Week in review

- U.S. Federal Reserve kept policy rates at 3.50%-3.75%

- China industrial profits rose 0.6% y/y YTD in December

- Australia trimmed mean inflation rose 3.3% y/y in December

Week ahead

- U.S. JOLTs and labour market report

- European Central Bank interest rate decision

- Reserve Bank of Australia interest rate decision

Thought of the week

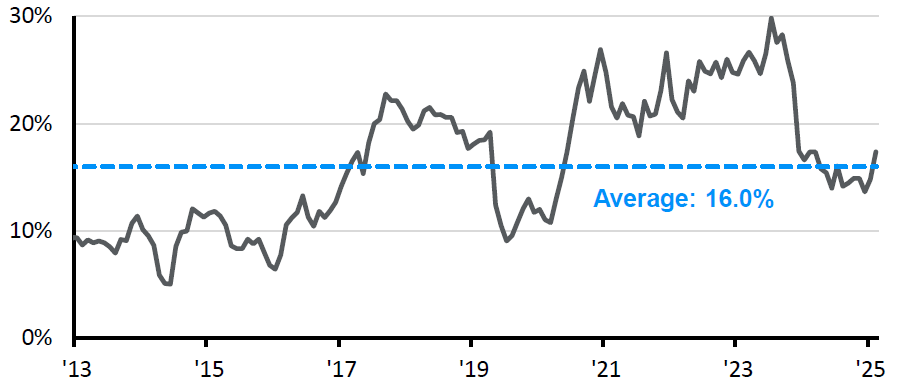

Following three cuts last year, the Federal Reserve opted to hold the policy rate steady at last week’s meeting while striking a hawkish tone, signaling an extended near-term pause, with markets now implying the next cut will not materialize until 2H26. In a slower easing environment, equity leadership should rotate toward quality—firms with robust balance sheets, durable margins, sustainable earnings, and low leverage. Recent underperformance, amid crowded positioning in mega cap AI exposures and speculative growth, has compressed quality’s valuation premium below its long run average by year end. A prolonged pause should diminish the backdrop for broad risk taking, with markets poised to re price fundamentals over the coming quarters as liquidity conditions tighten relative to expectations and earnings dispersion widens across sectors globally. Added geopolitical uncertainty and elevated volatility should further benefit quality’s defensive traits. By the end of January 2026, quality has already outperformed the broader equity market, suggesting this rotation is underway.

Valuation premium on MSCI World Quality over MSCI World

Forward price-to-earnings ratio

Source: MSCI, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 30/1/26.

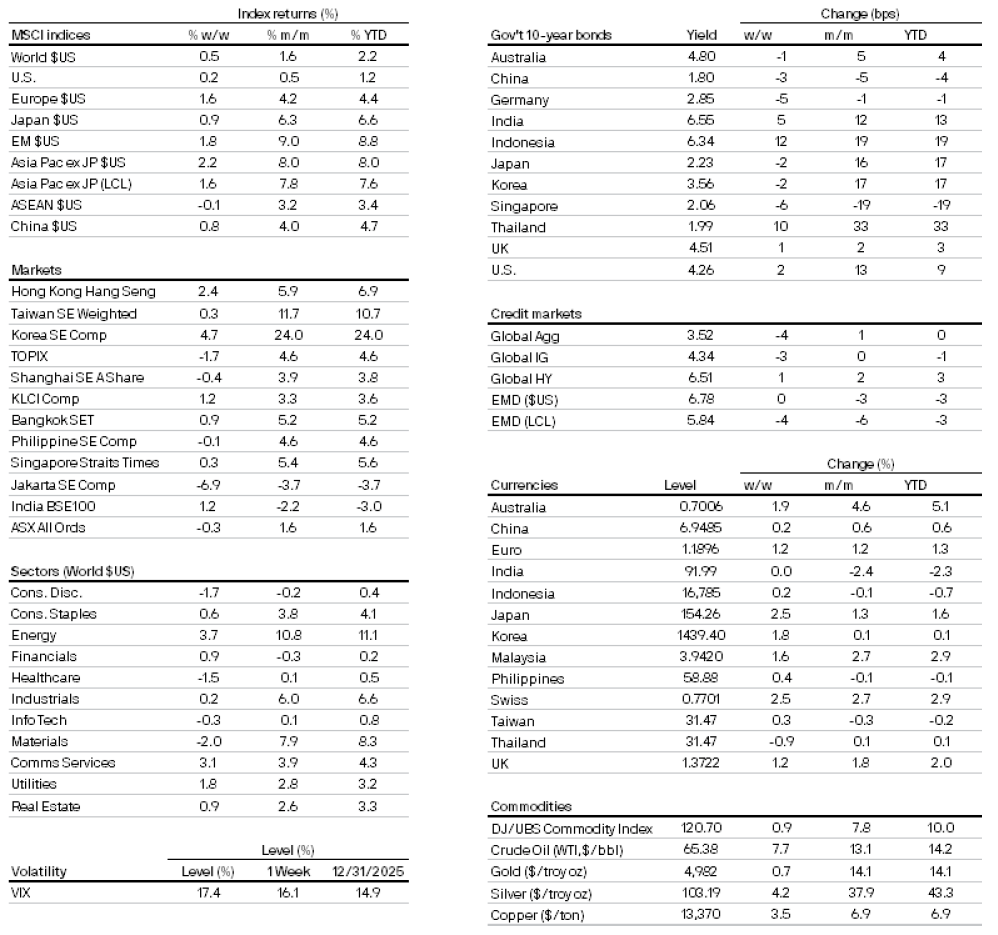

Market data

300a4900-f9d9-11e8-839f-fe2ee17e7f12

All returns in local currency unless stated otherwise.

Currencies’ return are based on foreign currencies per U.S. dollar. An appreciation of the foreign currency against the U.S. dollar would be positive and a depreciation of the foreign currency against the U.S. dollar would be negative.