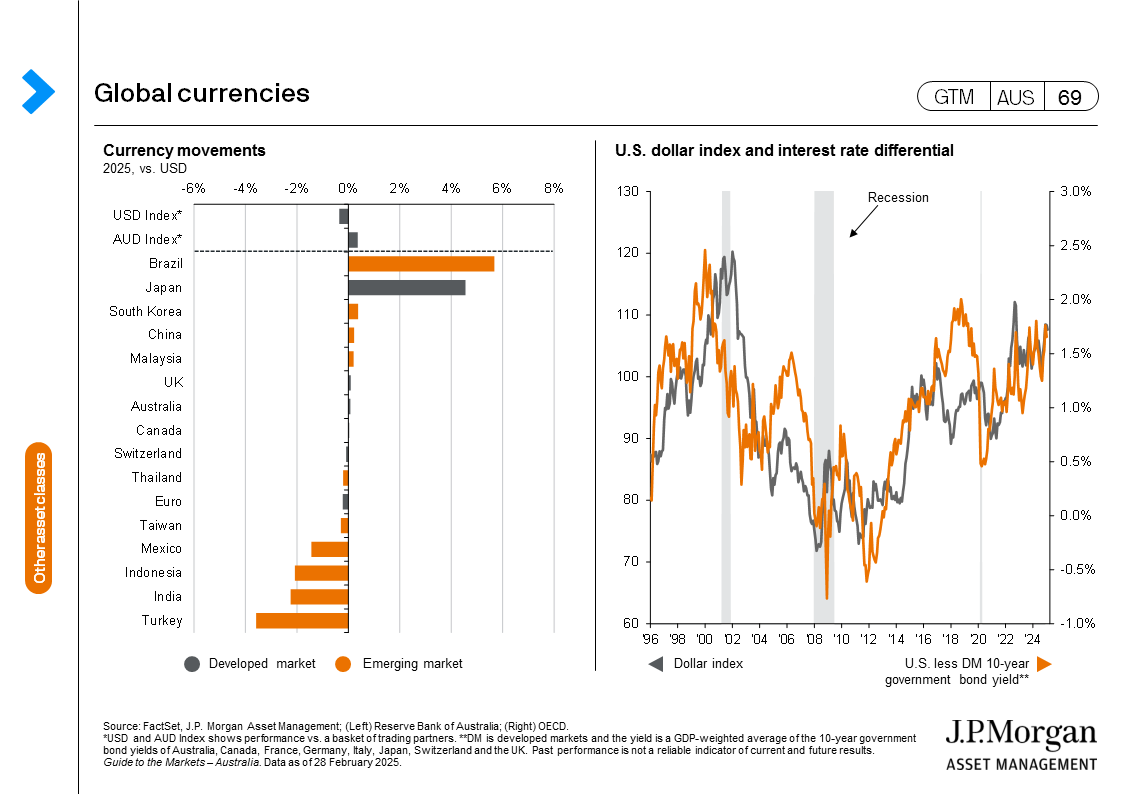

(GTM AUS page 64, 67) - The USD weakened by 0.2% in February, mainly driven by global growth concerns from rising tariff concerns as well as weaker-than-expected U.S. economic data. The Japanese yen strengthened by 3.3%, while the Chinese yuan was mostly flat.

(GTM AUS page 69)

|

|

0903c02a82674e7f