How will COVID-19 affect Sustainable Bonds?

2020/05/22

Samantha Azzarello

Listen to On the Minds of Investors

Global governments have been swift and bold in supporting their economies, building a bridge to get consumers, small businesses and corporates over the present abyss to the other side. Given the unknown breadth and depth of the abyss, more stimulus may be required.

This stimulus has and will continue to come in a number of different forms, and along with traditional government bond issuance, we have also seen an increase in the issuance of Sustainable bonds – in particular in Green, Social and Sustainability bonds.

Sustainable bonds refer to the broad complex including the three types listed below. These bonds are considered impact-oriented and outcome-driven in issuance and with use of their proceeds.

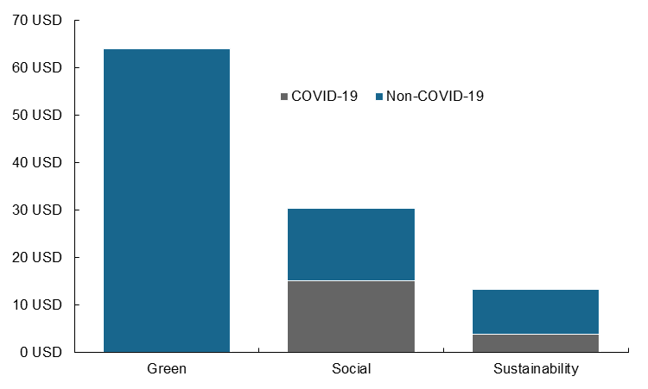

Year to date more than $100 billion USD of these bonds have been issued globally, and they are defined by the type of projects the proceeds will be earmarked for, as follows:

- Green bonds: proceeds will be applied toward green projects or activities that promote climate change mitigation or other environmental sustainability purposes.

- Social bonds: proceeds will be applied toward projects that promote improved social welfare and positive social impact specifically for underprivileged, low income, marginalized, excluded or disadvantaged populations.

- Sustainability bonds: a hybrid of Social and Green bonds, proceeds will be applied toward projects that are dedicated to environmentally sustainable outcomes – funding a mix of green and social projects as eligible.

Until recently, growth in Green bond issuance was substantial, reflecting rising awareness and concern around climate change and clarity on bond parameters, guidelines and practices. By contrast, the other two types- Social and Sustainability bonds were less utilized, as they were less well-understood by investors. But looking at the below chart, of the bonds issued specifically to address COVID-19 (“pandemic” is marked as use for proceeds), most are concentrated in the Social and Sustainability categories. This changing dynamic is likely due to the obvious and far-reaching social impacts of the global pandemic.

Moving forward, it seems likely that this momentum continues: Social and Sustainability bonds are not only appropriate for providing emergency funding during the pandemic, but also after, as economies are rebuilding and structural changes are occurring. As demand for ESG and Sustainable Investing assets across asset classes continues to grow, we will likely see further interest, adoption and use of Social and Sustainability bonds.

2020 global sustainable bond issuance

USD billions, amount outstanding

Source: Bloomberg, J.P. Morgan Asset Management. COVID-19 bonds are based on “pandemic” being the use of proceeds.

0903c02a828e18f5