Have markets recovered from the COVID-19 recession?

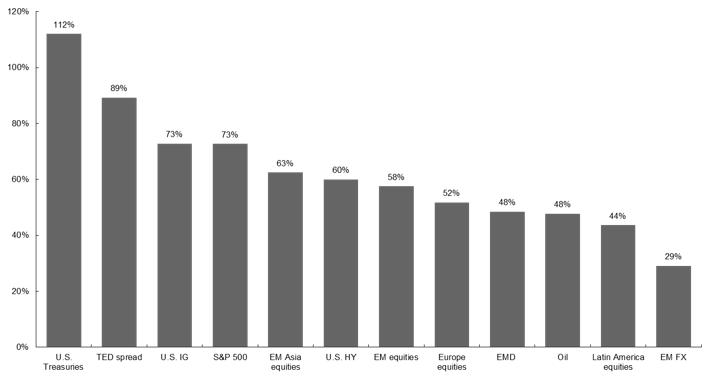

Investors have had to process a torrent of information and wild swings in sentiment so far this year. As we rapidly approach the middle of the year, it can be helpful to take a breath and process where markets stand in recouping their COVID-19 losses. Looking at the graph below, it is clear that whether markets have recovered depends a lot on which market. In particular, five conclusions come to mind:

- The U.S. Federal Reserve (Fed) has been incredibly successful in fixing the market’s broken plumbing. The panic during the first three weeks of March was related to the COVID-19 global economic shock, but also to concerns that highly liquid fixed income markets were not functioning properly and credit was not flowing well. The subsequent return in confidence is owed in large part to the unclogging of the system: 10-year Treasury yields have recovered 112% of their March pop, TED spreads have retraced 89% of their widening, and investment grade spreads have retraced 73% of theirs.

- Recovery has not been even across the risk spectrum. Lower beta equity regions like the U.S. and EM Asia have recovered far more of their losses than their more cyclical peers like Europe and Latin America. On the corporate credit side, quality has led with investment grade spreads recovering 73%, while HY only 60% and EMD only 48%.

- U.S. equities most primed for disappointment; EM Asia in a sweet spot. U.S. equities stand out as having recovered the largest share of its losses at 73%. This leaves it as the market most primed for some disappointment should fundamentals not catch up to expectations as fast as expected. On the other hand, EM Asia stands out as the region where fundamentals have improved faster than equity markets have recovered. According to Google data, mobility in retail and recreation has returned almost 100% to normal in countries like Taiwan and Korea, whereas EM Asian equities have recovered only 63%. In addition, EM currencies have only recovered 29% of their losses versus the U.S. dollar, providing an added tailwind to U.S.-based investors.

- Cyclical regions most due for a catch up. The recovery in cyclical regions, like Europe and Latin America, has lagged at around 50%, leaving them the most sensitive to positive upside surprises in global activity and policy support. While we do expect the global recovery to occur slowly and a full-on sustainable cyclical rally to take some time to materialize, it is important to maintain some exposure to cyclical regions (and sectors and styles) for catch-up rallies that can occur from time to time.

- Market timing is impossible. Overall, the rally since the mid-March lows has been swift, as investors never wait for all the stars to align. The investing conversation can often feel quite binary (are we bearish or bullish?), but it is often much more nuanced: How can we maintain a focus on quality, while also maintaining some exposure for the rebound? Often the answer is in balance and stock/security selection.

Whether markets have recovered from COVID-19 shock depends on which market

% of losses recovered, local currency

Source: Bloomberg, CRB, FactSet, Federal Reserve Economic Data, Standard & Poor’s, MSCI, J.P. Morgan Global Economic Research, J.P. Morgan Asset Management. Recovery calculated as total returns in local currency for equity markets; spreads for U.S. HY, U.S. IG, TED and EMD; yield for U.S. Treasuries; U.S. dollar per barrel for Crude Oil Brent. Data are as of June 1, 2020.