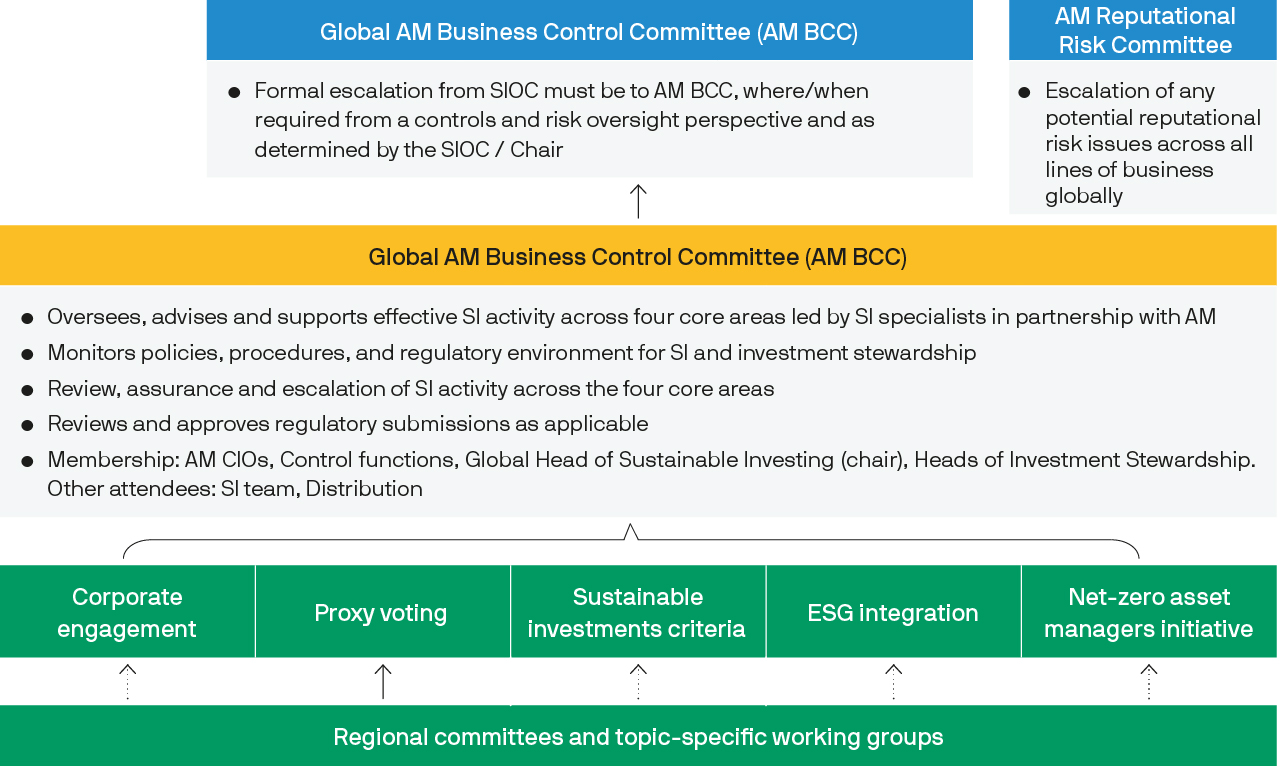

Sustainability governance

Accountability for sustainable investing and stewardship starts at the top of our business. Our Sustainable Investing Oversight Committee is made up of chief investment officers and leaders from our sustainable investing and control functions, and serves as a single point of strategic oversight, decision-making, review and assurance.

Source: J.P. Morgan Asset Management as at December 31, 2021.

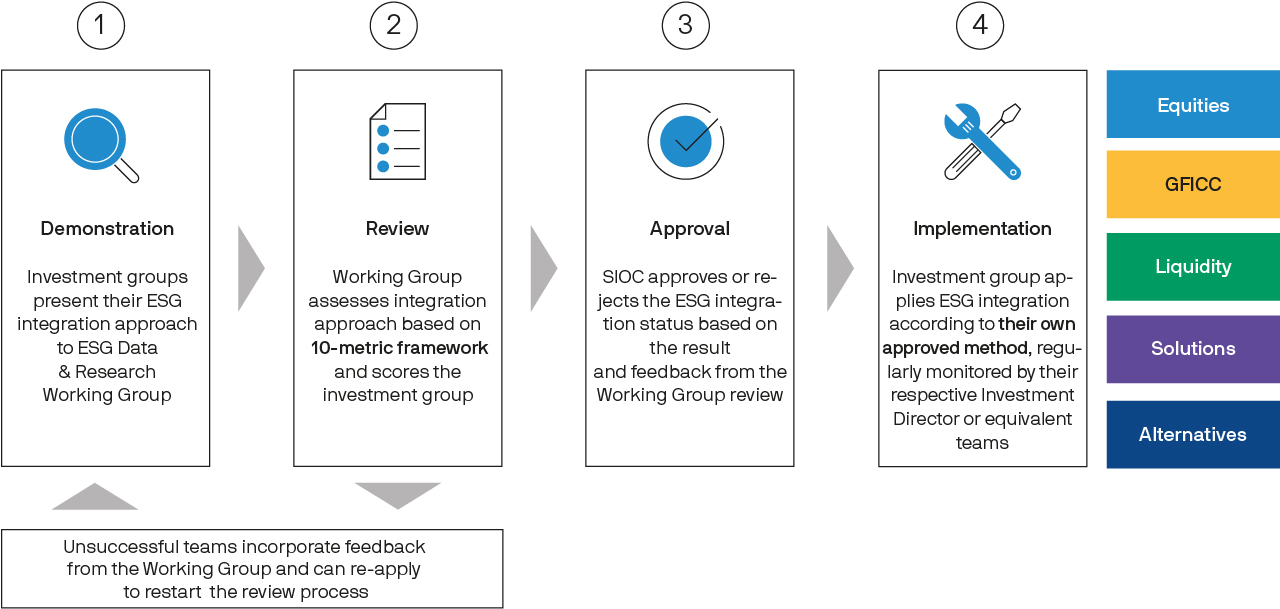

ESG integration oversight

Responsibility for reviewing and approving the ESG integration approaches of our investment groups lies with the ESG Data and Research Working Group. This group of senior investment professionals and sustainable investing team delegates is chaired by the global head of sustainable investing, Jennifer Wu, and its decisions are reviewed by the Sustainable Investing Oversight Committee. Once approved, each approach is subject to ongoing monitoring. Investment groups must seek recertification every three years.

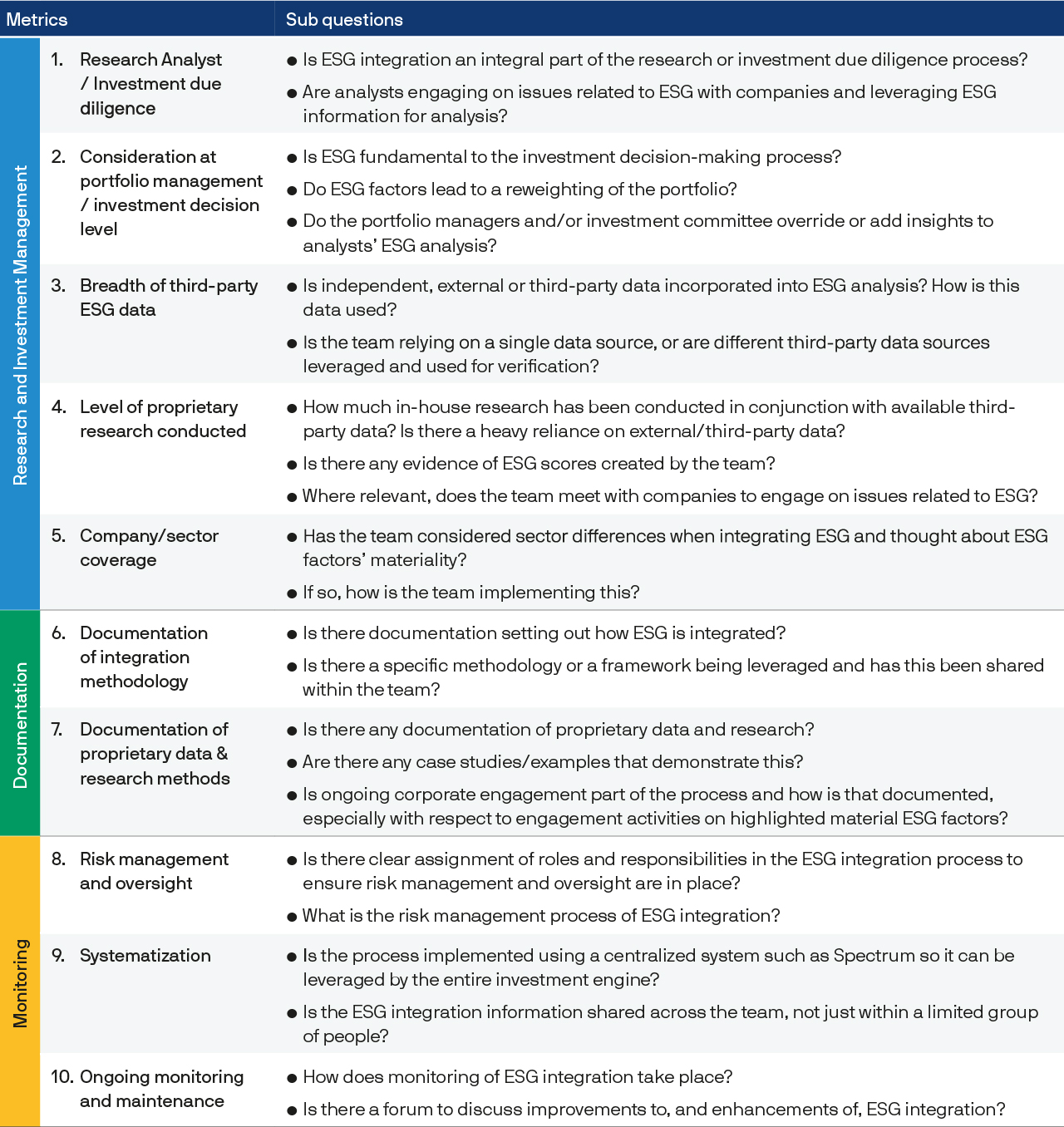

The ESG Data and Research working group uses a consistent 10-metric framework to evaluate and approve the integration approach of each investment group. Each metric is scored on a scale of 1-5, and a process must receive a total score of at least 30 to be verified as ESG integrated.

Source: J.P. Morgan Asset Management Sustainable Investing TEAM and ESG Data & Research Working Group.

Stewardship oversight

The Sustainable Investing Oversight Committee is responsible for global oversight of investment stewardship across all asset classes, investment styles, client types and regulatory regimes. Specialist working groups on voting and engagement report to the committee, providing an additional layer of oversight and escalating any issues.

Regional Proxy Oversight Committees are long established in our four key investing regions: North America; Europe, Middle East & Africa (EMEA); Asia excluding Japan; and Japan. The committees are composed of senior equity investment analysts, equity portfolio managers, stewardship team members and legal, compliance and risk specialists. These committees are responsible for formulating regional voting policies and guidelines, and provide an escalation point for voting and wider corporate governance issues.

Engagement Working Groups are made up of heads of investment research, analysts, portfolio managers and stewardship team members, with representation from across asset classes and investment styles. The groups enable active discussion, information sharing and coordination of engagement activities across asset classes, and facilitate assessment of ESG controversies and norms breaches with investment analysts, with a view to conducting reactive engagements.

Further reading

09uf222402104548