Reemergence of EM equities: the dawn of the EM consumer

06/11/2019

Heather Beamer

Jennie Li

In Brief

- Looking forward, the emerging market (EM) economic growth differential over developed markets will persist. This should continue to propel the emergence of the EM middle class, providing long-term investors with opportunities in EM equities. This includes not only consumer sectors but also financials and technology.

- EM equity performance can swing wildly in the short term as a result of big shifts in investor sentiment, which has an impact on multiples and currencies. However, in the long term, these sentiment waves are washed away and fundamentals determine the destination.

- Although the U.S. equity market has been the primary driver of strong investment returns over the last decade, we believe EM equities could be the next big driver going forward. Advisors are underweight emerging markets within their portfolios and may need to consider a larger allocation to take advantage of the demographic and economic trends.

Long-term drivers: keeping an eye on the horizon

One of the most important drivers of emerging markets is the growth differential between emerging and developed economies. Emerging markets should continue to provide a substantial economic growth alpha relative to developed markets due to better demographics and a productivity catch-up. We estimate that EM economic growth should provide close to an annual 250bps bump over those in developed markets over the next 10 to 15 years.1 This premium in economic growth should feed through to EM corporate revenue growth as well, translating into higher returns for investors over the next decade.

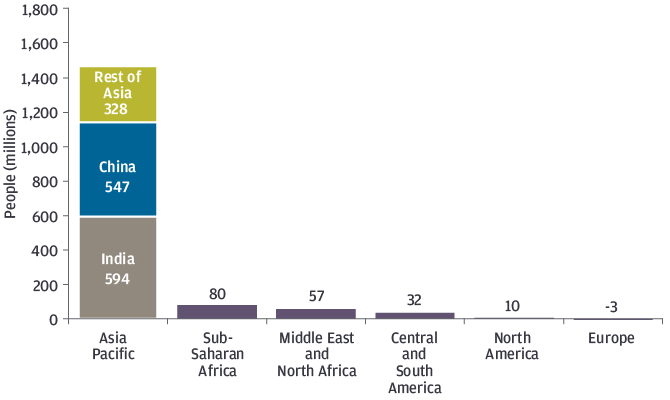

Looking forward, this pace of EM economic growth will continue to increase the GDP per capita in many EM countries, which will result in many people entering the global middle class. Consumers have and will continue to emerge in emerging markets. Projections show that, while developed markets have mostly tapped their potential growth of the middle class, emerging markets still have a lot of room to run over the next 10 years (EXHIBIT 1).

Almost all the future growth in the global middle class will come from emerging markets

EXHIBIT 1: Regional contribution to the middle class: 2020 to 2030

Millions of people

Source: Brookings Institution, J.P. Morgan Asset Management; data as of October 15, 2019. Estimates for regional contribution are from Kharas, Homi. The Unprecedented Expansion of the Global Middle Class, An Update. Brookings Institution, 2017.

1Expected economic growth based on J.P. Morgan’s 2020 Long-term Capital Market Assumptions (LTCMA).

0903c02a8273decd