A comprehensive look at US Money Market Fund Reform

As the world’s largest provider of institutional money market funds, J.P. Morgan Asset Management is committed to keeping clients well-informed about the important SEC reform affecting both institutional and retail money market funds (MMFs). On this page, investors will find all the updated news regarding money market reform and its implications for liquidity strategies.

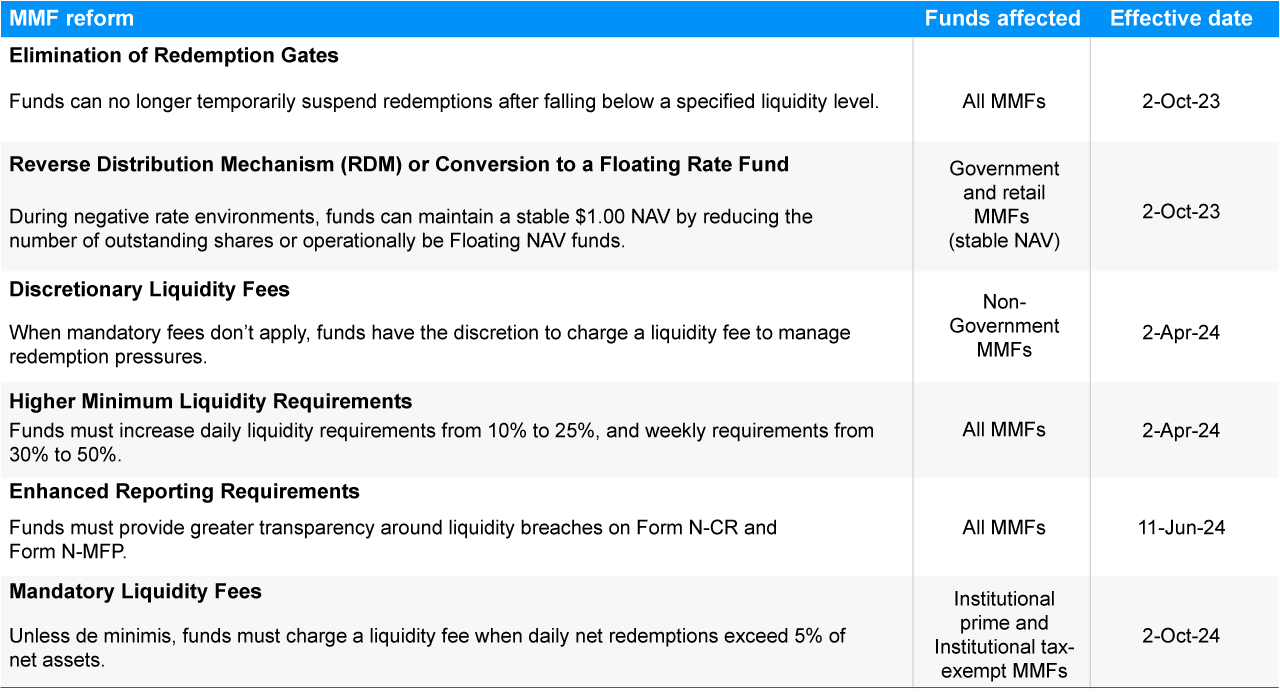

Some regulations are already in effect; others will be phased in over the course of 2024. As we approach these SEC rule implementation dates, we will continue to work closely with clients, intermediaries, industry participants and our Board to prepare for the changing regulatory landscape.

A deep dive on US Money Market Fund Reform

Some regulations are already in effect; others will phase in over the course of 2024. They are designed to enhance fund liquidity and transparency while shielding invested shareholders from the liquidity costs triggered by high redemption levels during market stresses.

More on reform