Infrastructure resiliency during the COVID-19 crisis

As it becomes increasingly challenging to source assets that provide both income and safety, infrastructure looks positioned to help investors grow and diversify their real asset portfolios.

The rapid spread of COVID-19 and resulting spike in market volatility has shaken the global investment community. Although equity prices have staged a modest recovery in recent weeks, the fall in government bond yields has complicated the way investors think about asset allocation. As it becomes increasingly challenging to source assets that provide both income and safety, it seems likely that investors will continue to embrace core real assets. Furthermore, with many institutional investors having sported dedicated real estate allocations for quite some time, infrastructure looks positioned to help investors grow and diversify their real asset portfolios.

From an asset allocation standpoint, this creates the need for three distinct sleeves – risk, protection, and uncorrelated income. The risk and protection sleeves are fairly straightforward – cash and high quality government bonds will provide protection, while equities and lower rated credit will continue to act as a source of growth. However, the past few years have seen growing investor interest in core real assets as a source of both income and diversification. Infrastructure in particular has benefitted from this trend; the asset class is fairly transparent, and U.S. investors remain under-allocated relative to their European counterparts.

With the global economy locked down, concerns around the ability of infrastructure assets to continue generating attractive streams of income have come to the forefront. However, not all infrastructure investments are created equal. Certain infrastructure assets, like airports and shipping terminals, tend to more sensitive to the business cycle, and will therefore see the greatest impact from the current slowdown. On the other hand, regulated utilities are obligated to maintain service, whereas any issues with contracted assets will be a function of changes in counterparty risk. This suggests that core infrastructure assets will be less affected while the economy is offline.

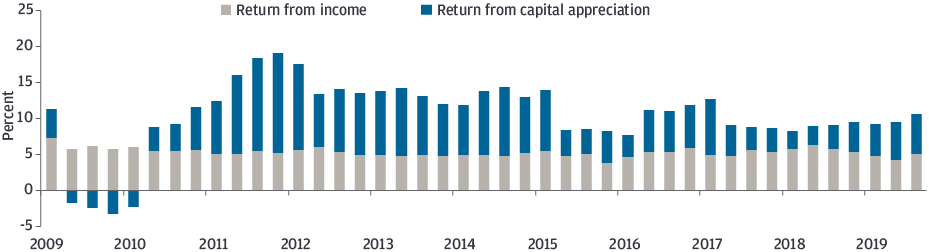

Exhibit 1: Global core infrastructure returns

Rolling 4-quarter returns from income and capital appreciation

Source: MSCI, J.P. Morgan Asset Management.

Infrastructure returns represented by the "low risk" category of the MSCI Global Quarterly Infrastructure Asset Index. Data show rolling one-year returns from income and capital appreciation. The chart shows the full index history, beginning in the first quarter of 2009.

Past performance is not indicative of future results. Alternative investments carry more risk than traditional investments and are recommended only for long-term investment. Some alternative investments may be highly leveraged and rely on speculative investments that can magnify the potential for loss of gain. Diversification does not guarantee investment returns or eliminate the risk of loss.

Data is based on avaliability as of February 29, 2020.

Furthermore, it is important to remember that periods of economic stress and dislocation create opportunity. The key is to construct portfolios that can successfully navigate the storm. With high quality fixed income looking expensive, and investments that move with the equity market increasingly becoming a source of yield, leveraging sources of uncorrelated income like core infrastructure to bridge the gap between these two types of assets will only continue to grow in importance.

0903c02a828a9f26