Municipal bond market: technical tailwinds and favorable fundamentals

11/14/2019

Jordan Jackson

In Brief

- Improving credit fundamentals, light tax-exempt supply and robust demand have driven the strong performance of municipal bonds (munis) in 2019. These dynamics are expected to continue.

- The passage of the Tax Cuts and Jobs Act (“TCJA”) has shifted supply and demand dynamics in the muni market, resulting in increased demand from individuals, but less demand from institutions. The elimination of issuers’ ability to advance refund has lowered new tax-exempt supply.

- Relative to Treasuries, munis provide a yield advantage on a tax-adjusted basis. Moreover, munis have historically been a better hedge against equity volatility when compared to corporate bonds given their higher quality bias.

- As the expansion continues, municipal bonds can provide investors with a source of stable income and portfolio diversification.

Strengthening fixed income portfolios is a key part of late-cycle investing. In a low-yielding world, high tax bracket investors can find opportunities in the municipal bond market to improve portfolio quality and provide downside protection.

The key advantage of investing in municipal bonds is that the interest generated from coupon payments is exempt from federal taxes. Given this tax benefit, muni demand is largely driven by retail investors, particularly high income earners looking to offset their tax burden. Indeed, households and mutual funds account for 72%1 of municipal bond holdings. Of this, close to 80% is owned by the top 10% in wealth2.

Tax reform: A technical tailwind

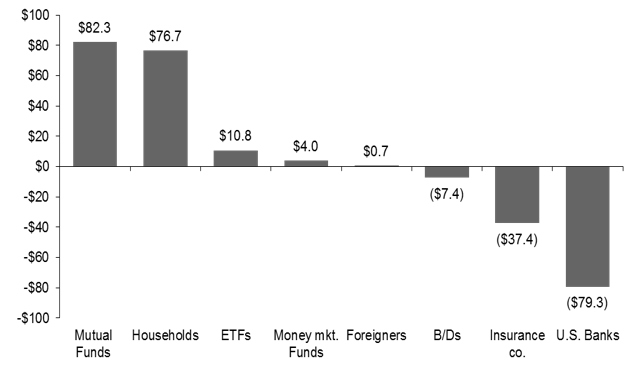

Tax policy changes have impacted both municipal supply and demand. On the demand side, the TCJA limits the state and local tax (SALT) deduction available to individuals, increasing the demand for tax efficient vehicles. Conversely, the reduction in corporate tax rates has enhanced the attractiveness of corporate bonds for financial institutions at the expense of muni debt. Still, as shown in Exhibit 1, demand from individuals has more than offset the weak demand from institutions since the first-quarter of 2018.

On the supply side, the TCJA removed the federal tax exemption in an advance refunding where issuers look to lower interest costs on outstanding higher interest debt. In an advance refunding, an issuer borrows money ahead of the nearest maturity or call date on an existing bond to pre-refund the future payment. The proceeds from the new issue are held in escrow, typically in Treasuries, in an amount sufficient to meet the interest and principal of the outstanding bonds. Previously, interest on the new debt was federally tax-exempt. Currently, issuers have to pay federal taxes on the debt used to advance refund a bond, reducing the incentive for them to do so unless interest rates are low enough to justify it.

Therefore, tax-exempt issuance declined by 23% in 2018 and is down 3.0% so far this year3. Unless tax-exempt advance refunding exemptions are brought back, supply is likely to remain in check. Together, tax-exempt supply constraints and strong demand are likely to remain a tailwind for holders of tax-exempt municipal debt.

EXHIBIT 1: Change in municipal holdings from Q1 2018 to Q2 2019

USD billions

Source: FactSet, Federal Reserve System, J.P. Morgan Asset Management. Data are as of November 8, 2019.

1 SIFMA: U.S. Municipal Securities Holders Report – June 2019. Includes households, nonprofit organizations, mutual funds, money market funds, closed-end funds and exchange traded funds. Holdings are based on market value.

2 Data from the Distributional Financial Accounts (DFAs) from the Federal Reserve System.

3 SIFMA: U.S. Municipal Issuance Report. Issuance is through September 2019.

0903c02a8275100f