Source globally. Seek quality.

Rapid technological advancements, shifting geopolitical dynamics, and significant policy changes are reshaping the global landscape, creating new risks and opportunities.

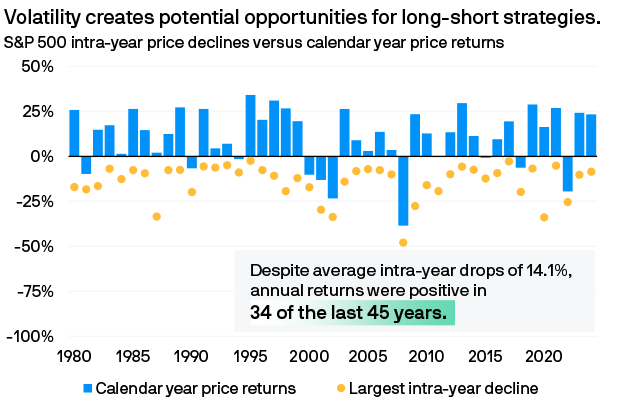

While market swings may be unsettling, they are an inherent part of this realignment. Nevertheless, opportunities may still abound.

To navigate these changes, investors will need to diversify market exposure and seek quality companies with robust fundamentals.

These assets can potentially serve as a buffer during challenging market conditions, while also presenting opportunities for sustainable and attractive long-term returns.

Active stock selection for active markets

The combination of broadening markets and valuation dispersion creates a favourable environment for active stock selection, both in developed markets such as the US and Europe, as well as in emerging economies like ASEAN.

Time-tested active equity funds can help investors tap into these opportunities while navigating the risks.

While normalised interest rates, geopolitical risks, and policy uncertainty may lead to periodic bouts of market volatility, they could also present opportunities for active stock selection. These challenges may create disparities across sectors and companies, where low-quality corporates with weaker balance sheets could face significant difficulties.

This environment highlights the importance of distinguishing potential long-term outperformers from underperformers and uncovering quality opportunities that can endure challenging market conditions.

It also underscores the value of long-short strategies that seek to capitalise on market volatility.

Seize opportunities in the US market with our long-short equity fund. Download the factsheet to learn more.

While US mega-cap tech giants often dominate headlines, numerous lesser-known companies in Taiwan, South Korea, and Europe may also play crucial roles in the artificial intelligence (AI) value chain, from compute providers and semiconductor design to data centres and power generation.

High-quality opportunities also abound outside the US in sectors like luxury and pharmaceuticals, presenting attractive growth opportunities at potentially fairer valuations.

Ultimately, no single market can capture all structural themes. A global strategy may help investors tap into high-quality opportunities, diversify return streams, and reduce reliance on a few companies for long-term performance.

Search the globe for quality companies through our global equity fund. Download the factsheet to find out more.

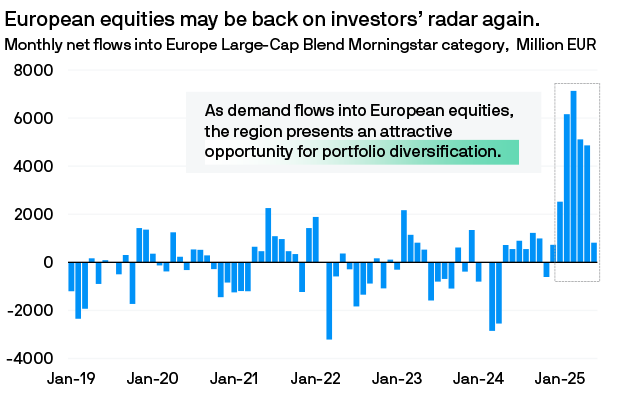

Buoyed by a constructive mix of monetary, fiscal and regulatory easing, European equities may be back on investors’ radar. European governments, especially Germany, are looking to step up fiscal spending on infrastructure and national defense, providing a boost to heavy industries. Meanwhile, rate cuts by the European Central Bank amid softening inflation has been an added tailwind.

The US-EU trade deal may have reduced some uncertainty regarding tariffs, but the implications on sector earnings remain wide and varied. For example, revenues for sectors like financials and utilities could be far less exposed to tariffs compared to health care and materials1.

This highlights the importance of active stock selection to capitalise on quality opportunities that may thrive in a broadly favourable environment for European equities.

Tap into opportunities in a new era for European stocks through our equity fund. Download the factsheet to find out more.

ASEAN, a 10-country economic bloc, is a fast growing region with favourable demographics, improving financial penetration and rising foreign direct investments.

Key secular themes powering the region include a rising middle class, evolving consumer behaviour, supply chain diversification and increasing demand for data centres.

Nevertheless, the region encompasses diverse markets in various stages of economic and financial development. ASEAN equity markets may also exhibit pricing anomalies which highlights the importance of on-the-ground presence and active stock selection to uncover quality opportunities.

Ride this long-term growth story with our ASEAN equity fund. Download the factsheet to find out more.

This information is provided for illustrative purposes only to demonstrate general market trends. Information shown is based upon market conditions at the time of the analysis and is subject to change. Not to be construed as investment recommendation.

Our actively managed equity funds

Underpinned by a rigorous, time-tested, bottom-up stock selection process, our actively managed equity funds have a history of seeking out quality companies that can navigate different market cycles and generate robust long-term performance.

Investment ideas on equities

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

JPMorgan ASEAN Equity Fund is the marketing name of the JPMorgan Funds - ASEAN Equity Fund.

JPMorgan Europe Dynamic Fund is the marketing name of the JPMorgan Funds - Europe Dynamic Fund.

JPMorgan Global Select Equity Fund is the marketing name of the JPMorgan Investment Funds – Global Select Equity Fund.

JPMorgan US Select Equity Plus Fund is the marketing name of the JPMorgan Funds – US Select Equity Plus Fund.

- Source: FactSet, MSCI, J.P. Morgan Asset Management. Data as of 16.07.2025. “European equities: Is it too late to catch the rally?” Published 22.07.2025.

- Please refer to the fund’s offering documents for further details on its objectives. The manager seeks to achieve its stated objectives and there is no guarantee they will be met. Actual account allocations and characteristics may differ. Holdings, duration, allocations or exposure in actively portfolio managed portfolios are subject to change from time to time. Investments involve risks. Not all investments, strategies or ideas are suitable for all investors. Investors should make their own evaluation or seek independent advice and review offering documents carefully prior to making any investment.

- Asian Private Banker Asset Management Awards for Excellence are issued by Asian Private Banker in the year specified, reflecting product performance, business performance, service competency, branding and marketing as at the previous calendar year end.

By using this information, you confirm that you are a Singapore resident and you accept the Terms of Use as set out in https://www.jpmorgan.com/sg/am/per/.

This website is meant for informational purposes only and is intended solely for the person to whom it is delivered. Except as indicated on this website or otherwise with express consent from JPMorgan Asset Management (Singapore) Limited, it may not be reproduced or distributed, in whole or in part, to any third parties and in any jurisdiction.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It does not constitute investment advice and it should not be treated as an offer to sell or a solicitation of an offer to buy any fund, security, investment product or service. The information contained herein does not constitute J.P. Morgan research and should not be treated as such.

Investments involve risks. Investments in funds are not deposits and are not considered comparable to deposits. Past performance is not a guarantee or necessarily indicative of future results and investors may not get back the full or any part of the amount invested. Dividend distributions if any are not guaranteed and are made at the manager’s discretion. Fund’s net asset value may likely have high volatility due to its investment policies or portfolio management techniques. Funds which are invested in emerging markets, smaller companies and financial derivative instruments may also involve higher risks and are usually more sensitive to price movements. Any applicable currency hedging process may not give a precise hedge and there is no guarantee that any hedging will be successful. Investors in a currency hedged fund or share class may have exposure to currencies other than the currency of their fund or share class.

Not all investment ideas referenced are suitable for all investors. Investors should make their own evaluation or seek independent advice prior to making any investment. Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions and are subject to change without notice. The information provided herein should not be assumed to be accurate or complete and you should conduct your own verification. References to specific securities, asset classes and financial markets and any forecast contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. J.P. Morgan accepts no legal responsibility or liability for any matter or opinion expressed in this material.

The funds mentioned in this document have been approved as recognised schemes under the Securities and Futures Act, Chapter 289 of Singapore. Any offer or sale, or invitation for subscription or purchase of the Funds must be accompanied with the relevant valid Singapore Offering Documents (which incorporates and is not valid without the relevant Luxembourg prospectus). Please refer to the Singapore Offering Documents (including the risk factors set out therein) and the relevant Product Highlights Sheet for details before any investment at https://www.jpmorgan.com/sg/am/per/

The funds seek to achieve the investment objectives stated in the offering documents, there can be no guarantee the objective will be met. Investments in the Fund are not deposits and are not considered as being comparable to deposits. Fund’s net asset value may likely have high volatility due to its investment policies, exposure to emerging markets, financial derivatives instruments or portfolio management techniques. The value of the units in the scheme and the income accruing to the units, if any, may fall or rise. Past performance is not indicative of current or future results and investors may not get back the full or any part of the amount invested.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy.

This material is issued by JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K). All rights reserved.