China: Too big to ignore

The Chinese equity and bond market is home to a number of exciting opportunities for ETF investors, but have so far been largely overlooked.

The investment case for China has long been established. The market has experienced an accelerated economic expansion and is on course to becoming the largest economy in the world. Although near-term GDP growth is expected to moderate from previous years, the International Monetary Fund is still predicting growth of 4.4% in 2022, which compares to its forecasts of 3.3% for advanced economies1.

Despite its prominence in the global economy, China represents a remarkably small proportion of international investors’ portfolios. In 2020, according to Greenwich Associates, international institutional investor’s total China exposure was only 4.6%.

Perhaps some explanation for this low allocation can be placed upon the relatively recent opening of access to onshore Chinese markets to international investors via programs including Stock Connect and Bond Connect. But now that there are established pathways for foreign investors to access China’s onshore equity and bond markets, we think there are a number of exciting opportunities to uncover.

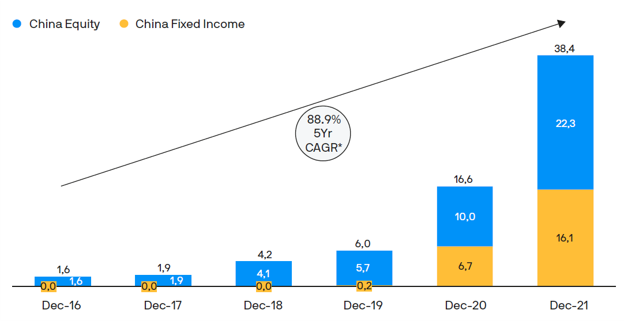

As investors wake up to China’s onshore opportunities, the ETF market is playing an important role. Over the last five years, exposure to Chinses assets via UCITS ETFs has grown almost 89% on a compound annual growth basis. We expect the market for China ETF strategies to continue expanding.

Exhibit 1: Growth of China assets in UCITS ETF market (USD billion)

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31 December 2021.

*CAGR: Compound annual growth

Driving efficiencies in fixed income markets

China’s economic growth has also translated to its onshore bond market, which is broadening and diversifying, to form an important opportunity for investors. China’s bond market is really made up of a series of smaller markets representing one very large opportunity, ranging from government bonds listed locally through to hard currency bonds issued in Hong Kong by Chinese companies.

Chinese companies have been aggressive users of international credit markets, resulting in a broadening and deepening of the opportunity, with new issuers and new sectors reflecting a greater depth and ultimately a more efficient marketplace.

Further driving efficiencies is government regulation. Reforms, such as the government providing fewer implicit guarantees to state-owned enterprises, should translate over time into more efficient pricing of risk. That would lead to higher default rates, tipping the mix of bonds toward higher quality companies and spread compression. The next few years could be particularly volatile as reforms are rolled out but, like many of China’s new reforms, they should give way to a more stable future market.

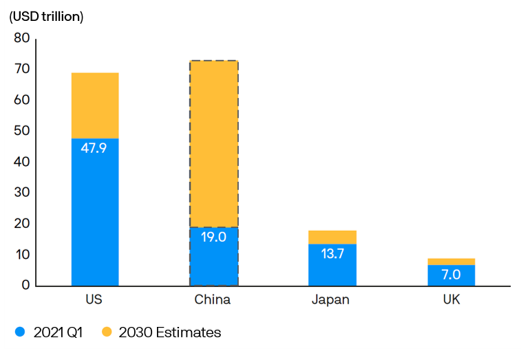

Exhibit 2: China’s bond market is the second largest today, but has the potential to be first in 2030

Bond market potential

Opinions, estimates, forecasts, projections and statements of financial market trends are based on market conditions at the date of the publication, constitute our judgment and are subject to change without notice. There can be no guarantee they will be met.

Source: J.P. Morgan Asset Management, Bank of International Settlements, as at 31 March 2021.

A transforming equity market ripe for active ETF strategies

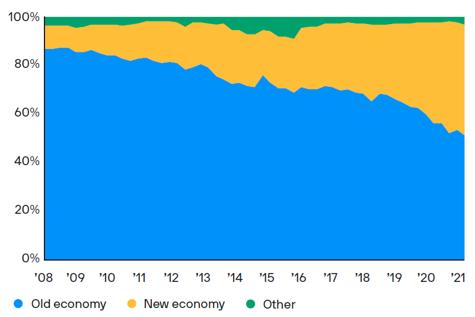

China’s equity market is shifting towards sectors that are aligned to its transition to a more consumption and innovation driven economy, and away from sectors that are more reliant on investment and exports. The beneficiaries of China’s economic transformation include consumer goods, technology, health care and high-end manufacturing. We expect these shifts to continue, potentially offering China investors more exposure to these high growth sectors compared to emerging markets overall.

Exhibit 3: The composition of China’s benchmark onshore equity index, the CSI 300, has tilted toward growth sectors

Evolution of CSI 300: new economy vs. old economy sector weightings

Source: Refinitiv, J.P. Morgan Asset Management; data as of September 30, 2021. New economy sectors include technology, telecom services, consumer goods and health care; old economy sectors include financials, materials, industrials and energy. The CSI300 index is a free-float weighted index that consists of 300 A-share stocks listed on the Shanghai Stock Exchange or the Shenzhen Stock Exchange.

China’s onshore equity market is particularly interesting. Many investors do not differentiate between offshore (Chinese stocks listed on international exchanges, mainly in Hong Kong and New York) and A-shares, which trade in mainland China. 2021 was a stark reminder that that these markets can diverge. Offshore equities were hit by government regulatory changes that targeted technology and real estate sectors. While offshore Chinese stocks struggled, onshore equities delivered positive returns, albeit more muted than global equities, as China tapered its stimulus. With China now set to ease monetary policy at the margin, while major developed market central banks are raising interest rates, we think China could once again diverge from the global business cycle.

While there are opportunities within China’s onshore market, there are a number of inefficiencies. Retail investors make up 42% of the holding value of the Chinese A-shares free-float and contribute over 80% of its trading volume. The speculative nature of retail investors means this market is often moved by rumours rather than company fundamentals, and has a high turnover.

While traditional index ETF strategies are unable to mitigate the impact of the market’s high turnover and the short-term investment horizon of its investor base, these market inefficiencies create opportunities that can be exploited by active ETF managers with local market knowledge, a long-term investment horizon that looks through short-term volatility, and a rigorous valuation framework.

1 Source: International Monetary Authority, data as at 26 April 2022