The Weekly Brief

22-07-2024

Thought of the week

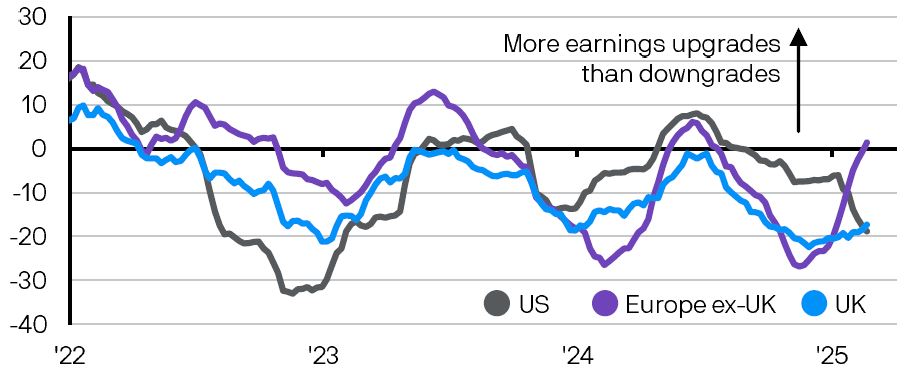

Recent communication from several Federal Reserve (Fed) policymakers suggests that a September rate cut is increasingly likely. Last week, Fed Chair Jerome Powell stated that he wants to begin lowering rates before inflation is back at 2%, a sentiment that was echoed by the often more hawkish Governor Waller. New York Fed President John Williams also hinted at how the Fed would frame such a move, describing a potential cut as policy becoming less restrictive rather than outright loosening. Our base case sees a relatively gradual easing cycle ahead. Current market pricing for 100 basis points of cuts by March would require significantly weaker labour market data in the months ahead. Fed officials will instead be hoping that they are easing off the brakes early enough to ensure that any further slowing in the economy is smooth.

The first US interest rate cut is approaching

%, Federal Reserve policy rate expectations

More Insights

0903c02a81fb9234