Multiple reasons for multi-family

28/01/2021

Neil Dey

The COVID-19 pandemic has impacted every segment of the commercial real-estate (CRE) market, however some sectors have fared better than others. Two of the sectors in CRE that have remained resilient are multi-family and industrial property types. These properties have performed better than “brick and mortar” retail and hotels, which continue to be acutely vulnerable to the economic fallout from the pandemic. Traditional private-label, also known as non-agency CMBS, transactions tend to pool multi-family loans with other COVID-impacted property types, such as retail and hospitality, while the agency CMBS market offers more of a pure-play exposure to multi-family properties. We believe the agency CMBS market offers an attractive way to access a large portion of the CRE market and in particular a property sector with fundamental characteristics that enables it to generate steady performance for years to come.

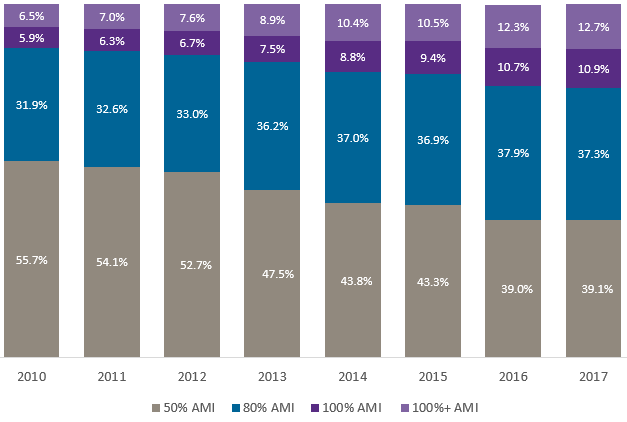

The growth of the multi-family property market has been significant, thanks to the positive demographic trends experienced in the rental market. Over the last two decades, the massive millennial generation has continued to enter the workforce while a surge of low-and middle income households have entered the rental market1, due to affordability challenges and credit accessibility issues around homeownership. At the same time, the economics of high construction costs mean most new rental units coming online are not affordable for low and middle income families. The chart below shows that nationally since 2010 the percentage of multi-family units affordable to very low income households (the grey bars represent households making 50% or less of the area median income) have steadily been on the decline. According to Freddie Mac, this trend has translated into the loss of millions of rental units from 2010 - 2017 that were once affordable to very low income households.

National Metro-Level Multi-family Housing Supply By Affordability

Source: Freddie Mac, data as of September 30, 2020

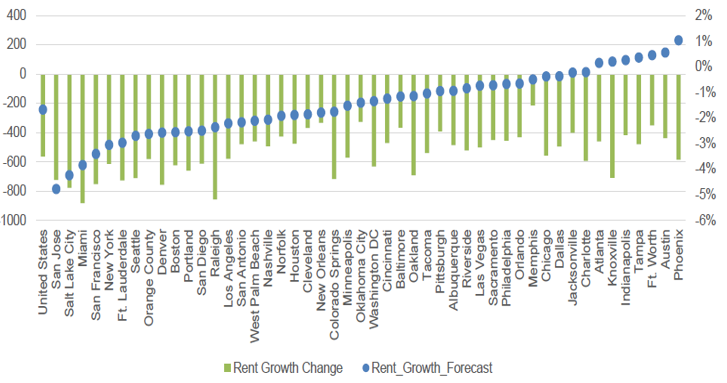

The affordability issue is especially severe in high-cost areas such as Los Angeles, New York City, and San Jose, where the median lower-income household cannot realistically afford even the median low-end rental, as bottom-tier rents in those markets would require 121.2%, 102.9%, and 99.8% of their income, respectively2. As a result of rising living costs population migration over the last decade has gravitated towards the “Sunbelt” metro areas. That is why during this recession, rents in more affordable parts of the U.S. are expected to fare much better than those in higher priced coastal markets.

Annual Rent Growth 2020 Forecast

Source: REIS, data as of September 30, 2020

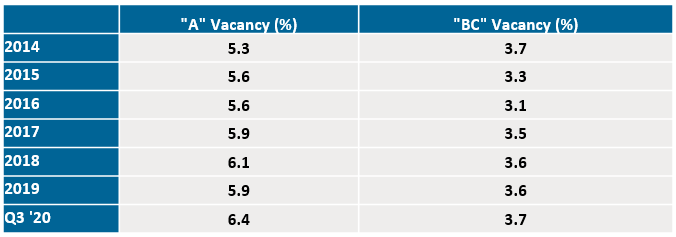

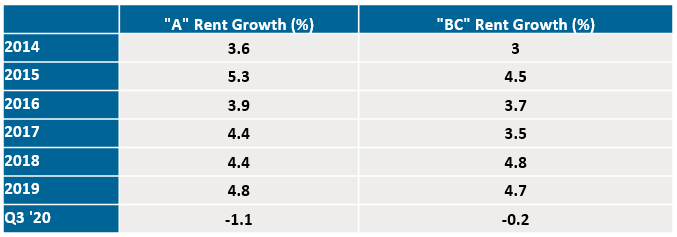

Along this same trend, rents for class-A apartments, which tend to cater to higher earning households and are more prevalent in coastal cities, have experienced steeper declines compared with the lower price points found in class-B and class-C rental units, where demand has remained sticky.

Table 1: Vacancy Increased More for “A” Than “BC” Apartments...

Table 2: …and Rents Declined Nationally But a Bit More For “A”

In keeping with their mandate to maintain and expand affordable rental housing across the U.S. the government-sponsored enterprises (GSEs) provide mortgage loans to owners of multi-family properties and have requirements that a significant percentage of the assets being lent on are accommodative to low income households. As such, a sizeable portion of the GSE loans that go into their securitization programs are secured by properties which have some or all of the units deemed affordable for the relevant communities (measured by the ratio of rent to area’s median income). In fact, a hallmark of Freddie Mac’s multi-family securitization programs is the considerable weight given to the financing of sizeable class-B or class-C buildings, which are older but more affordable than newer construction class-A units with more modern building materials, appliances and amenities. Historically during times of economic stress the comparatively affordable portions of the multi-family sector have performed better than the more costly class-A buildings. While CMBS investors rely on cash flow growth at the property level from rising rents during times of economic prosperity, the more affordable class-B and class-C composition of agency CMBS deals may act as a natural hedge to rising defaults in other parts of the commercial real estate sector during periods of economic stress. The GSE portfolio of multi-family loans has been exemplary in terms of stability as their loss percentage has not gone above 0.50% for any of their origination years going back to 1994.

One area of concern to the sector is to the extent to which lawmakers are using legal means in areas such as New York, California and Oregon, to reign in multi-family rent growth. Furthermore, following Covid-19, the federal government along with many individual states have enacted residential (and commercial) eviction suspensions. While this may potentially help tenants, it can put stress on landlords who remain responsible for paying their respective mortgages resulting in increased loan defaults. To the extent this situation continues, or that the next stimulus plan doesn't offer them sufficient relief, it may cause pressure for undercapitalized property owners. Indeed, with an extended period of high unemployment and possibility of a double dip recession the multi-family sector will not be immune from dips to property valuations. For certain borrowers who own class-A assets in the most expensive markets which may experience longer periods of higher vacancy rates and declining rents along with greater tenant protection laws, the impact to cash-flows could result in potential property sales.

While there are many reasons for investors to add exposure to the multi-family sector, investors should also consider that these risks could be mitigated by the fact that lending institutions have been given additional leeway in how they account for troubled assets and have greater ability to work with troubled borrowers (i.e. loan payment modifications) rather than foreclose on the assets.

The value of investments in mortgage-related and asset backed securities will be influenced by the factors affecting the commercial real estate market and the assets underlying such securities. The securities may decline in value, face valuation difficulties, become more volatile and/or become illiquid. They are also subject to prepayment risk, which occurs when mortgage holders refinance or otherwise repay their loans sooner than expected, creating an early return of principal to holders of the loans.

Mortgage-related and asset-backed securities are subject to certain other risks. The value of these securities will be influenced by the factors affecting the housing market and the assets underlying such securities. As a result, during periods of declining asset value, difficult or frozen credit markets, swings in interest rates, or deteriorating economic conditions, mortgage-related and asset-backed securities may decline in value, face valuation difficulties, become more volatile and/or become illiquid. Additionally, during such periods and also under normal conditions, these securities are also subject to prepayment and call risk. When mortgages and other obligations are prepaid and when securities are called, the strategy may have to reinvest in securities with a lower yield or fail to recover additional amounts (i.e., premiums) paid for securities with higher interest rates, resulting in an unexpected capital loss. Some of these securities may receive little or no collateral protection from the underlying assets and are thus subject to the risk of default described under “Credit Risk”. The risk of such defaults is generally higher in the case of mortgage-backed investments that include so-called “sub-prime” mortgages. The structure of some of these securities may be complex and there may be less available information than other types of debt securities.

[1] 6 million net new low-and middle-income households entered the rental market between 2000 and 2016 (Source: Freddie Mac, as of September 30, 2020)

[2] Morgan Stanley Research, as of September 30, 2020