Principles for Successful Long-term Investing

Using Market Insights to achieve better outcomes

Market insights was founded in 2004 in the wake of the fallout from the tech Bubble. At a time when investors needed it most, the first Guide to the Markets provided clarity and perspective, and helped to reinforce key habits of successful long-term investors. Today, more than a decade later, it is in that same spirit that we are pleased to offer, “principles for successful long-term investing”.

We believe that a combination of these principles, sound financial advice and deeper insights can help make every investor better off.

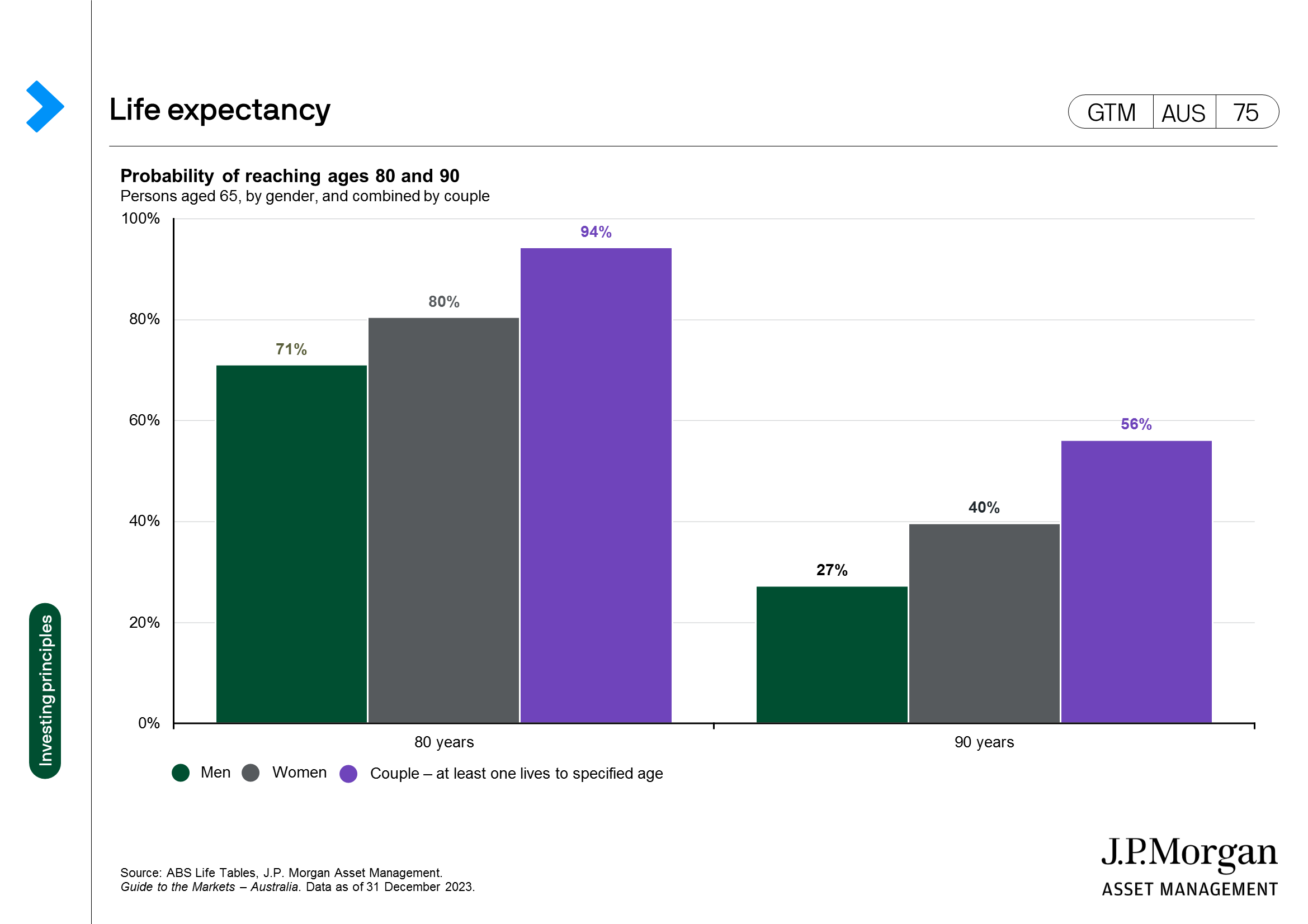

1 . PLAN ON LIVING A LONG TIME

We are living longer

Thanks to advances in medicine and healthier lifestyles, people are living longer. This chart shows the probability of reaching the ages of 80 or 90 for some who are aged 65 today. A 65 year-old couple may be surprised to learn that there is a 56% chance that at least one of them will live another 25 years, reaching the age of 90!

Many of us have not saved enough

Investors should start early by saving more, investing with discipline and have a plan for their future. Many people are worried about the risks associated with investing, but not enough about the risks that come with longevity.

2 . CASH ISN’T ALWAYS KING

Cash is a real drag

Investors often think of cash as a safe haven, or even a source of income from earning interest. However, despite rising interest rates by the Reserve Bank of Australia real rates remain low and rate cuts are likely in the coming year.

Holding more cash for short periods of time to protect capital in a volatile markets may be a viable strategy. However, investors should be sure an allocation to cash does not undermine their long-term investment objectives given the opportunity cost of holding too much cash.

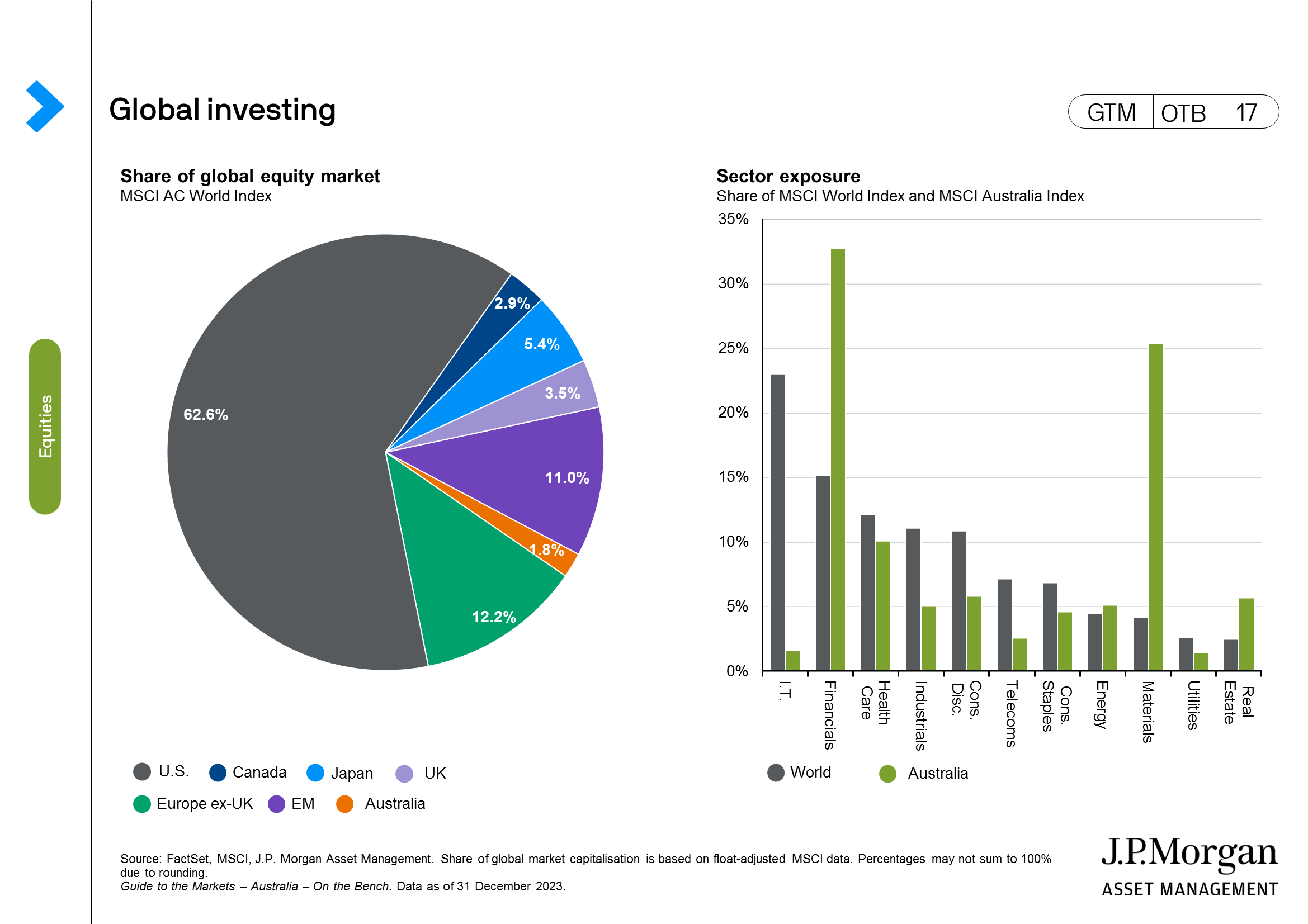

3 . AVOID EMOTIONAL BIASES BY STICKING TO A PLAN

LEFT: Home-country bias

The Australian economy represents only a fraction of the global economy and accounts for less than 2% of the global equity market. Yet for most Australian investors, a large portion of their portfolio can be concentrated in this small portion of global capital markets.

RIGHT: Familiarity bias and concentrated positions

The major Australian equity index, the ASX 200 Index, is not representative of global equity markets. Because of “home bias” and a preference for the domestic equity market, investors may find themselves having larger position in these sectors than a global investor.

It is important that investors are aware of these biases and employ a disciplined investment plan that can help minimise their influence.

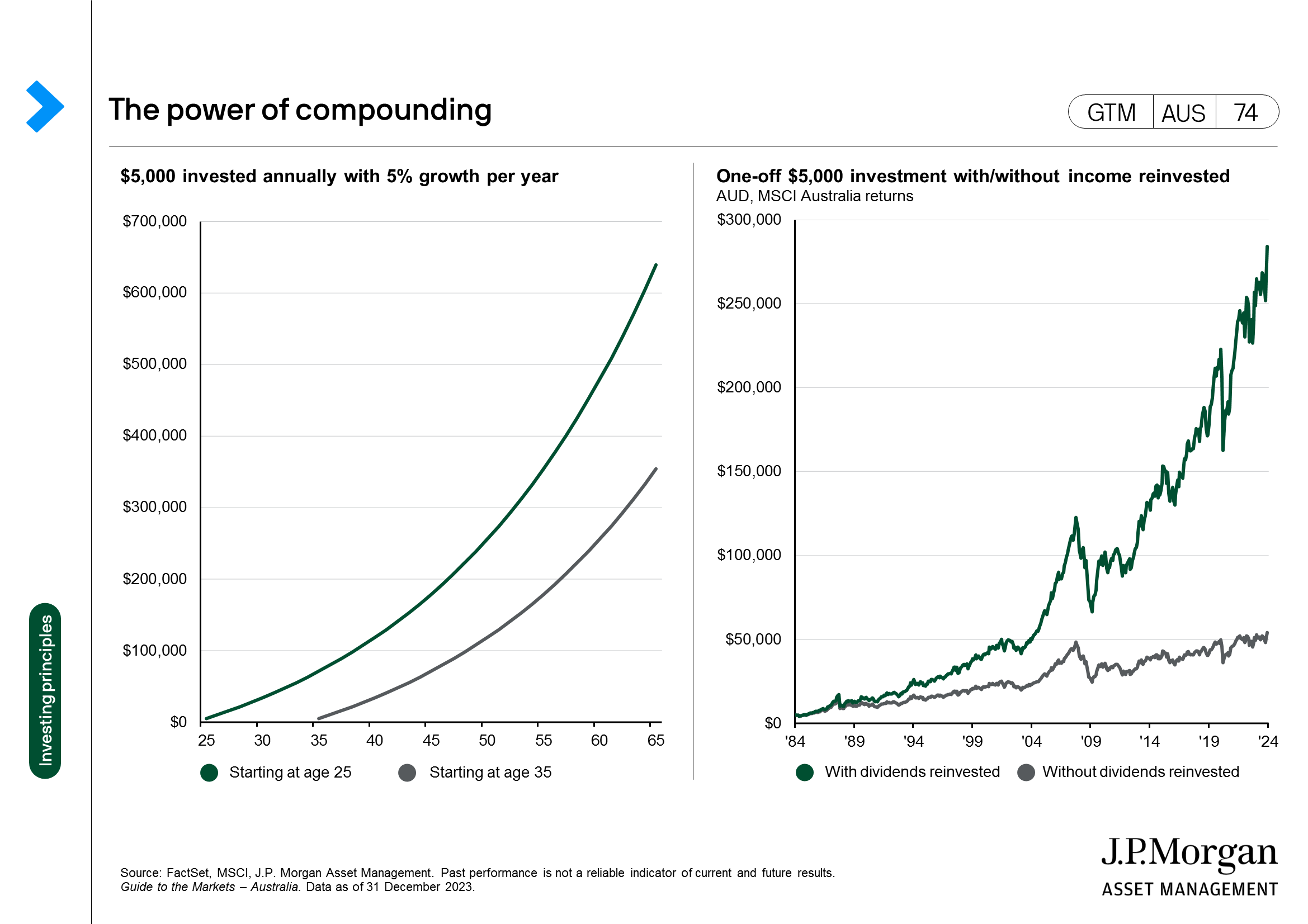

4 . COMPOUNDING WORKS MIRACLES

LEFT: Start early and invest regularly

Compounding interest has been called the eighth wonder of the world. Starting to save at the age of 25 and investing AUD5,000 annually in an investment that grows at 5% each year would leave you with over AUD250,000 more by the age of 65 than if you had started at 35.

RIGHT: Re-invest income from investments if you don’t need it

You can make better use of the magic of compounding if you reinvest the income from your investments to boost your portfolio value further. Compounding can make an exponential difference over time, compared to stock price appreciation alone.

5. VOLATILITY IS NORMAL; DON'T LET IT DERAIL YOU

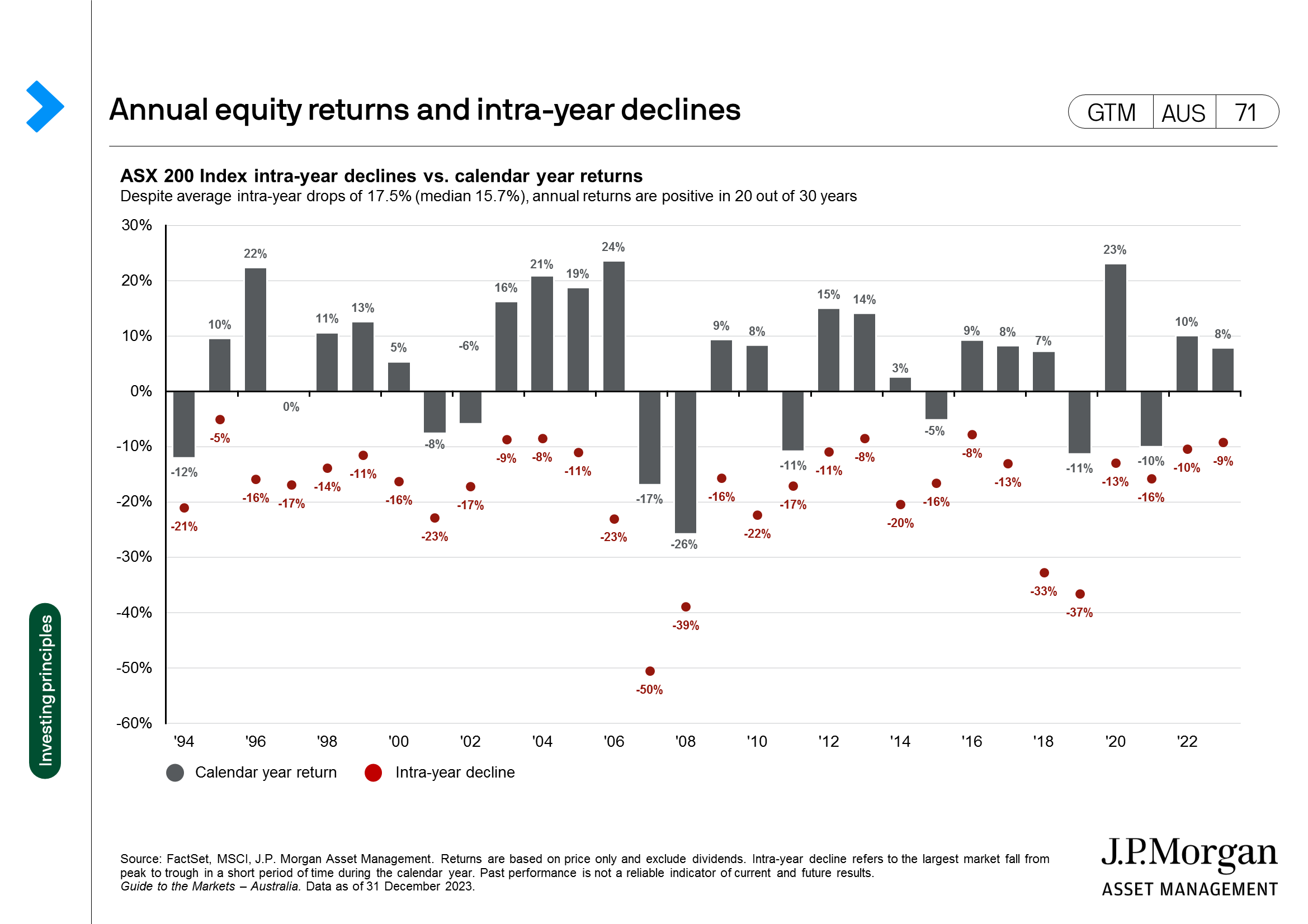

Seeing through the noise

Every year has its rough patches. The red dots on this chart represent the maximum intra-year decline in each calendar year for the ASX 200 Index going back to 1994. Despite the many pull-backs in equities, two thirds of those years ended with positive returns

But investors should also have a plan for when the going gets tough, instead of reacting emotionally. Volatility is unlikely to derail a long-term allocation. The lesson is, don’t panic: More often than not a pull back in the equity market is an opportunity, not a reason to sell.

6. STAYING INVESTED MATTERS

The most essential principle of all

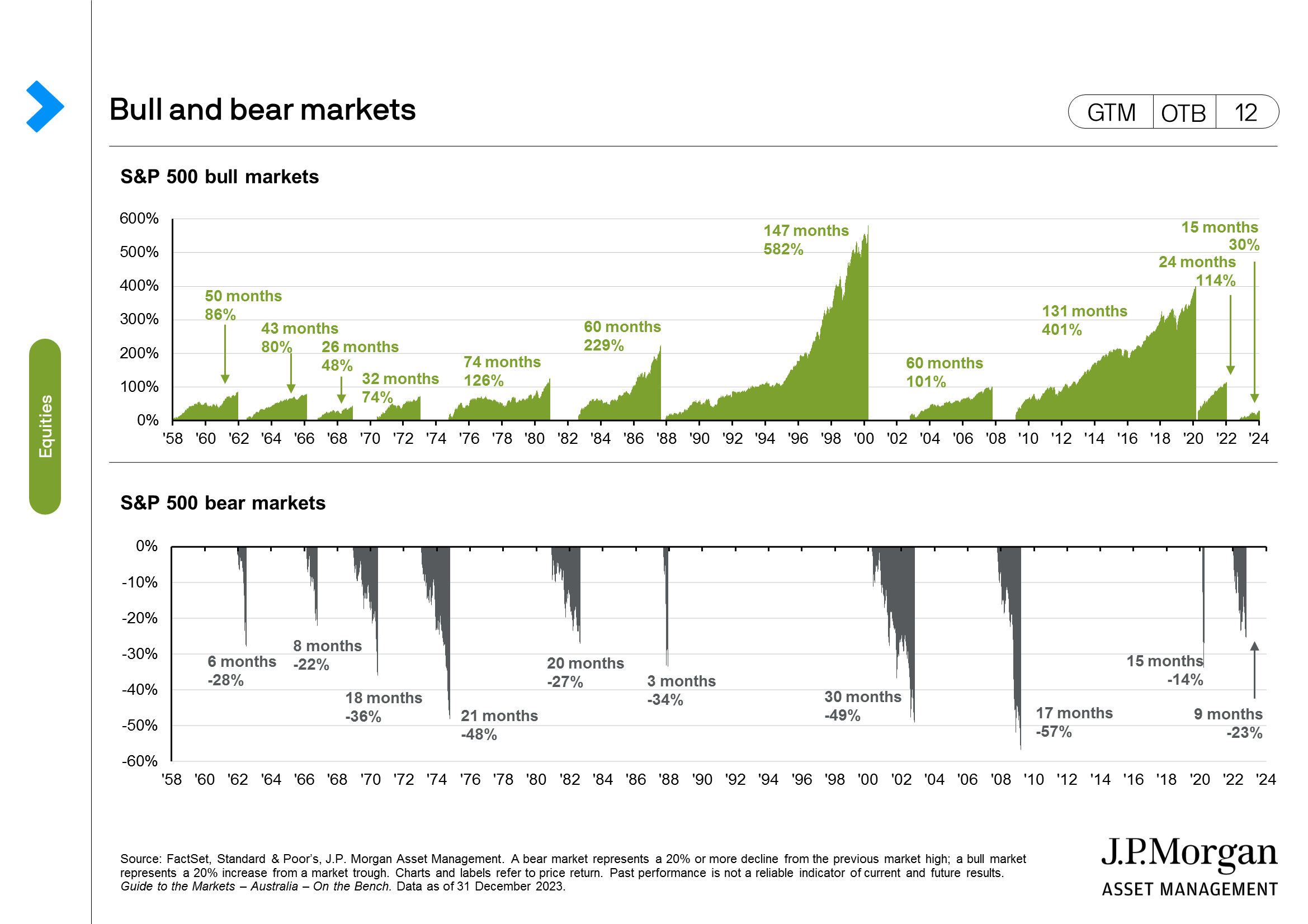

Market timing can be a dangerous habit. Investors think that they can outsmart the market or let the emotions of fear and greed push them to make emotional, rather than logical, decisions.

More importantly investors should position for the longer-term. Bull markets in equities can, and have, lasted a lot longer than bear markets. In a case of long summers, short winters, investors should remember their long-term objectives when positioning in markets.

6. STAYING INVESTED MATTERS (Part 2)

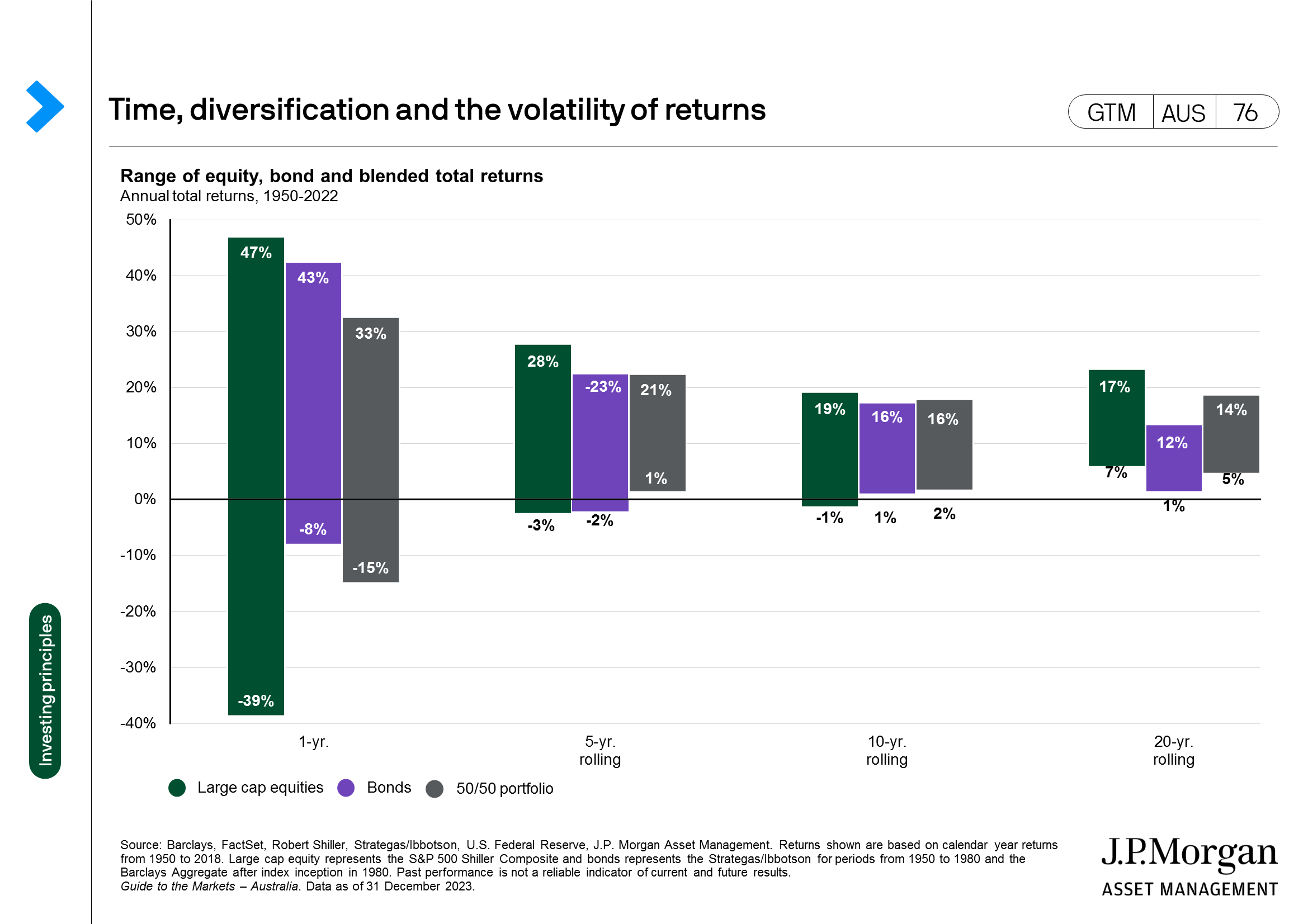

Good things come to those who wait

While markets can always have a bad day, week, month and even year, history suggests investors are less likely to suffer loss over longer periods.

This chart illustrates this concept. While one-year equity returns have varied widely since 1950 (+47% to -39%), a blend of equities and bonds has not suffered a negative return over any ten-year rolling period within the past 71 years.

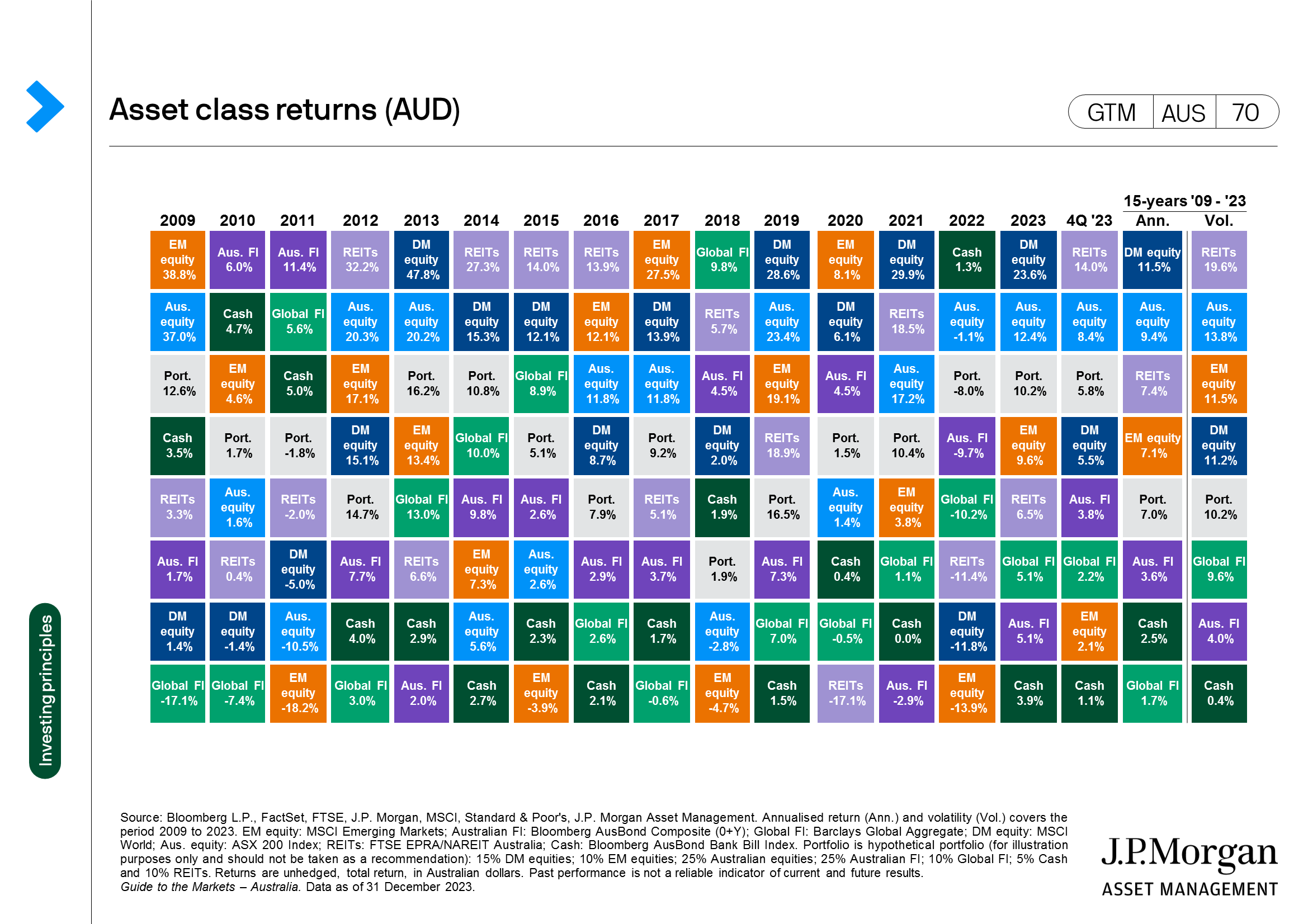

7. DIVERSIFICATION WORKS

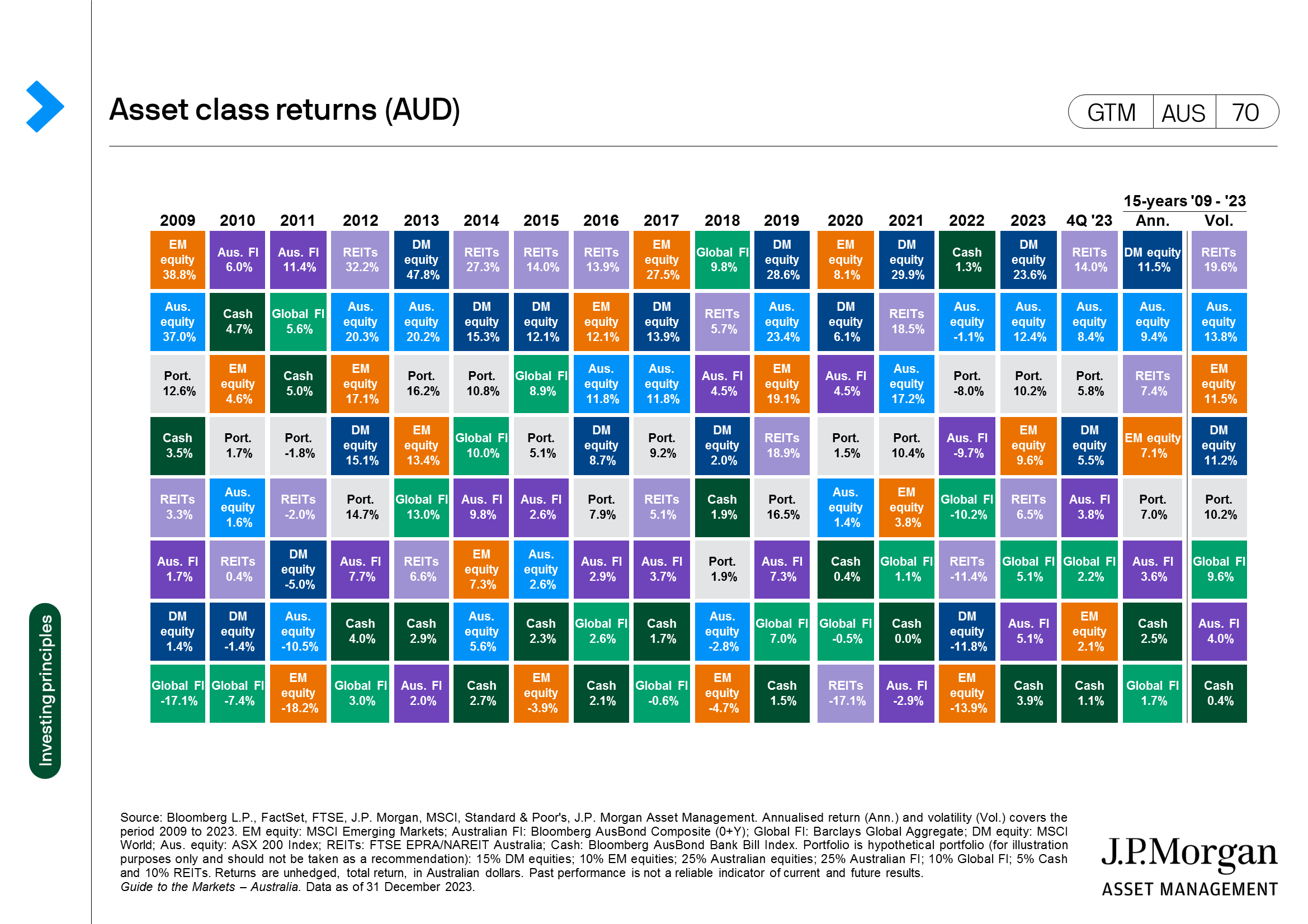

It’s the winning strategy over the long run

The last 15 years have been a volatile and tumultuous ride for investors, with multiple natural disasters, numerous geopolitical conflicts and major market downturns.

Through it all, a diversified portfolio of equities, bonds and other uncorrelated asset classes proved itself a winner.

0903c02a8202ce4c