Listen to On the Minds of Investors

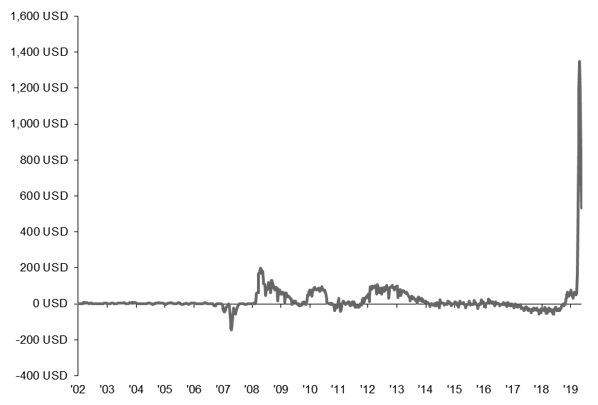

The U.S. Federal Reserve's (the Fed) response to COVID-19 is unprecedented. In a few short weeks, the Fed has slashed interest rates to zero, restarted asset purchases, begun directly lending to businesses and providing support to state and local municipalities. This week’s chart shows how the scale of recent Fed support dwarfs the response during the Financial Crisis. But still, given the severity of the economic impact of COVID-19, many investors may be wondering: has the Fed done enough?

While investors are hoping for a quick recovery, it is important to remember that we are operating off of the virus’ timetable, not humanity’s. If newly reopened economies begin to see infection rates rise, we will likely require further lockdowns to stop healthcare systems from being overwhelmed. Under this scenario, it is likely that the economic recovery will be sluggish until a vaccine is developed. If the Fed has not done enough given the projected length of economic malaise, what more could it do? Thankfully, there are a few remaining options.

- Expand the scale and scope of programs: The first step would likely be an expansion and/or extension of existing programs. A number of the Fed’s programs are set to expire in September; this deadline could be moved back or removed entirely if required.

- Negative interest rates: The jury is still out on whether this unorthodox policy would work. Five developed market central banks have explored negative interest rates since 2012 and few have seen significant rise in growth rates1. In early May, the Fed futures curve started pricing in negative interest rates for April 2021; however, Fed officials remain wary of adopting this policy.

- Yield Curve Control (YCC): In Australia and Japan, the central banks have committed to fixing the yield of government bonds at an explicit target. This approach allows a central bank to send a strong signal to markets that it will be conducting unlimited asset purchases to keep yields lower for longer. It also provides support to fiscal policymakers who have the confidence to be able to borrow at very low fixed yields.

Ultimately, the Fed’s next step will be dictated by the pathway of the virus. Despite the elevated uncertainty, there is one clear takeaway for investors: the frenzied hunt for income will become more challenging. The actions of global central banks will see bond yields stay lower for even longer, perhaps forever. During the next expansion, income-generating strategies will be more important than ever in helping clients meet their investment goals.

Federal Reserve bond purchase

USD billions, 4-week rolling sum of U.S. Treasury and MBS securities

Source: FactSet, Federal Reserve System, J.P. Morgan Asset Management. Bond purchases includes net purchases of U.S. treasury securities (bills, notes and bonds) and agency mortgage-backed securities. Data are as of May 12, 2020.

1Denmark (2012), European Central Bank (2014), Sweden (2015), Switzerland (2015) and Japan (2016)

0903c02a828c9564