Add extra guacamole for a dollar!

16/10/2020

Giles Bedford

Kush Purohit

Choosing to become an emerging markets (EM) local currency manager is something of an esoteric professional choice. It is an intellectually taxing task, and not commonly glamourous - even for the gifted. Unlike our more swashbuckling hard currency options, EM local can go years without being much in favour, so it probably isn’t a good choice if you like being the centre of attention. The reason for this is simple: Local curves might often be steep, but the US dollar is also mostly dominant. Currencies, such as Zloty, Lira and Rand just don’t commonly appeal as better choices for most investors versus a reserve currency. Skilled local currency managers make huge returns in local markets, only to see the mighty US Dollar pedestrianize their gains. It is probably fair to say that if Sisyphus was a bond investor, he’d be an EM local currency manager.

Therefore it is probably newsworthy that our local currency team is currently nowhere near miserable, and is in danger of getting excited about their space.

This unfamiliar sensation has been percolating for a while. At the baseline, EM Local Currency assets have always offered the compound appeal of the pure beta of local currency exposure and the opportunity to play domestic treasury curves. That combination looks reasonably appealing right about now – after all, the steeper local curves in emerging markets look like a kind of tropical mountain paradise compared to the rolling prairie that is European investment grade.

That appeal appeared to play out during our most recent Investment Quarterly meeting in September, as the committee spent some time debating the case for a softening US dollar with core yields low and the policy pumps on. Right on cue, emerging market local currency debt emerged as a favoured idea at the end of the session several hours later. This combination of events is not a coincidence: investors like to look to EM local currency assets as an alternative when the US dollar is expected to weaken. They are usually right: as a softening dollar generally brings a small pickup in return.

But to drive a sustained rally in the space, we need a broader confluence of factors, and this is why our EM local team is beginning to smile. The most optimal scenario sees emerging market growth accelerating at a time when developed market growth is relatively slow – and the US Dollar subsequently less ascendant. To really run, we need a few other things in place: it helps if the EM macro story is on an improving trajectory, local policymakers are doing mostly predictable things, and global appetite for commodities and manufactured goods is improving. When such a confluence happens, EM local currency can really move – and it seems we are getting closer to exactly this potential scenario. Spice that mix with the appeal of higher real yields to attract flows and the appeal is clear.

“Buy the emerging markets local currency carry story!” is such a common refrain in our space that it is almost an anthem. And while it is true that EM commonly offers an elevated carry, it really has to reach preposterous levels to drive material crossover flows singularly without an additional catalyst. The usual argument offered by fund selectors happily rejecting this higher carry is that it is seen to come packaged with the inconvenient potential for alarming levels of volatility. We will refrain from the usual reply about macro improvement, because the simple fact is this: No matter how often the EM community talks about robust and resilient fundamentals, and no matter how many white papers, thought pieces and conferences we do, EM’s greatest source of shock remains foreign investors setting fire to their confidence and fleeing their positions ahead of some alleged apocalypse. This is ultimately why buying dips typically works in emerging markets – because life goes on.

COVID-19 has made growth in EM somewhat controversial. Emerging market bears would have you believe that underinvested healthcare systems would be poorly placed to manage a dangerous disease in countries with less developed infrastructure – leave aside that emerging markets have largely defeated endemic poverty over the last 30 years. Meanwhile, emerging market bulls point to the region’s relative youth and vigorous public policy response as sufficient to protect the macro story. The unfolding data tells a story somewhere in the middle. While emerging countries did see a drop in growth this year, they have also shown resilience in the face of the pandemic and are now recovering swiftly, helped by experience gained in managing other infectious disease outbreaks. Ultimately, this recovery in growth in EM should reinforce that EM really is a different asset class than it was, in say, 1997.

The resulting EM growth recovery is increasingly becoming very difficult to ignore. The problem is, you’ve probably heard most of it before.

Back at the investment quarterly meeting, our CIO threw up his hands in mock frustration as our Head of EMD began his presentation with the now traditional Chinese growth argument. “Is there anything more to EM than China?” he asked, demanding to know what was happening in the other roughly 85 countries that make up our space. The answer to that one is this: China is booming post pandemic and that is driving export growth across the EM complex. Analysis from JP Morgan shows China now accounts for 13% of EM (ex-China) exports, double the share of the US and Euro Area which stand at around 6%. This is somewhat new; this relationship was the other way round at the start of the millennium.

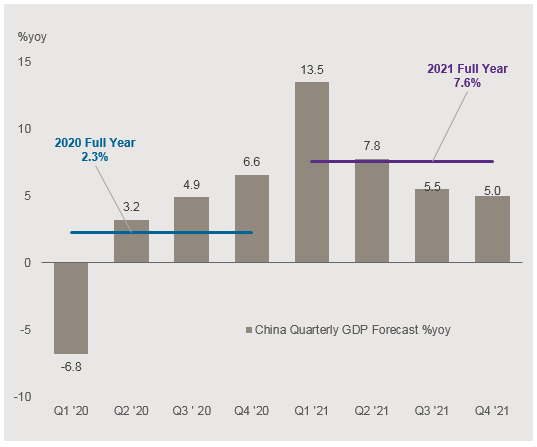

With all due respect to New Zealand, China is the first large economy to really put COVID-19 behind it, and the growth impact of this success is vivid. Most visible through pickups in demand across the service sector, China’s growth is surging as life gets back to normal. Our expectations for China reflect this recovery: we look for China’s GDP growth to be around 2.3% in 2020, but we forecast that accelerating strongly into 2021, where we expect 7.6% growth. While positive for China, this growth in turn supports the outlook for the wider Chinese supply chain, lifting EM’s export performance. We see this reflecting in a marked increase in trade between emerging countries, as China’s voracious consumer appetite returns.

China: base case strong recovery in 2021

Source: JPMAM as of 18 September 2020

The upshot of all this is that EM is transitioning from COVID-19 slowdown to star growth performer without experiencing a widespread macro crises triggered by the disease. We continue to look for EM growth of -1.4% in 2020, but expect the broader base of our universe to swing positive after the second half of 2021, to reach 5.7% for 2021 as a whole. That is notable, particularly when compared with the equivalent European and US recoveries: the difference between the two could see emerging markets growing some 3.9% faster than the developed world over a short period. Very little of this is currently fully reflected in EM risk premiums. Know this: EM has had some big years in the past – we have happy memories of people yelling “roof it!” on trading floors around the City as some Indonesian small cap did just that in response – but from low to high this swing is forecasted to be bigger than any previous acceleration in the space.

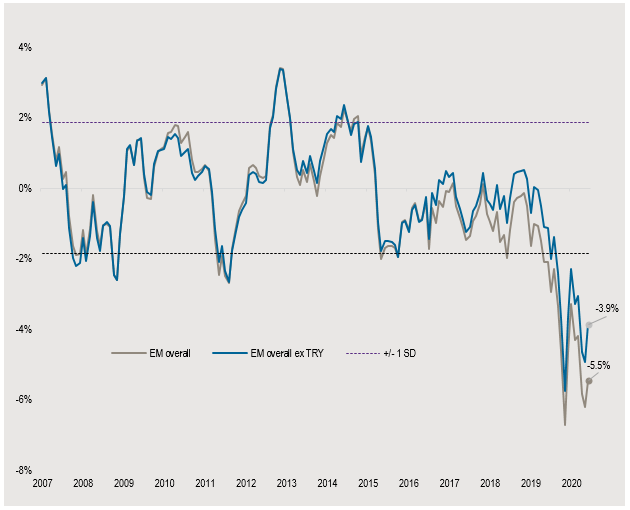

So what will trigger the inflows to drive those returns? Flows tend to follow improving expectations of returns, and those relate to improving growth forecasts. But what sparks the actual rally is likely to be a valuation opportunity that just seems too good. Enter the current real effective exchange rate picture for EMFX, which shows the EM currency complex trading around 4% cheap after removing some more volatile lines.

Global EM REER % Deviation from Fair Value

Source: J.P. Morgan, FV determined by JP Morgan BEER Model as of October 2020

So where does all of this lead? Well, local currency tends to work really work well when EM offers a growth premium over the developed world, where developed markets don’t offer much of an income alternative, where flows are beginning to accelerate as a few people notice, and where most people… have not noticed yet. All of which seems very familiar currently. To say that it isn’t always like this in local currency is an understatement, so you can perhaps pardon our team’s quiet excitement.