Market misconceptions on Scandinavian currencies

08/01/2020

In Brief

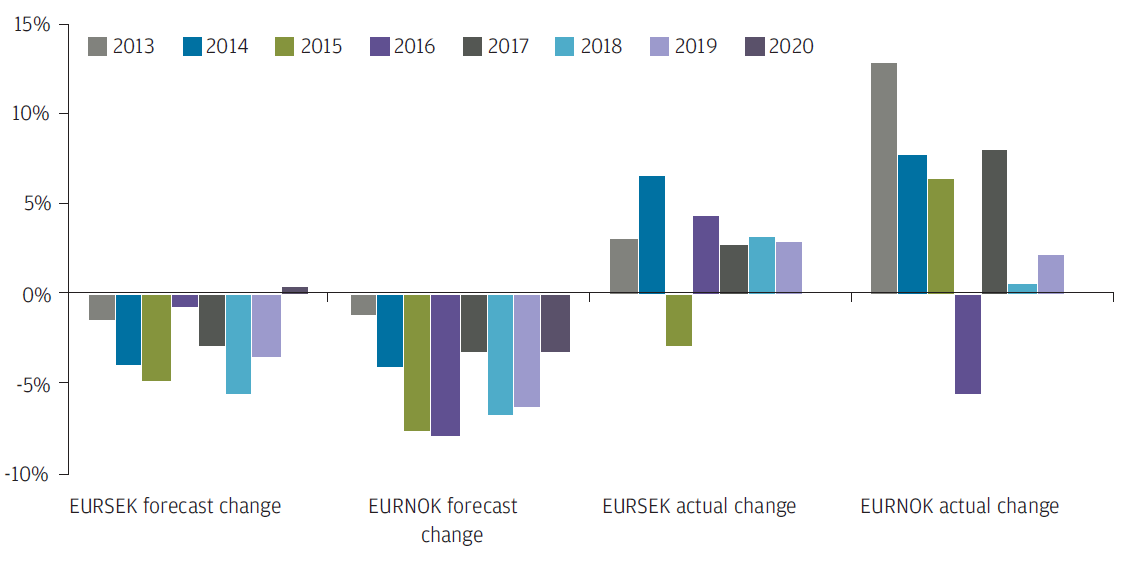

- Since the start of 2013, consensus forecasts for the Swedish krona and Norwegian krone have been persistently bullish and persistently wrong.

- Despite the positive forecasts, both currencies have traded to all-time low levels versus the euro over the past year.

- With forecasters remaining positive on the 2020 outlook for the Norwegian krone, but finally adopting a neutral stance on the Swedish krona, we explain why we believe the consensus has been such a poor guide to Scandinavian currency performance.

- We also take a look at the factors that are driving consensus forecasts for 2020.

Why has the consensus been so wrong on the krona and krone?

The Swedish krona and Norwegian krone have significantly underperformed consensus forecasts over the last seven years. The reasons why the market consensus has been so wrong are multi-faceted, although interpretations of inflation comparisons and balance of payments data may be at the core of the problem, particularly for the Swedish krona. Valuing the Norwegian krone, meanwhile, is further complicated by its large oil and gas sector.

EURSEK AND EURNOK RATES: FORECASTS VERSUS ACTUAL

Source: Bloomberg, J.P. Morgan Asset Management; data as of December 2019.

Source: Bloomberg, J.P. Morgan Asset Management; data as of December 2019.

Swedish inflation estimates: Too low?

We believe the primary reason why the Swedish krona has been expected to appreciate is the perception that the currency has been significantly undervalued based on purchasing power parity (PPP) fair-value frameworks. While we believe evaluating currencies using a PPP-based approach can add value over time, we note a few issues that have likely led to the consensus incorrectly calculating fair value levels for the Swedish krona.

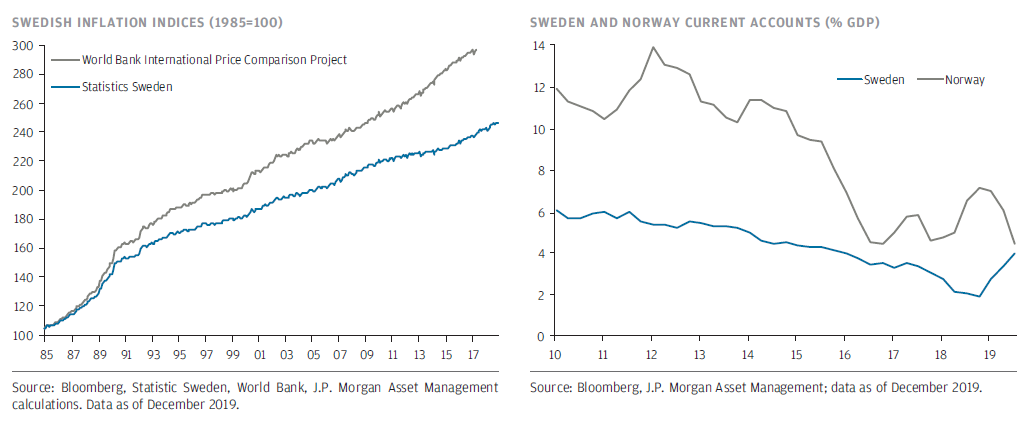

The first reason is that PPP-based valuation approaches rely on establishing “real” fair values for currencies—that is, the value after taking into account inflation differences between economies. Measurement of inflation is inherently difficult and some choices made by statistics agencies materially affect the comparability between countries. The methods used to include house prices in inflation measures, and the detailed assumptions made when adjusting prices for improvements in the quality of goods and services, vary around the world. These differences have been particularly marked in certain historical periods, such as the early 1990s.

Due to the long time horizon of currency market cycles we believe these historical variations in inflation measurements still affect many widely used PPP measures. Our efforts to use internationally comparable data suggest national source measures of Swedish inflation have been too low and that if higher inflation measures had been used, the krona would not have been observed to be undervalued.

Interpreting current account trends

When we assess the valuation of a currency we also look at balance of payments dynamics. Our research suggests that balance of payment trends, rather than actual levels, help to forecast exchange rates.

In contrast to the consensus view, which sees the krona supported by Sweden’s current account surplus, we believe the deterioration in the surplus observed from 2007 to 2018, which was led by a decline in the goods trade balance, was more symptomatic of the krona being overvalued rather than undervalued.

As we head into 2020, the consensus view appears to have finally capitulated on krona optimism. However, we now see the krona as having finally reached undervalued levels—a view supported by the sharp improvement in Sweden’s current account position in 2019.

Monetary policy: The impact of negative rates

A second reason why we believe the consensus has been too bullish on the krona is the effect of the Riksbank’s unconventional easing policies. Analysing the effect of negative rates on currencies is complicated by the limited historical experience. However, our favoured framework, which uses shadow rates as a measure of the pressure on capital outflows, has worked well for the euro in recent years.

When we extend this framework to Sweden we find a significant drag on the krona from negative rates in prior years, though this has recently reversed with the return to zero deposit rates despite the continued fall in longer-term bond yields. The impact of a central bank raising rates into a slowing economy is a risk for Swedish asset prices, but we are watching this development with cautious optimism for 2020.

Oil and gas revenues: Negative for the krone?

For the Norwegian krone, we share some of the same concerns around valuation as for the Swedish krona. However, in Norway the impact of the oil and gas sector, and particularly the mechanism for recycling oil and gas revenues into Norway’s sovereign wealth fund (the Government Pension Fund Global) are additional factors that complicate our balance of payments analysis. When adjusting for sovereign wealth fund transfers, Norway has run a current account deficit in recent years, which is much more consistent with the way the krone has traded.

We also see the development of a global natural gas market as a challenge for Norway. In recent years, gas exports have risen to match the size of oil exports. While European gas prices have historically followed oil prices reasonably closely, the rise of US liquefied natural gas exports is disrupting this linkage. In the US, gas prices have been far below European and Asian prices for several years, but it is the recent expansion of export capacity following a decade of construction activity that has seen US exports finally accelerate and put downward pressure on European prices.

While Norway may be among the lowest cost oil producers in the world, it remains the swing producer in the European gas market and appears particularly vulnerable as a surplus of US and Russian gas is expected to test the limits of European gas storage capacity next summer. We therefore maintain a more cautious approach towards the Norwegian krone and expect little improvement in Norway’s current account position, which would confirm a chart-based view of krone cheapness versus PPP-based estimates of fair-value.

Currency Management

Since our first segregated currency overlay mandate funded in 1989, J.P Morgan Currency Group has grown to manage a total of USD 361 billion in bespoke currency strategies. Our clients include governments, pension funds, insurance clients and fund providers. Based in London, the team consists of 20 people dedicated exclusively to currency management with an average of over 15 years of investment experience.

We offer a range of hedging solutions for managing currency risk as well as a tailored optimal hedge ratio analysis:

- Passive currency hedging serves to reduce the currency volatility from the underlying international assets. It is a simple, low cost solution designed to achieve the correct balance between minimising tracking error, effectively controlling transaction costs and efficiently managing cash flows.

- Dynamic ‘intelligent’ currency hedging aims to reduce currency volatility from the underlying international assets and add long-term value over the strategic benchmark. A proprietary valuation framework is used to assess whether a currency looks cheap or expensive relative to the base currency and the hedging strategy is adjusted accordingly.

- Active ‘alpha’ currency overlay strategy offers clients’ passive currency hedging, if required, combined with an active investment process to deliver excess returns relative to the currency benchmark. Our approach is to build a global currency portfolio combining the output of fundamental models and incorporating the qualitative views of our strategy team.

0903c02a8276e573