Volatility in perspective

Global market swings and heightened uncertainty can be unsettling. And while investors can’t avoid volatility, they could make the most of it. Investments grounded in research and guided by data and insights can help investors achieve their long-term objectives.

In challenging times, it is always useful to keep a few things in perspective.

First, volatility is normal, and market declines are part and parcel of investing.

The urge to exit can be overwhelming when markets are falling, but doing so may mean selling at the most inopportune time and missing potential market rebounds. This can be costly for portfolios in the long run.

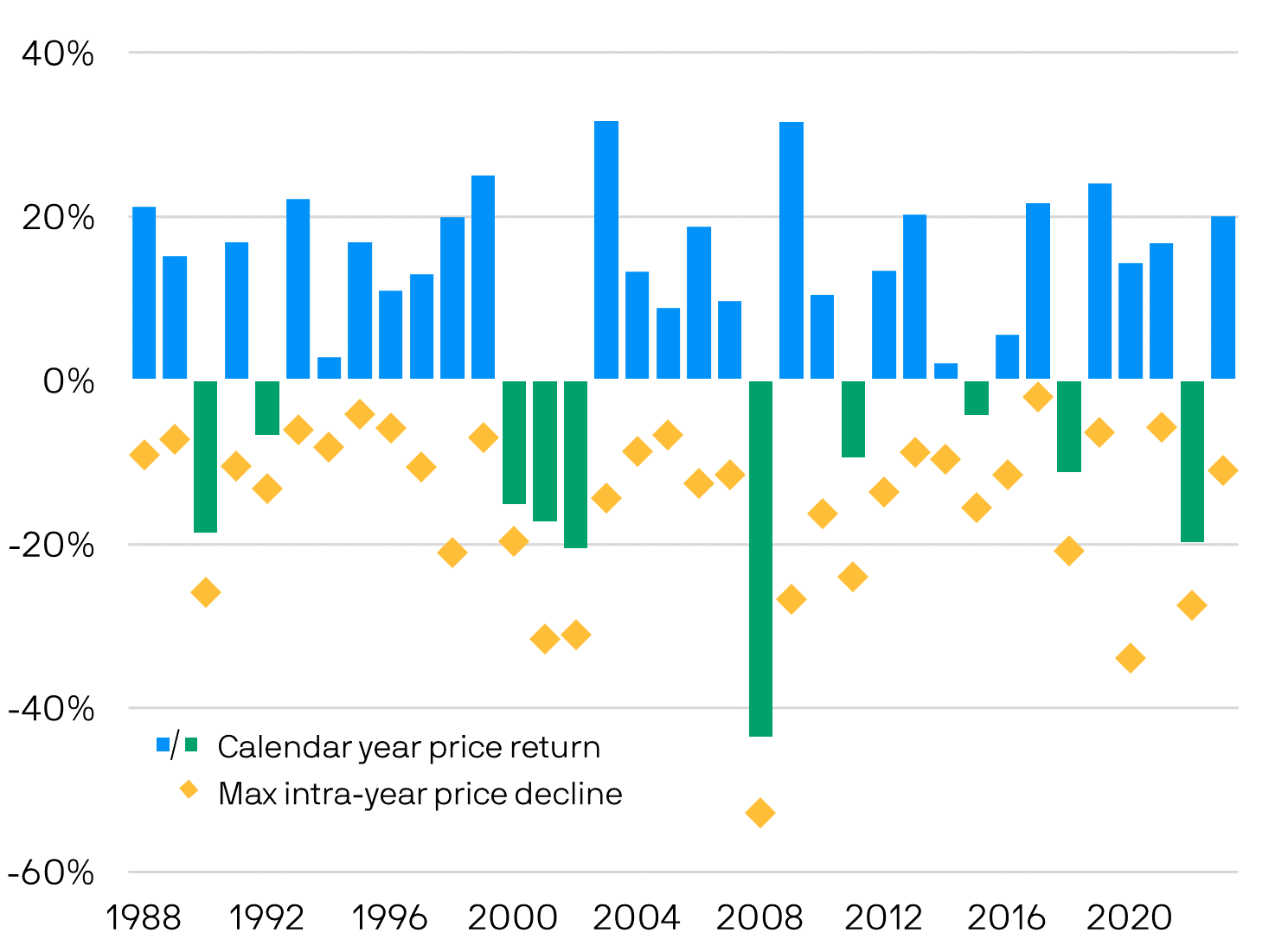

While periodic pull-backs are not uncommon, 27 of the last 37 years have ended with positive returns for the MSCI All Country World Index.

This underscores the importance of patience and perseverance to ride out choppy markets. Investors should not let short-term volatility derail their long-term investment plans and stay focused on their end goal.

Volatility is normal. As a general macro trend, annual returns of the MSCI All Country World Index were positive in 27 of the last 37 years despite average intra-year drop of 15.11%.

MSCI All Country World Index annual price return and intra-year declines (1988 – 2024)

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.12.2024. Max intra-year price declines refer to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Past performance is not a reliable indicator of current and future results. Average annual return between 1988 to 2024 was 7.45%.

Second, investing is about time in the market, not timing the market.

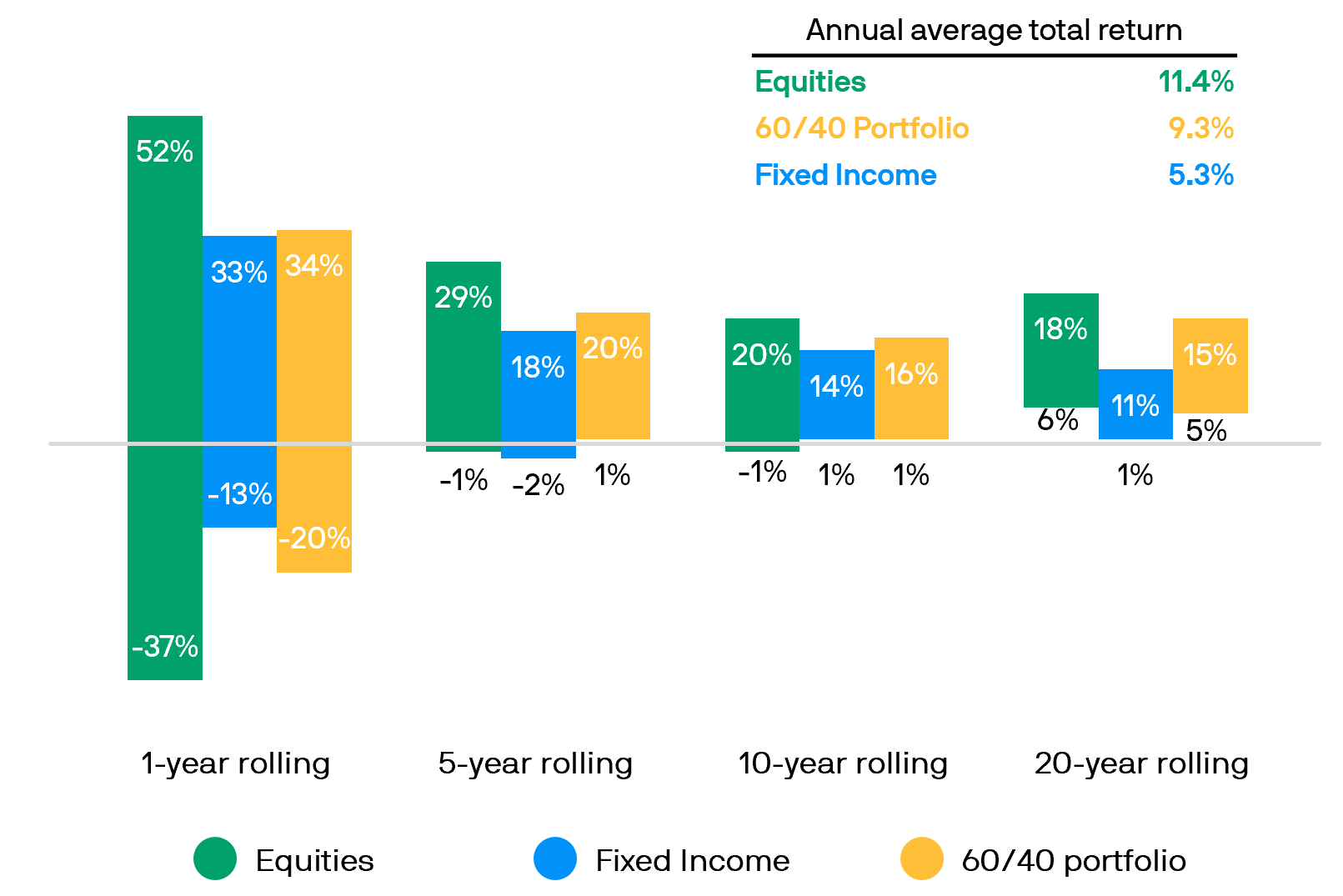

For one, the range of return outcomes narrows considerably and skews positive over longer time horizons.

The data shows the resilience of a 60/40 stock-bond portfolio by illustrating its 1-year and 3-year returns in excess of cash during each market shock. In most scenarios, a 60/40 portfolio can outperform cash over a 3-year period despite these market shocks.

While there is no guarantee of future returns, the data demonstrate the importance of staying invested, focusing on time in the market and not timing the market.

A 60/40 stock-bond portfolio during market shocks

1-year and 3-year returns of a 60/40 stock-bond portfolio in excess of cash (Cash returns are based on Bloomberg U.S. Treasury Bellwethers (3M) Total Return Index.)

Source: Bloomberg, FactSet, MSCI, J.P. Morgan Asset Management. Portfolio returns reflect allocations of 60% in the MSCI AC World Index and 40% in the Bloomberg Aggregate Bond Index. Cash returns are based on Bloomberg U.S. Treasury Bellwethers (3M) Total Return Index. Returns are total returns. *Based on incident-to-date returns due to less than 3 years of track record. Past performance is not a reliable indicator of current and future results. Data reflect most recently available as of 06.05.2025.

Third, diversification can be useful to ease the journey through choppy markets.

Diversifying portfolios across a variety of negatively correlated and/or uncorrelated asset classes can help manage the risks during a market downturn.

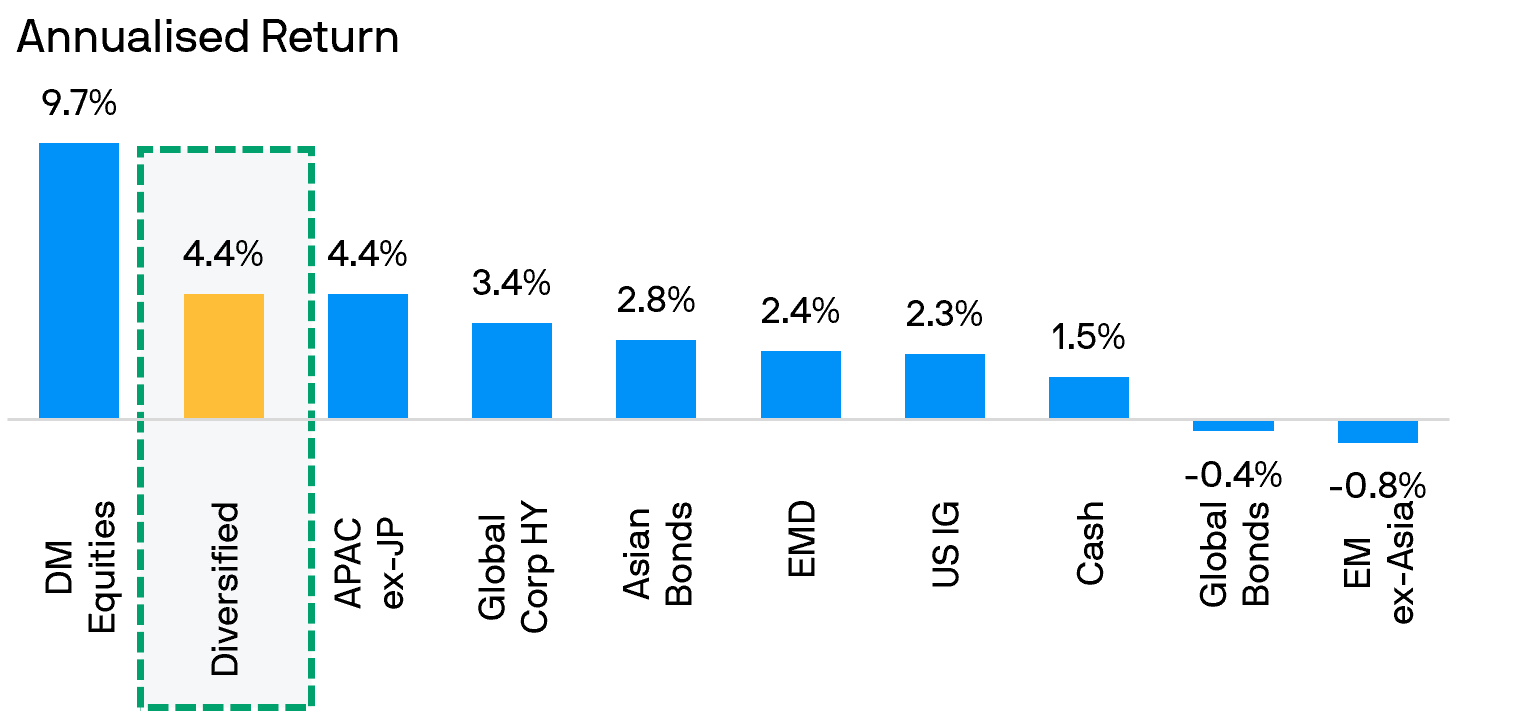

As an illustration of the macro trend, a well-diversified portfolio1 has recorded average returns of around 4.8% annually over the last decade, comparing favourably with other individual asset classes.

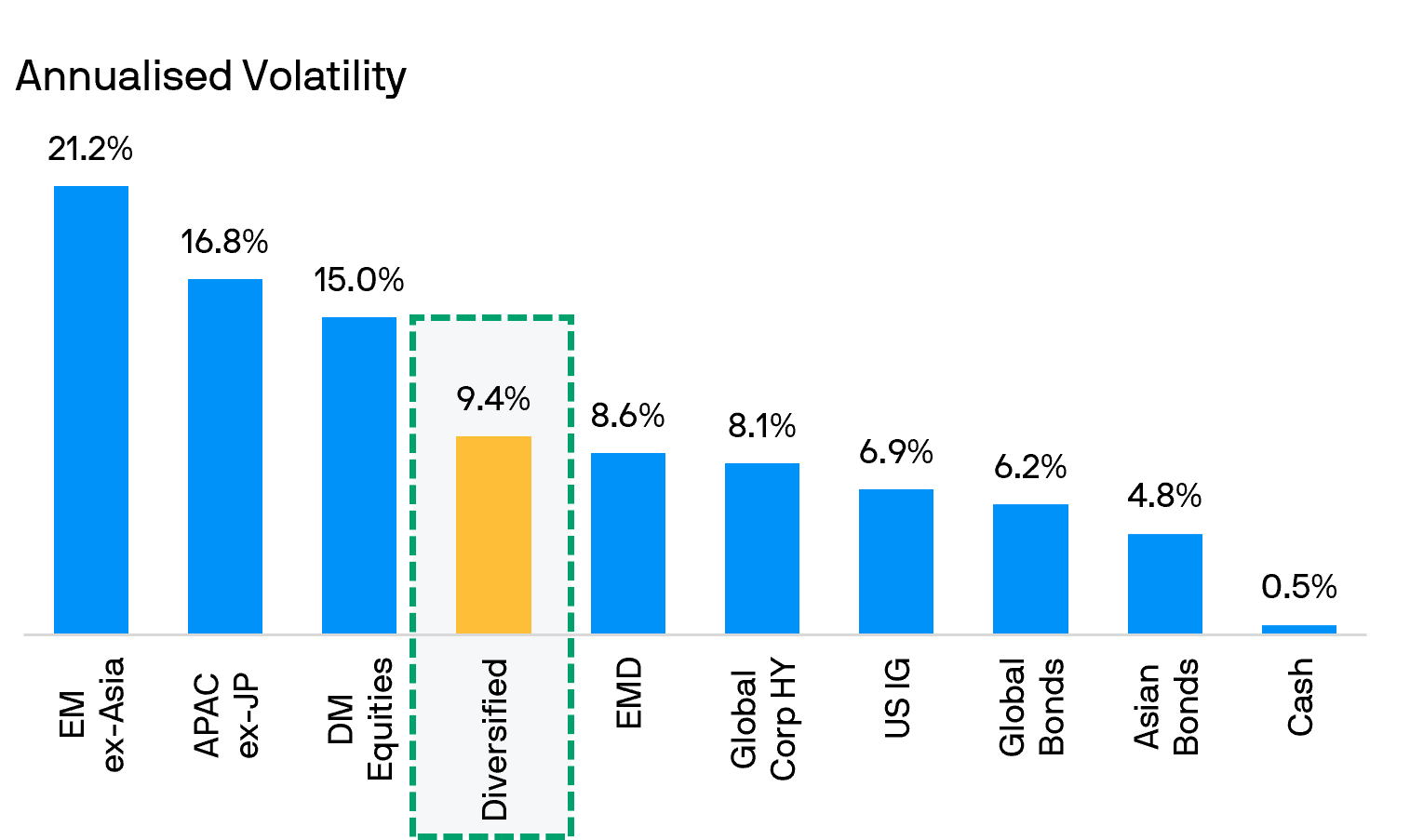

Such a portfolio also experienced just two-thirds of the volatility of developed market equities and less than half of the volatility of emerging market equities.

As such, diversification can help mitigate volatility and harness opportunities across various asset classes.

Annualised performance and annualised volatility (Apr 2015- Apr 2025)

Source: Bloomberg Finance L.P., Dow Jones, FactSet, J.P. Morgan Economic Research, MSCI, J.P. Morgan Asset Management. The “Diversified” portfolio assumes the following weights: 20% in the MSCI World Index (DM Equities), 20% in the MSCI AC Asia Pacific ex-Japan (APAC ex-JP), 5% in the MSCI EM ex-Asia (EM ex-Asia), 10% in the J.P. Morgan EMBIG Index (EMD), 10% in the Bloomberg Barclays Aggregate (Global Bonds), 10% in the Bloomberg Barclays Global Corporate High Yield Index (Global Corporate High Yield), 15% in J.P. Morgan Asia Credit Index (Asian Bonds), 5% in Bloomberg Barclays U.S. Aggregate Credit – Corporate Investment Grade Index (U.S. IG) and 5% in Bloomberg Barclays U.S. Treasury –Bills (1-3 months) (Cash). Diversified portfolio assumes annual rebalancing. All data represent total return in U.S. dollar terms for the stated period. 10-year total return data is used to calculate annualised returns (Ann. Ret.) and 10-year price return data is used to calculate annualised volatility (Ann. Vol.) and reflect data as of the latest month-end. Please see disclosure page at end for index definitions. Past performance is not a reliable indicator of current and future results. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Data reflect most recently available as of 01.05.2025.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

Positioning for resilience with income solutions

Alongside diversification, income in the form of coupons from bonds, dividends from stocks and options premiums can help create a cash flow buffer for portfolios.

Additionally, income investing can help capture opportunities that may tap the broader market upside. Cashflow from income-generating assets can be reinvested to help harness valuation opportunities that emerge in volatile and fast-moving markets.

Rigorous bottom-up security selection, diversification across and within asset classes, markets and sectors, and flexibility to adjust allocations are essential to building resilient income-focused portfolios.

Our active income solutions can help balance the search for opportunities with a focus on risk management amid elevated volatility.

This unconstrained, global fixed income fund seeks to deliver relatively attractive and consistent yield, with lower volatility than individual sectors.

^Past Performance is not indicative of current or future results. [Click here for the full performance data]

Make the most of a wide income opportunity set with a fund that can invest flexibly across 10+ asset classes, 3000+ securities and 80+ markets.

*Past performance is not indicative of current or future results. [Click here for the full performance data.]

**The declaration and payment of dividends is at the discretion of the manager and is subject to the dividend policy referred in the Offering Documents. Please refer to the Offering Documents for details on the Fund’s investment strategy including risk factors and the dividend policy. Dividends are not guaranteed.

Benchmarked against the S&P 500, Nasdaq-100 and MSCI World Index (Total Return Net), these equity premium income ETFs combine active equity portfolios with a disciplined options overlay to enhance income potential.

Insights to navigate volatility

Explore our flagship insights