Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

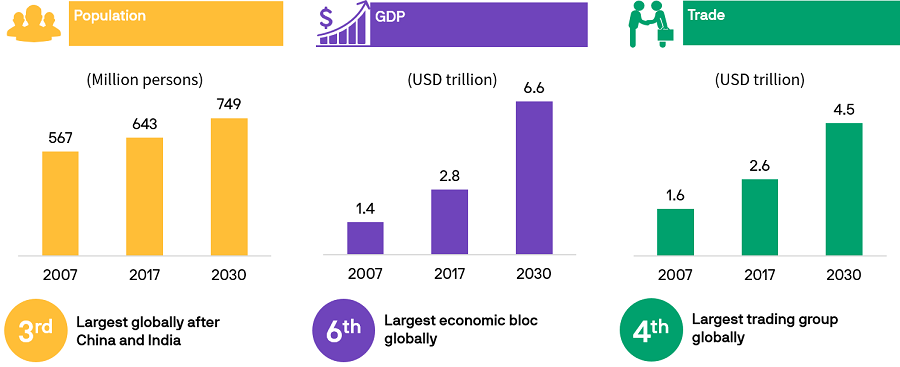

2. Source: UOB Economic-Treasury Research, Macrobond, Visual Capitalist. Data as of end-December 2020. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

4. Source: Ministry of Heath Singapore, data as of 01.08.2022.

5. Source: Ministry of Health Malaysia, data as of 07.08.2022.

6. Source: Ministry of Tourism and Sports(Thailand), Statista. Data as of May 2021.

7. Source: “e-Conomy SEA 2020”, Google, Bain & Company, Temasek, 10.11.2020.

8. Source: “ASEAN E-commerce: beyond the Pandemic”, Hong Kong Trade Development Council Research, 09.06.2021.

9. Source: “Indonesia On Track To Dominate The Supply Of Nickel To Make Batteries”, Forbes, 02.06.2021.

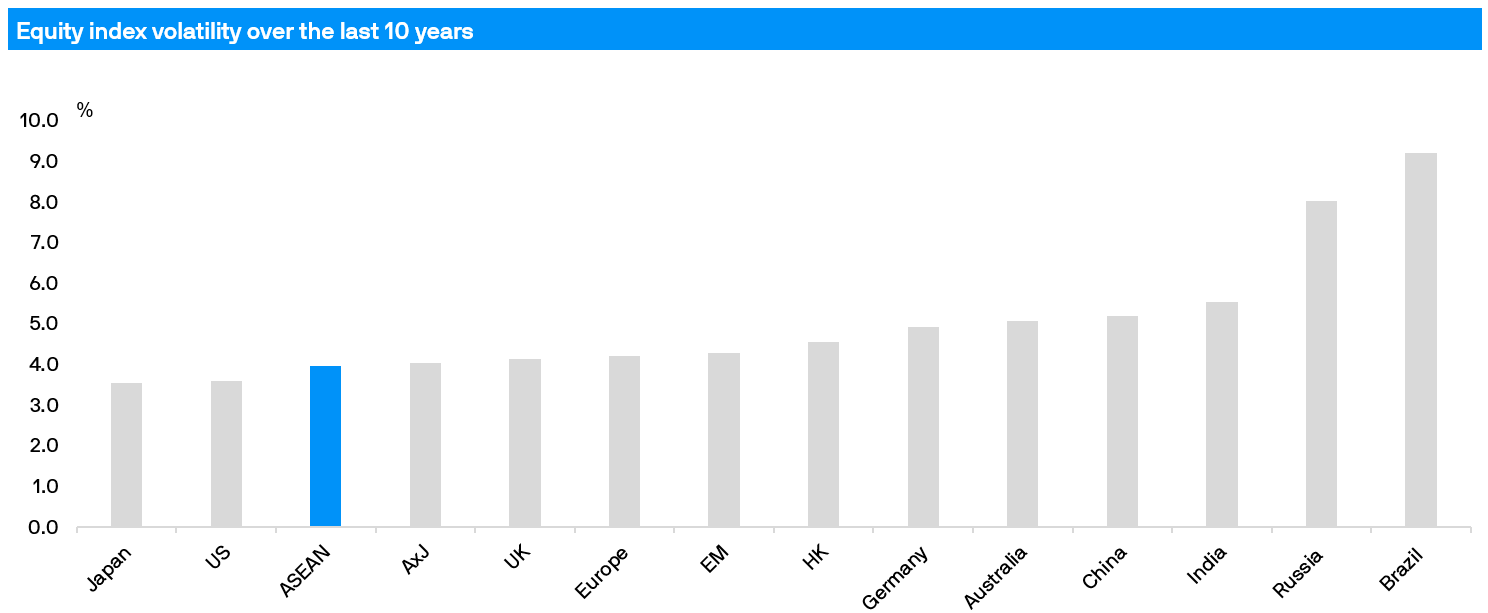

10. Source: J.P. Morgan Asset Management, data as of 30.06.2022.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investment product or service. Informational sources are considered reliable but you should conduct your own verification of information contained herein. Investment involves risk. Investments in funds are not deposits and are not considered as being comparable to deposits. Past performance is not indicative of future performance and investors may not get back the full or any part of the amount invested. Dividend distributions if any are not guaranteed and are made at the manager’s discretion. Fund’s net asset value may likely have high volatility due to its investment policies or portfolio management techniques. The value of the units in the scheme and the income accruing to the units, if any, may fall or rise. Funds which are invested in emerging markets, smaller companies and financial derivative instruments may also involve higher risks and are usually more sensitive to price movements. Any applicable currency hedging process may not give a precise hedge and there is no guarantee that any hedging will be successful. Investors in a currency hedged fund or share class may have exposure to currencies other than the currency of their fund or share class. Investors should make their own investigation or evaluation or seek independent advice prior to making any investment. Please refer to the Singapore Offering Documents (including the risk factors set out therein) and the relevant Product Highlights Sheet for details at https://am.jpmorgan.com/sg/en/asset-management/per/. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with https://am.jpmorgan.com/sg/en/asset-management/per/privacy-statement/. Issued by JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K). All rights reserved.