For investors looking to diversify concentration to U.S. tech names or to lean into underappreciated AI opportunities, Asian high-quality technology stocks could provide an attractive opportunity set.

AI adoption remains a key theme for the markets and investors this year, and while much attention has focused on U.S. mega-cap companies, Asian technology companies appear to be major beneficiaries as well. Increased global demand for AI-related products and high-performance semiconductors could be particularly significant for companies in Taiwan and Korea given their key roles as AI enablers and their established dominance in tech supply chains. Moreover, recent government policies aimed at strengthening and building upon technological advantages, with ambitious goals for gaining ground as global chip leaders, could help these economies gain global market share.

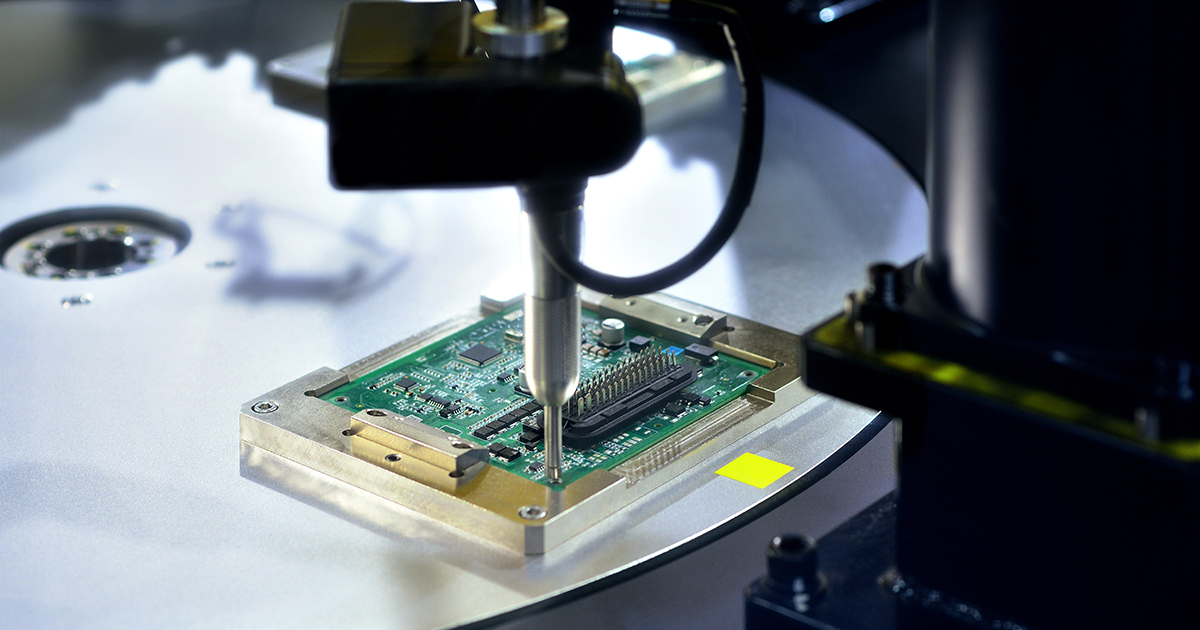

Taiwan is perhaps the most obvious Asian beneficiary to AI. As the epicenter of global semiconductor manufacturing, Taiwan produces over 60% of the world's semiconductors and around 90% of advanced semiconductors, making it a leader in the technology with a strong advantage in pre-existing design and intellectual property ecosystems. Taiwan’s leading chipmaker, Taiwan Semiconductor Manufacturing (TSMC) is already strongly benefitting from the AI adoption wave. TSMC registered a record-high sales growth of 11.3% y/y in February, with robust demand from clientele such as Nvidia, Apple and Advanced Micro Devices.

So far, Taiwan exports have seen just modest growth, up +1.3% y/y in February, but do seem to be recovering after mostly having fallen in 2023 and analysts expect this to grow further. MSCI Taiwan 2024 earnings growth expectations have been upwardly revised to 19.4% from 17.4% at the end of the last year and investor sentiment has become increasingly bullish. This boost in optimism also comes on the back of Taiwanese companies shifting focus towards developing “edge AI” devices, with strong demand expected to come from the integration of AI into PCs and smartphones in the coming years.[1]

South Korea is also well positioned due to their production of high bandwidth memory (HBM) chips, a technology that provides higher computation ability in AI chips. The government has been active in trying to support this advantage, with tax benefits extended directly to its leading memory companies as well as a broader scope of businesses undergoing key research and development. Korea is also taking lessons from Japan’s Tokyo Stock Exchange corporate government reforms, with a “corporate value-up program” that provides incentives and tax benefits to companies that prioritize shareholder reforms. Undoing the “Korea Discount”[2] is no simple endeavor, but these reforms could have a significant impact if successful, as nearly 70% of local companies in Korea trade at a price-to-book ratio below 1.

Healthy balance sheets and fair valuations offer further fundamental support for companies in Korea and Taiwan.[3] In Japan, where we continue to view governance reforms and economic growth as constructive, digitalization policy initiatives could also help activate the estimated 53% share of beneficiaries to AI in Japanese markets.[4] Importantly, active management remains key in these markets given greater currency and regulatory risks. However, for investors looking to diversify concentration to U.S. tech names or to lean into underappreciated AI opportunities, Asian high-quality technology stocks could provide an attractive opportunity set.