Infrastructure Outlook

How core is your core infrastructure?

14/01/2021

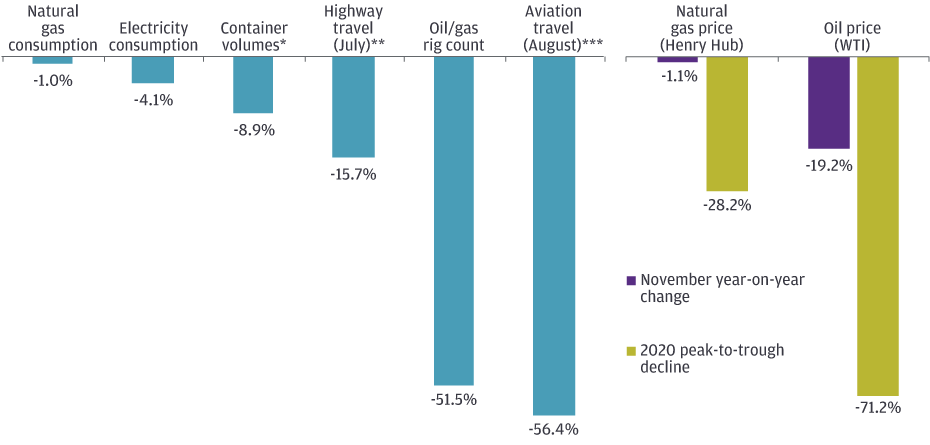

Nicholas Moller

Before anyone had heard of COVID-19, many institutional investors shrugged off the distinction between lower risk (core) and higher risk private infrastructure assets. Capital flowed into assets traditionally seen as higher risk due to their volumetric and/or commodity exposures (airports, ports, toll roads, energy, etc.). Some even described such assets as having a core risk profile. Many investors expected higher returns without an undue level of risk compared with relatively “expensive” traditional core infrastructure assets (regulated and long-term contracted assets for essentials like water, heat and electricity); 2020 put this thesis to the test. When pandemic lockdowns hit, many (but not all) higher risk infrastructure assets struggled on a relative basis, highlighting the very different risk profiles of the asset types (EXHIBIT 1).

The effects of COVID-19 have varied by asset type and level of price exposure

EXHIBIT 1: INFRASTRUCTURE USAGE AND PRICING, 2019 vs. 2020

Bureau of Transportation Statistics, EIA, Port of Los Angeles, St. Louis Fed; data as of November 30, 2020 unless otherwise noted. ** Represents July year-to-date data. *** Represents August year-to-date data.

The experience of 2020 has reaffirmed the role of private core infrastructure equity as a lower-risk, more forecastable source of diversification, inflation protection and yield in multi-asset portfolios. It also has pointed the way to opportunities to be found in 2021. In particular, the past year has underscored the benefits of an integrated ESG (environmental, social and governance) approach, with a focus on governance and stakeholder engagement, in core infrastructure investments.

The power of control and stakeholder engagement

On the governance front, we saw clearly that owning a controlling stake in a business often provides the tools required to manage a crisis. A majority owner can make needed changes—and move with the requisite speed. In the “batten down the hatches” second quarter of 2020, control positions allowed investors to work hand in hand with their companies and management to quickly resolve any issues they were facing. This proved key to mitigating risk during a very tumultuous period.

The COVID-19 crisis also emphasized the importance of proactive stakeholder engagement. For example, in the early weeks of the pandemic shutdowns, regulated utilities agreed not to disconnect any customers for nonpayment. That was both the right thing to do and exactly what regulators were looking for. Proactive engagement with key customers and communities on the challenges they were facing was also critical for contracted businesses.

An accelerated energy transition

Turning to the “E” in ESG, the COVID-19 crisis certainly accelerated focus on the transition to a low carbon economy. That will in turn impact infrastructure investment in the coming years. Many governments (and prospective governments) pledged commitments to a “green recovery,” promising environmentally friendly stimulus to mitigate the effects of the coronavirus recession.

Only time will tell what deal might be struck between the incoming Biden administration and Congress with respect to long-discussed infrastructure legislation. Whatever happens in Washington, the build-out of solar and wind energy capacity will continue to accelerate. Utilities will further shift from more traditional fossil fuels to renewables, as they have been doing for the last few decades since the energy transition began, often complemented by less carbon intensive and non-intermittent natural gas generation. Facilitating this transition and its acceleration will continue to provide investment opportunities. We also anticipate that there will be necessary complementary investments in electricity transmission and utility electric grids.

Opportunities and risks in 2021

How might the infrastructure investing environment change over the coming year, and what are the risks to our outlook? By their nature, investments in private core infrastructure are expected to be relatively cycle-agnostic, given they represent essential services. If we do see a post-COVID-19 surge in economic growth and a material recovery in risk assets, private core infrastructure will likely benefit relatively less than other assets. However, this would be entirely consistent with the diversification objectives of the asset class and the lower relative drawdown that was seen during the coronavirus crisis. Remember too that infrastructure is an inflation-sensitive asset class with opportunity for upside participation given the pass-through structure of many contracts. To the extent an economic recovery creates more normalized levels of inflation, it would be a positive for asset class returns.

We do expect that very accommodative monetary policy will keep bond yields extremely low for at least the near to medium term. As investors have a tough time finding income, we expect the relatively attractive yield of infrastructure will stand out. Indeed, more and more yield-centric investors are allocating to private infrastructure. Even if bond yields were to rise, the higher yields available in infrastructure should provide some cushion, especially if rising rates are coupled with rising inflation.

Non-U.S. investors (especially those in Australia, Canada, Europe, Japan and the UK) were early adopters of core private infrastructure investment, given that they have had fewer fixed income options, and they continue to invest. In part as a result of the effects of COVID-19 on higher risk infrastructure investments, and in part due to depressed rates, we have recently seen increased flows from U.S. investors into core infrastructure. Like real estate 20 or 30 years ago, private core infrastructure is fast becoming a standard part of institutional asset allocation.