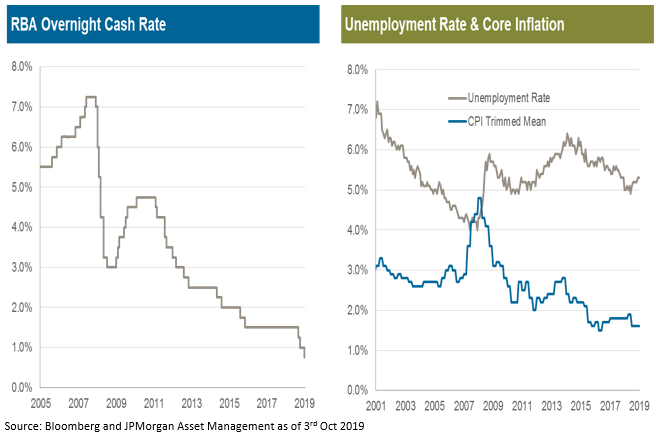

At the beginning of October, the Reserve Bank of Australia (RBA) cut its overnight cash rate by 25bps to a new record low (Fig 1a). The third rate cut in five months has effectively halved the central bank’s key policy rate – leaving the RBA in uncharted territory and one step closer to unconventional monetary policy to achieve potentially unattainable employment and inflation goals. The current trajectory of cash rates will have significant and far-reaching implications for local currency cash investors.

Optimistic rate cuts:

In recent speeches, RBA governor Philip Lowe struck an upbeat tone, noting the economy had reached a “gentle turning point”[1] helped by a combination of low interest rates, tax cuts, lower currency, infrastructure spending and housing market stabilization.

Despite this professed optimism, the RBA still cut rates in October and remained dovish, committed to “ease monetary further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target”[2]. However, given current lack of macroeconomic drivers to achieve the central banks full inflation target of 4.5% and core inflation target of ≥2% (fig 1b), the probability of attaining either goal remains remote.

Fig 1: The Australian central bank has cut base rates to a new record low; however, inflation and unemployment remain well below its target levels.

The reality is more nuanced: While Australia is currently in its 28th year of economic expansion, gross domestic product (GDP) growth has slowed to a decade low; moreover the rising labour participation rate is offsetting almost 2-years of positive jobs creation and despite the recent recovery, house prices have fallen below their long term trend. Meanwhile, the long term slowdown and rebalancing of the Chinese economy will eventually weigh on exports – although short term Chinese infrastructure stimulus will benefit Australia’s commodity driven economy.

Sluggish consumption and structural trends:

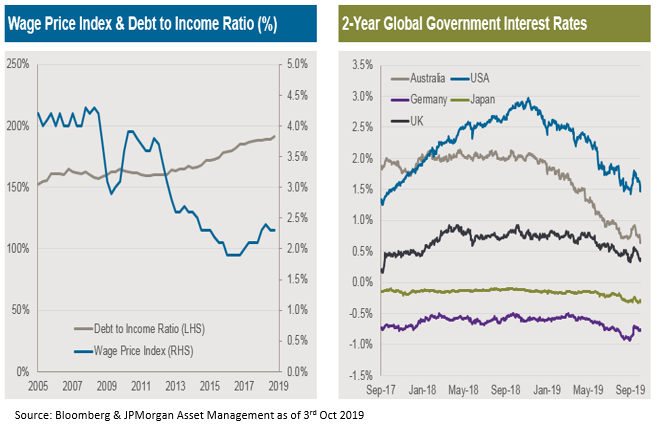

Apart from weak global growth, the RBA’s other key domestic concern remains the lack of growth in domestic consumption – especially during a period of rising employment. However, this can partly be explained by job insecurity, muted wage growth and the high level of consumer indebtedness (Fig 2a). All these factors should still benefit from lower interest rates – suggesting that monetary policy remains an effective policy tool – provided commercial banks pass the rate reductions on to consumers.

Fig 2: Debt to GDP continues to increase while wage growth remains sluggish. Globally, government bond yields have declined to new record lows.

Interestingly, for the first time, the RBA alluded to a new rationale for the latest rate cut. The structural shifts in global interest rates (Fig 2b) – which have fallen to record lows have also placed downward pressure on Australian interest rates. The central bank fears if it ignored the actions of major central banks, the “exchange rate would appreciate, which in the current environment would be unhelpful on terms of achieving both the inflation target and full employment”[3].

The implications of sustain lower interest rates:

The recent rate cuts, fiscal stimulus and continued Chinese commodities demand, suggest the modest Australian economic recovery is likely to endure. However, growing expectations of additional monetary policy easing by major central banks may force additional, unnecessary RBA rate cuts and even trigger unconventional monetary policy to restrain unwanted capital inflows and AUD appreciation.

For Australian cash investors who are more familiar with high interest rates, steep yield curves and competitive deposit rates, the prospect of extremely low or even zero yields represents a significant challenge. These difficulties have been compounded by the Royal Commissions impact on commercial banks demand for deposits and APRA’s clarification on the definition of cash.

Nevertheless there are several techniques developed and refined during the past decade of zero US interest rates which should help Australian corporate treasurers mitigate some of these complications. These include diversifying beyond deposits into money market funds and ultra-short duration funds, segmenting cash by liquidity requirements and identifying sectors and tenors that offer additional return for minimal reductions in liquidity and security.

Although combining these three techniques will not fully offset the negative impact of RBA rate cuts on cash returns, they will allow treasurers to achieve a competitive return consistent with the objectives of capital preservation and maintaining a high degree of liquidity.

[1] An Economic Update by Philip Lowe, 24th September 2019.

[2] Statement by Philip Lowe, Governor: Monetary Policy Decision, 1st October 2019

[3] An Economic Update by Philip Lowe, 24th September 2019