Transport Outlook

Green tech—a key driver for transport investments

14/01/2021

Andrian R. Dacy

The future of transportation will differ from its past in a crucial way: The sector will be led by larger, more stable players with access to a more selective capital base and a drive toward environmental sustainability.

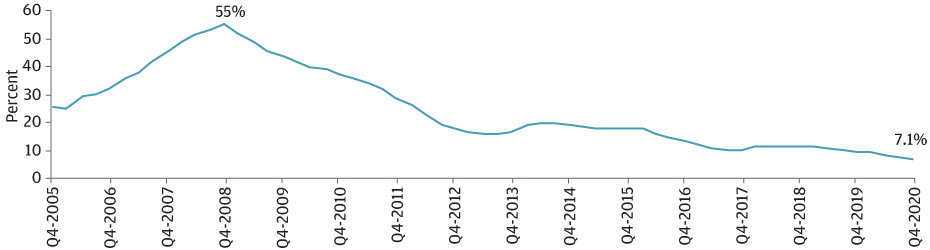

In the decade leading up to the global financial crisis (GFC), capital poured into the transportation sector. Amid ample and low cost liquidity, orders for new assets piled up. These excesses occurred in aviation, rail and shipping. For example, shipping’s global order book had swelled to historical highs by 2008 (EXHIBIT 1). When the GFC hit, lenders pursued a “flight to quality,” and the industry entered a period of overcapacity and reduced earnings. Capacity growth was more measured in aviation, given the natural limitations of just two major global aircraft manufacturers. However, the shocks of the GFC and, more recently, COVID-19 have led to a constrained aviation demand environment and the departure of many opportunistic investors.

The last 10 years have also seen the impact of post-GFC regulatory changes, particularly on traditional lenders’ leasing activity. In the wake of post-GFC regulations as well as market pressures, banks retreated from leasing and focused on lending to an increasingly small group of strong borrowers. The result: “smoother” ordering cycles (particularly in shipping), an improved supply-demand balance and a more stable transportation sector led by increasingly large players. And as COVID-19 recedes in 2021, we expect to see that the cohort of well-capitalized airlines will have taken market share from their weaker brethren.

EXHIBIT 1: SUPPLY-DEMAND BALANCE HAS IMPROVED IN THE PAST DECADE

Global order book as a percentage (%) of fleet

Source: Clarksons Research, data as of December, 2020

Critical need for capital

Financial strength has always been important in this capital-intensive sector. Access to capital is critical for participation, particularly in the long-duration leasing segment, where assets can cost up to USD 200 million each. An estimated USD 3.5 trillion in capital is needed to fund aviation and shipping over the next decade. Depreciation and the finite useful lives of transportation assets create the need for ongoing replacement and associated financing (assets typically depreciate at 3%–4% per annum). But capital strength is even more critical now, given the pressing need for investment in environmentally sustainable technology. Indeed, all industry stakeholders (owners, end users, regulators, investors and financiers) are increasingly focused on sustainability.

Companies with ample access to capital will be better positioned to make the necessary investment in clean technology solutions. That technology is expensive, reinforcing the need for additional capital to replace aging assets. Moreover, the link between capital strength and environmental sustainability will be self-reinforcing as financing and leasing opportunities in the industry become linked to environmental, social and governance (ESG) performance. Just as banks prefer to lend to well-capitalized owners with strong sustainability records, end users (global conglomerates, utilities, energy companies, etc.) seeking to lease transportation assets for long periods prefer to work with large, stable lessors with robust ESG credentials.

To make the sector more sustainable, various technology solutions are under development. One overarching goal: to improve engine technology and reduce emissions. Progress is underway through the development of carbon-reducing propulsion methods such as liquefied natural gas (LNG), hydrogen and various low emission synthetic fuels.

We note one recent success in the ESG transportation sphere: the global adoption of ballast water treatment systems within the shipping industry. These systems “clean” the stabilizing ballast water in commercial vessels by neutralizing biological organisms in a vessel’s ballast tanks. In this way, they prevent the spread of organisms that can become invasive species—an increasingly important environmental consideration.

Zero carbon emissions in shipping?

The sector is focused on meeting new rules from the industry’s global regulator, the International Maritime Organization (IMO). One of the most important new regulations, which took effect in January 2020, requires all ships to use very low sulphur fuel rather than marine “bunkers”; in one fell swoop, this materially reduced nitrogen oxide and sulphur oxide emissions. The IMO’s long-term goal is to reduce overall shipping emissions by 50% (compared with 2008 levels) by 2050.

To become more sustainable, the industry is taking interim steps by adopting transitional fuels such as LNG, which may ultimately serve as the bridge to zero emissions solutions like hydrogen or ammonia.

Search for scalable and sustainable technology solutions

How realistic are the new technologies in the transportation sector? That remains to be seen. Engines powered by hydrogen or ammonia could be an option for ships but will require a global fueling infrastructure. As we’ve discussed, it will be the larger, better-capitalized companies that will be able to fund these improvements, likely accelerating industry consolidation. Similar issues challenge long-haul aviation, where synthetic fuels or biofuels are the most likely alternatives.

Renewable power generation presents both a challenge and an opportunity. While wind farm generation can be unpredictable, small-scale hydrogen or synfuel plants can be positioned along transmission lines to use off-peak power (when it would otherwise not be utilized). Similar solutions are under development for excess solar power transmission. With battery storage improvements, energy storage options will expand, providing further flexibility to future carbon-free power generation for transportation.

Optimistic outlook: A coordinated push for carbon reduction

What technologies will be relevant in the future? Who will be able to afford to make the necessary investments for the industry to become more sustainable? Those are the central questions the industry faces. Certainly, it helps that banks are prioritizing the financing of ESG-oriented initiatives, backed by large, well-capitalized industry participants. Indeed, a virtuous circle is starting to emerge in which banks, bigger asset owners and high quality end users are all focused on cooperating to reduce carbon reduction and promote sustainability.

What are the risks to our generally hopeful outlook? The reemergence of undisciplined capital, recalling the early 2000s, could reintroduce overordering and potentially set back sustainability initiatives. A low oil price could lead to delays or variations in regional adoption of carbon-neutral strategies. However, emerging markets have notably demonstrated a recent commitment to sustainability. This bodes well for the long term. On balance, we believe investors can find good opportunities in a transportation sector increasingly adopting sustainability goals and providing attractive, predictable, long-term returns.