Since the start of 2012, MSCI Japan has delivered an annualized return of 12% in JPY terms, reflecting Japanese companies’ profitability and gradual corporate governance improvements in prioritizing shareholders.

In brief

- Improved economic data, including rising inflation and wages, gives the Bank of Japan (BoJ) confidence to normalize monetary policy. Gradual Japanese government bonds (JGB) purchase reductions and potential rate hikes are anticipated and should help to stabilize the weak Japanese yen (JPY), providing some relief to U.S. dollar (USD) based investors.

- Japan’s earnings growth is set to outpace the U.S. and Europe in 2024-2025. Corporate governance improvements support long term investment.

- Beyond domestic factors, Japanese equities are also a good source of diversification from U.S. election uncertainties, especially relating to its trade policy outlook, considering Japan Inc’s supply chain diversification.

Following some consolidation in 2Q 2024, Japanese equities have started to enjoy positive momentum again. The TOPIX index finally hit a new high after over three decades. The earnings fundamentals remain strong, and improvements in corporate governance provide a long-term incentive for investors to stay invested in Japanese equities. However, some USD-based investors are hesitant due to the negative impact of JPY weakness on USD returns. The persistent currency weakness may reflect market disappointment with the very gradual pace of policy tightening in Japan and ongoing balance sheet expansion. However, the BoJ is expected to announce a plan to reduce JGB purchases at its July 30-31 meeting. The policy rate could also be raised further in the coming months. A key question is whether these measures will be sufficient to boost the JPY and stimulate international investors’ appetite for Japanese equities.

The Bank of Japan’s policy direction driving Japanese yen

Recent economic data from Japan has shown some cyclical improvement following weak gross domestic product numbers for 4Q 2023 and 1Q 2024 and depressed domestic consumption. Headline inflation rebounded to 2.8% year-over-year (y/y) in May as several inflation relief measures expired. Meanwhile, core consumer price index inflation continues to slow, easing pressure on households. May retail sales were strong, and the 2Q Tankan survey for large manufacturers rose to match the post-pandemic high. Cash earnings for workers also increased by 2.3%, led by the Shunto wage negotiation, which saw large companies and labor unions agreeing to a 5.28% wage increase, the highest in 33 years. Overall, improving domestic demand gives the BoJ more confidence in normalizing monetary policy.

The BoJ announced in its June meeting that it will provide a more detailed plan on its JGB purchase reduction in the July meeting. It is reported that the central bank is collecting feedback from financial institutions on the pace of this reduction. We expect the central bank to start slowly, such as reducing monthly purchases from JPY 6trillion to JPY 5trillion. Financial institutions hope the central bank can step away from bond purchases completely in the next 1-2 years to reduce market distortion.

Another question is whether the BoJ will also raise rates in the July or September meetings. Recent economic data suggests a small increase, such as 10-15 basis points (bps), is possible. The Overnight Index Swap market is pricing in a 60% chance of a 10bps increase in July.

Disappointment in the central bank for not being aggressive enough in cutting back bond purchases or raising rates could fuel further weakness in the JPY. This was the case with the March and June meeting announcements, as the central bank adopted a more conservative approach to tightening monetary policy.

This will also partly depend on the timing and pace of the U.S. Federal Reserve’s (Fed’s) rate decisions in the months ahead, given the influence of the USD/JPY interest rate differential on the currency

Japan’s corporate earnings are in good shape

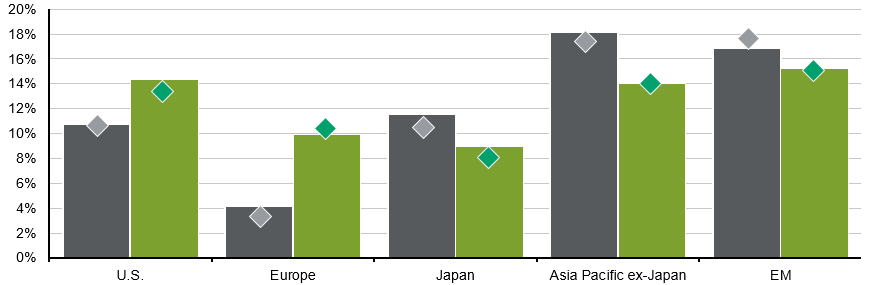

As Exhibit 1 shows, MSCI Japan’s earnings per share growth is expected to hit nearly 12% and 9% respectively for 2024 and 2025, with 2024 earnings growth expected to outpace the U.S. and Europe. Japan’s earnings forecasts have also enjoyed steady upward revisions in recent months.

Rising earnings growth revisions is not only a function of a weaker JPY boosting exporters’ overseas earnings, as financials and utilities have also enjoyed earnings upgrades. The prospect of higher interest rates could continue to boost financial institutions’ interest income.

Beyond near-term drivers, Japan’s corporate governance improvements remain a key factor supporting the long-term investment case for Japanese equities. This progress stems from a decade of Abenomics, further boosted by the Tokyo Stock Exchange’s guidance on improving equity valuations and return on equity (ROE). To lift their ROE, Japanese companies can improve their products and operations to boost profits. Some can also unwind cross-holdings in equities to free up capital and engage in more share buybacks. There is still plenty of low-hanging fruit for Japanese companies to improve their financial metrics to be closer to their U.S. and European counterparts.

Exhibit 1: Earnings growth

EPS, year-over-year change, consensus estimates

Source: FactSet, MSCI, Standard & Poor’s, J.P. Morgan Asset Management. Asia Pacific ex-Japan, emerging markets (EM), Japan, Europe and U.S. equity indices used are the MSCI AC Asia Pacific ex-Japan, MSCI Emerging Markets, MSCI Japan, MSCI Europe and S&P 500, respectively. Consensus estimates used are calendar year estimates from FactSet. Revisions are based on the current unreported year. Data are based on availability as of 30/06/24.

Investment implications

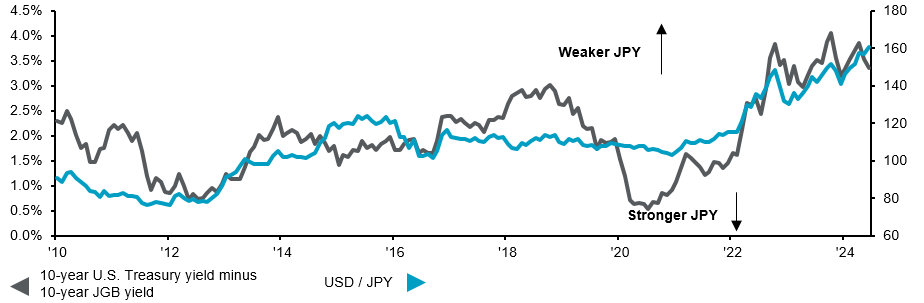

Since the start of 2012, MSCI Japan has delivered an annualized return of 12% in JPY terms, reflecting Japanese companies’ profitability and gradual corporate governance improvements in prioritizing shareholders. For USD based investors, this performance was partly undermined by JPY depreciation between 2012 to 2015 and 2021 to now. These periods coincided with the rapid widening of the interest rate differential between the USD and JPY, as shown in Exhibit 2.

Exhibit 2: U.S. – Japan interest rate differential and USD / JPY

Source: Bank of Japan, FactSet, J.P. Morgan Asset Management. Data are based on availability as of 30/06/24.

BoJ is set to reduce its JGB purchases in the coming quarters, accompanied by a gradual increase in the policy rate. This should help to lift JGB yields. Combined with the Fed potentially relaxing monetary policy, we expect JPY weakness to be less of a headwind for USD based investors.

Looking more broadly, as many investors are watchful over the November 5 presidential and congressional elections in the U.S., the future of U.S. trade policy, especially against China, is a contentious issue. A globally diversified portfolio can help investors manage such uncertainty. In Japan’s case, being a close U.S. ally in the Asia-Pacific region can help mitigate this risk. Japanese companies have already been diversifying their supply chains. For example, top Asia-Pacific destinations for Japan’s overseas direct investment in manufacturing include Australia, India, Indonesia, and Thailand.

In sum, domestic and international factors are providing solid support to Japanese equities as a component of portfolio construction. Foreign exchange risk has been a headwind, but this should ease with central banks’ policies pointing in the right direction.