Listen to On the Minds of Investors

Year-to-date, emerging market (EM) equities are down -17.6%, as a combination of the COVID-19 recession and the oil price shock has led to downward revisions to earnings expectations, as well as weaker currencies relative to the U.S. dollar.

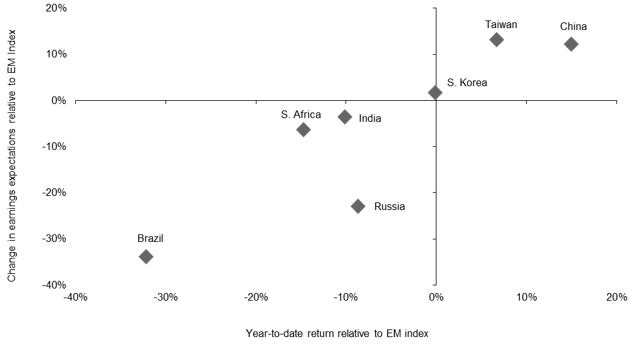

Year-to-date, emerging market (EM) equities are down -17.6%, as a combination of the COVID-19 recession and the oil price shock has led to downward revisions to earnings expectations, as well as weaker currencies relative to the U.S. dollar. However, this index level performance hides significant differences beneath the surface: Chinese equities are down only -3.2% while Brazilian equities are down -50.3% - and other countries find themselves in between the two. In general, the major EM Asia markets have outperformed EM, while EM Latin America and EM EMEA (Europe, Middle East and Africa) have underperformed.

What explains these vastly different returns beneath the EM surface? Outside of a few exceptions, country performance relative to overall EM performance has closely tracked fundamentals. Countries that have outperformed have had less negative earnings revisions relative to the EM average and vice versa. Negative earnings revisions are starkly different between the top and worst performing EM markets: Chinese next twelve month earnings expectations have come down 12%pts less than those of overall EM, while Brazilian earnings expectations have come down 34%pts more.

Two major factors help to explain this difference in fundamentals: 1) Domestic control over COVID-19 and 2) Sectoral composition of these markets. Countries in EM Asia, like China, Korea and Taiwan, now have weekly COVID-19 cases growing only 1%, allowing their economies to reopen more and more. Meanwhile, countries like Brazil, Russia, Mexico, and South Africa are still seeing their new cases grow at a 35-50% weekly rate, postponing their reopening phase and casting doubt on their recovery path.

In addition, the sector composition is vastly different between these regions. Latin America and Eastern Europe are more exposed to the oil price shock, with the energy sector making up 9% and 46% of their market capitalization, respectively, versus 4% in EM Asia. On the other hand, sectors whose long-term trends are being positively amplified by COVID-19, like technology and health care, have a much bigger representation in EM Asia at a 25% combined weighting versus 3% in Latin America and less than 1% in EMEA.

Investors should look carefully beneath the surface in EM equities, as fundamentals and returns are vastly different depending on the country or region. The combination of the response to COVID-19, sectoral representation, and long-term potential for growth in the middle class all continue to favor EM Asia.

Returns and fundamentals have varied wildly beneath the EM surface

Year-to-date return and change in NTM earnings, all relative to EM and in USD

Source: MSCI, J.P. Morgan Asset Management. Data are as of May 20th, 2020.

0903c02a828d983f