Week in review

- U.S. consumer confidence in March missed expectations at 92.9

- U.S. preliminary PMI composite for March at 3-month high of 53.5

- Australia February headline inflation rose 2.4% y/y, lower than expected

Week ahead

- Japan unemployment

- China manufacturing PMI

- U.S. JOLTS

Thought of the week

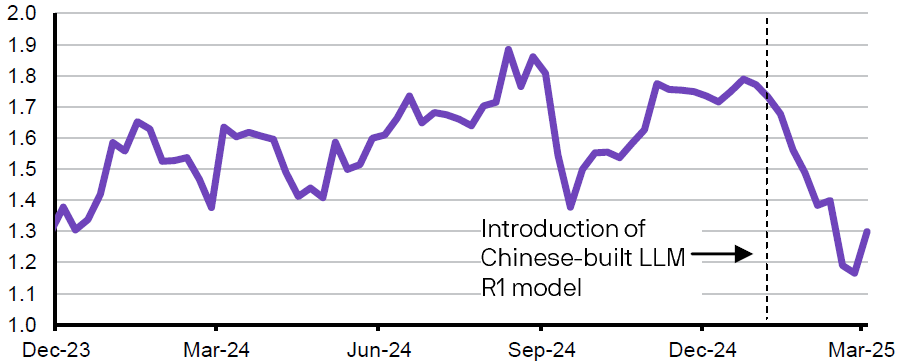

From the Jan 13 low, MSCI China has risen 33% to the Mar 13 high, causing the valuation gap between Chinese and U.S. tech stocks to narrow. However, since then, markets have given back partial gains. Profit-taking is expected, after a rally of such speed and extent, especially given the April 2 tariff risk window where investors want to lock in gains. However, the sustainability of this rally relies on tech companies’ long-term profitability and earnings, which relies on economic momentum. On the economic front, China’s January-February industrial production, retail sales and fixed asset investment all managed to beat consensus. Markets are now expecting China’s Q1 GDP to log close to the target 5% y/y, but sequential q/q growth will likely be weak due to exports front-loading and boost from trade-in programs fading. To boost liquidity, Chinese banks lowered rates on consumer loans to near record lows and the People’s Bank of China injected 450 billion yuan through the one-year medium-term lending facility. The “Two Sessions” also reiterated policymaker’s supportive stance for growth, increasing headline fiscal deficit to 4% of GDP, increasing issuance of debt, and expanding trade-in subsidies. While the flurry of actions by banks and policymakers are in the right direction, follow-up execution from government agencies, the feed-through into economic data and subsequently earnings, continues to be key for the current rally.

Valuation premium of U.S. tech over China tech has narrowed

NASDAQ 100 divided by MSCI China Tech 100 forward P/E

Source: Bloomberg, JP Morgan Asset Management. Data reflect most recently available as of 26/03/25.

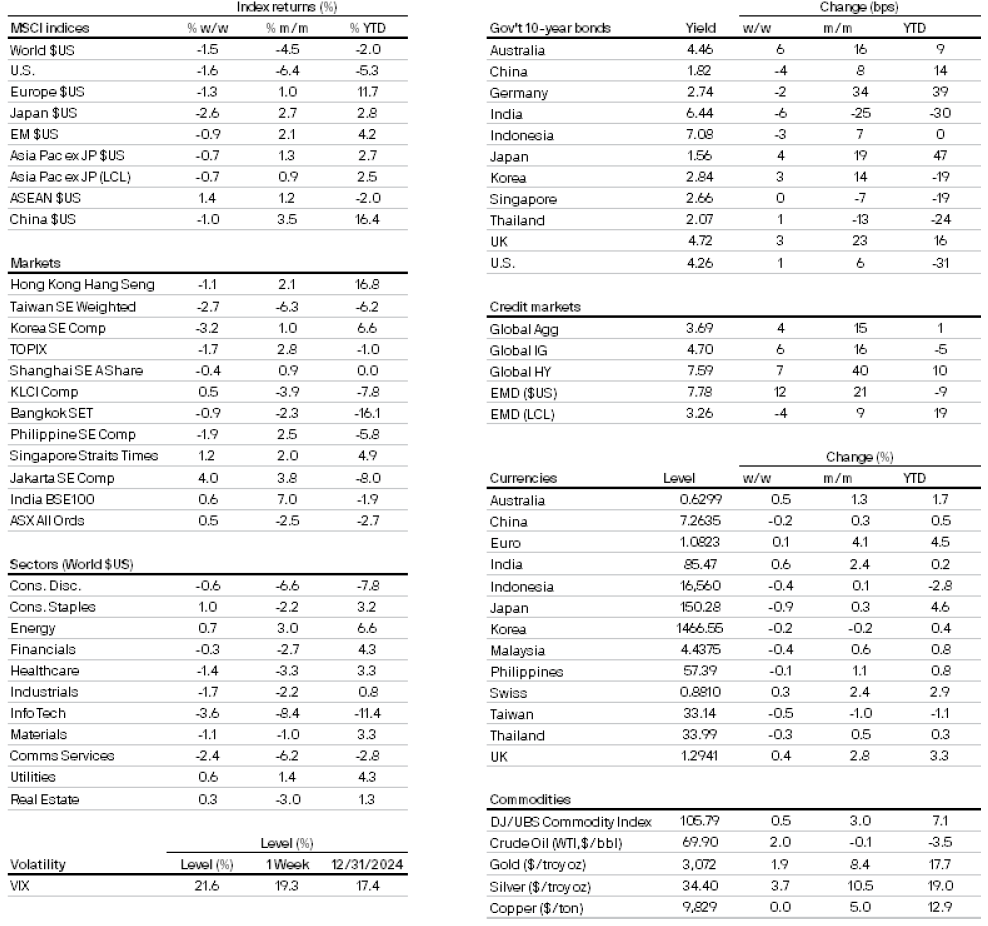

Market data

0903c02a82467a72

All returns in local currency unless stated otherwise.

Currencies’ return are based on foreign currencies per U.S. dollar. An appreciation of the foreign currency against the U.S. dollar would be positive and a depreciation of the foreign currency against the U.S. dollar would be negative.