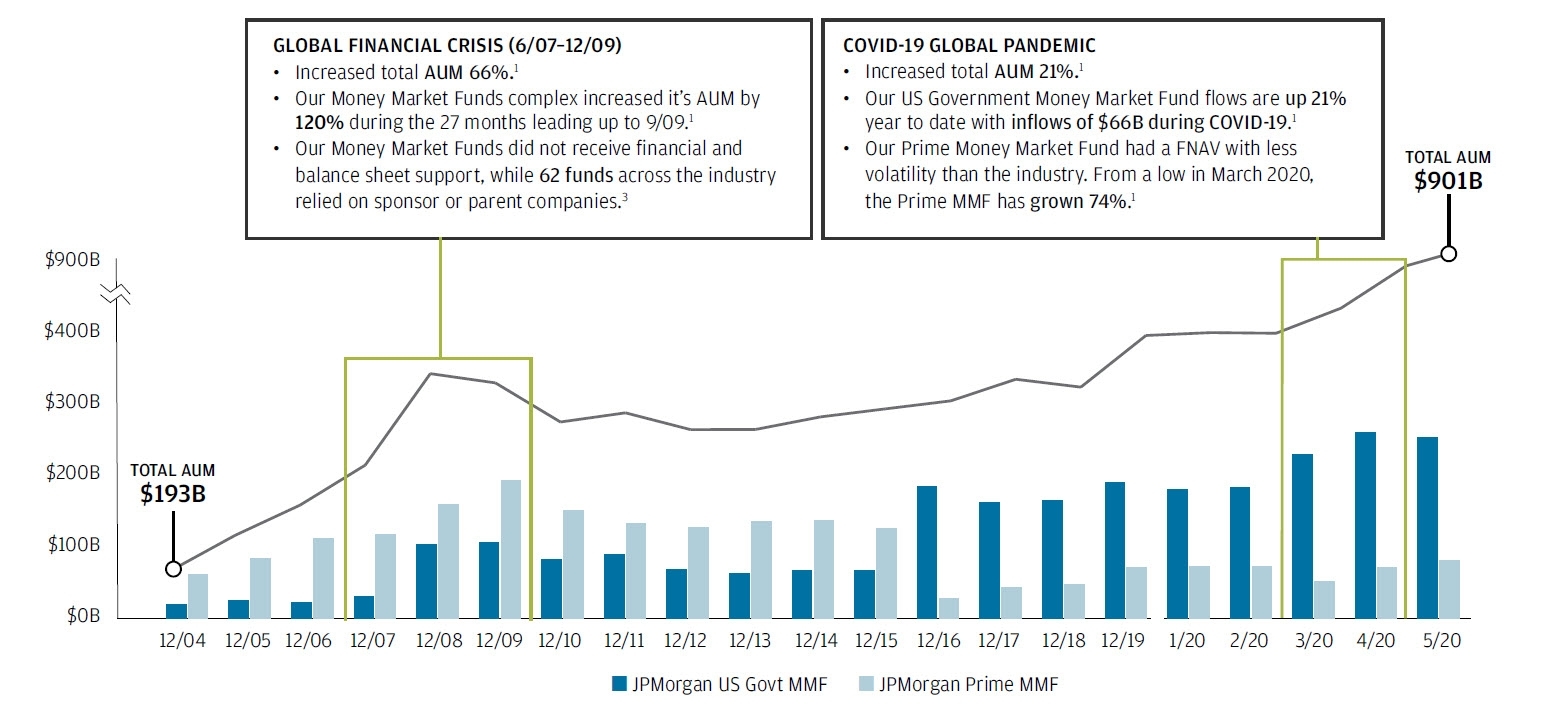

Over the course of our three decades in the business, J.P. Morgan Global Liquidity has successfully navigated through difficult market environments.

Chart source: J.P. Morgan Asset Management. Data as of 5/29/2020.

1 Source: J.P. Morgan Asset Management. Total AUM: data as of 5/29/2020. Global Financial Crisis: AUM data from 6/30/2007-12/31/2009. COVID-19 Global Pandemic: AUM data from 2/29/2020–4/30/2020, US Government Money Market Fund data from 1/1/2020–6/23/2020 and 2/29/2020–4/30/2020. Prime Money Market Fund data from 2/29/2020–4/30/2020 and 3/25/2020–6/23/2020.

2 Source: iMoneynet Fund Analyzer. Based on assets under management (AUM) as of 5/1/2020.

3 Source: Moody’s Investors Support, Sponsor Support Key to Money Market Funds as of 8/9/2010.

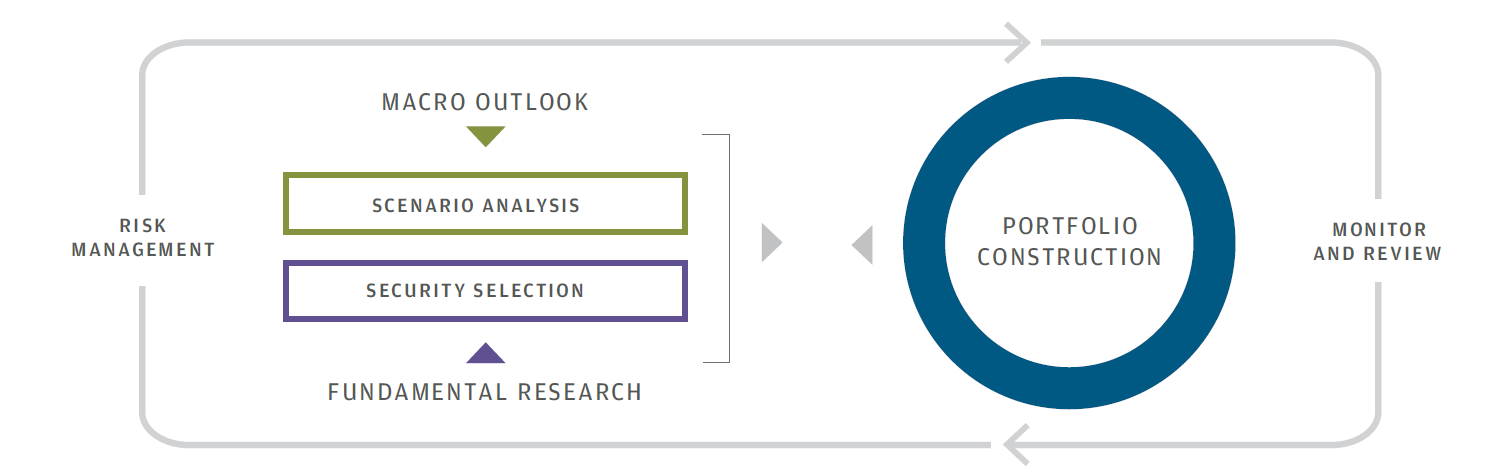

ROBUST CREDIT PROCESS

The Portfolio Management team and Credit Analysts within Global Liquidity bring an average of 22 years of industry experience to their investment decisions. Our strong quantitative credit approach and continuous oversight ensure a dynamically maintained list of approved issuers.

Strategic solutions for your cash needs

Simple onboarding process for efficient account openings

![]()

Client service is available 24 hours a day, 7 days a week

![]()

A variety of solutions along the front end of the curve

![]()

Integration with sustainble investing principles

![]()